Today, knowing how to build a mobile banking application is critical for essentially any financial institution. According to Statista, today, about 2.37 million people around the world use online banking services, and that number is projected to keep growing. By embracing digital transformation in banking and following online banking security measures financial institutions can meet the needs of modern customers.

With a financial application for clients, your organization can boost customer loyalty, increase income, and reduce the cost of services. As a result, producing a reliable, capable app is a worthwhile investment. Let’s take a closer look at how to make a mobile banking app following the best practices of fintech mobile app development.

Banking apps for smart financial decisions: market overview

Before diving into how to build a mobile banking application, it’s wise to explore the market research that shows why such an investment is smart. Currently, 54% of consumers state that they are using digital banking tools to access their bank account more often than they did prior to the pandemic.

Additionally, 98% of Millennials and 99% of Gen Z use mobile banking apps, and they turn to them for a variety of reasons. Along with viewing account balances, reading statements, transferring funds, and other traditional activities, these generations also turn to mobile banking apps when they need a budgeting app far more often than older generations. Additionally, younger generations turn to these apps for many other reasons, including asking questions, tracking savings goals, and more. As a result, mobile banking apps are a fundamental part of their financial lives, and that trend is only going to continue.

Plus, there are other benefits to consider that relate to the mobile banking market. In 2022, the revenue across the mobile banking market hit $772.96 million. But by 2030, it’s projected to reach $1.87 billion. That means there is profit to be had by financial institutions and banks that figure out how to build a mobile banking application that meets the needs of their clients.

Trends in mobile banking

Understanding the main trends in the development of banking applications helps you see where the market is headed. According to Insider Intelligence, along with our own research based on top mobile apps in the niche (which are discussed in below), here are some key trends in modern mobile banking apps:

- From several functions to a full-on assistant: Today, instead of offering users just a few in-app features, mobile banking applications functionally replace a visit to a bank branch, providing direct assistance through chatbots and introducing AI in banking through various tools.

- Designed for advanced users: Younger generations are tech-savvy, giving financial institutions the ability to offer features geared toward advanced users, including more customization and a wider array of banking app features for enhanced control and navigation.

- Integration with mobile payment tools: In the post-pandemic landscape, contactless payment options, electronic wallets, and NFC rose in popularity, so more banking apps feature integrations to make these mobile payment tools available in the application.

- Enhanced cybersecurity: Providing advanced banking users with two-factor authentication and other secure mechanisms in a banking application, e.g., face recognition, is a growing trend in the niche, particularly as cybersecurity in banking becomes more critical in the eyes of consumers.

- Voice payments: Because of the popularity of voice search in general, voice payment is one of the new features increasingly appearing in banking apps.

- Chatbots: Instead of communicating with the call center staff every time a problem arises, customers prefer getting answers to their questions via a chatbot.

Why build a mobile banking app

A well-designed mobile banking application provides your business with many benefits, including:

- Increased customer value: A mobile application can offer personalized banking experiences while streamlining daily banking activities for enhanced convenience, giving customers more value overall.

- Strengthened company brand: Today, a mobile banking app isn’t just a nicety; it’s often viewed as a necessity. By adding one, it makes your financial institution seem modern and digitally aware, which elevates your brand.

- Faster service: Mobile applications allow customers to complete routine banking tasks without direct assistance, ensuring a speedy experience that wouldn’t be possible if you had to use direct support.

- Improved competitiveness: Due to the popularity of developing mobile banking software as a service, practically all leading online and traditional banks have an application. Without a banking app, maintaining a competitive edge is essentially impossible in the current climate, so designing one is critical for improving competitiveness within the market.

- Increased number of communication channels: The mobile app is another communication channel that’s available to customers, allowing them to turn to their preferred device when assistance is required.

Top-tier examples of mobile bank applications

By knowing what top-tier financial institutions offer in their mobile apps, it’s easier to design a banking application that meets customer expectations. Here’s a quick look at five mobile apps provided by the most famous banks in the world:

- Bank of America mobile banking app. This application offers advanced security mechanisms to protect client data, and it doesn’t just provide basic access to the accounts of bank customers; it also has access to FICO scores, mobile check deposits, cashback services, and other cutting-edge features.

- Capital One mobile banking app. This application allows users to conduct transactions, find the nearest ATMs and bank branches, as well as see their credit ratings. The app also supports Touch ID, SureSwipe, and has an integration with Apple Watch.

- Chase mobile banking app. In addition to standard financial transactions, this application has tools for storing completed transactions for up to seven years. The app also has a geolocation feature for finding nearby ATMs quickly.

- Discover mobile banking app. This advanced product offers the ability to quickly view select data without going through a lengthy login process, all while providing proper security. There is also a transaction scheduling function for recurring payments.

- TD Bank mobile banking app. This application has a wide array of expected features. Along with money transfer options and excellent analytical tools, it has geolocation features to find the nearest ATM.

Types of mobile banking apps

The world of mobile banking doesn’t just include apps; there are also other versions currently in the market. Here’s a brief overview of the main types of mobile banking.

App-based

App-based mobile banking allows customers to download a mobile application designed and released by their bank to handle a wide variety of activities. It features a mobile UI that lets customers tap their screens to navigate menus, input information, gather data, or manage a variety of supported transactions. Often, mobile banking apps also provide access to customer service, either via chat or by launching a phone call to reach a representative.

SMS

Mobile banking over SMS — also known as SMS banking — allows customers to complete certain actions via text messages. For example, they can request account balances, review truncated statements, and initiate internal transfers without going through an app, browser, or customer service.

USSD

Unstructured supplementary service data (USSD) mobile banking is a service that supports customers without internet or mobile device data access. It is a code-based option that uses the GSM protocol that provides mobile banking services to feature phones or smartphones without data plans.

The process feels similar to text messaging, and it allows for real-time communication between a customer and their bank. After inputting the code, the customer navigates a series of menus to complete their desired task.

The core features of banking apps

Whether you’re an internet-only bank or also have a brick-and-mortar presence, ensuring that specific core features are present in your mobile banking app is essential. Here is an overview of the must-haves.

Authentication and authorization

Multi-factor authentication provides enhanced security over the static password and single-factor authentication processes. Using this advanced authentication and authorization strategy enables banks to comply with industry regulations. Many banks use biometric authentication data (such as face ID or fingerprint scanning) as an option for security when accessing accounts, but other options are also available to meet this need in finance digitalization.

Transaction management

Account management is critical functionality for a banking app, and it needs to include the ability to view the balance, make money transfers (including regular payments), display the transaction history, and similar options.

Customer support

Mobile banking apps need to provide quick ways to access customer service. This can include traditional approaches like placing a call with a tap to let them speak with a customer service representative or more cutting-edge options like chatbots.

Geolocation

The overwhelming majority of mobile services offered by banks are integrated with geolocation APIs which help customers find nearby ATMs, terminals, and bank branches when they need those services.

Push notifications

Since the app is not always active on the user's device, you can integrate push notifications to send urgent and regular messages about transactions, updates, and more.

Near-field communication (NFC)

This is a rather new technology that allows financial institutions to support contactless payments via a user's smartphone.

Digital wallets

Digital wallets contain all the data of a user's bank and credit card information, functionally eliminating the need to use plastic versions. They are usually integrated with NFC solutions.

Quick reply (QR)

A mobile QR code scanner allows you to check out goods at offline points of sale and pay bills, making it a potentially valuable offering.

Internet payments

The vast majority of banks have mobile applications that allow online payments through well-known payment systems like PayPal or Stripe.

Mobile transaction management

This type of virtual bank application provides users with end-to-end control over transactions carried out through the bank card. As a result, in many cases, it can eliminate the need for a visit to a physical bank branch.

In some cases, mobile transaction management functionality can double as a budget app, analyzing the user's transactions and allowing for advanced personal finance management.

Modern mobile banking solutions, as a rule, include features relating to several of the above applications.

Nice-to-have features of a mobile banking app appreciated by users

While some features are primarily considered essential, others are niceties. Often, they aren’t expected by customers, but they dramatically elevate the customer experience, making them worthy additions to a banking app. What features will be nice to have in the mobile app from your financial institution? Here are some of the strongest options.

- Cost optimization tool

This feature will help clients plan their budgets wisely and save more. In particular, it contains analytical functionality that allows you to identify the most expensive cost areas and identify places for potential improvement.

- Cashback

This feature provides a return of a certain percentage of funds spent on services or goods in partner organizations.

- Personalization

The ability to choose a theme for the application, select an avatar, and set other personalization settings significantly improves the customer experience.

- Chatbot

Estimates show that modern chatbots can handle 80% of routine tasks and customer questions, often in real time. That significantly reduces the burden on customer service personnel, all while ensuring customers can find solutions to issues quickly.

- Bill-splitting

With bill-splitting, users can automatically calculate separate shares of total bills in restaurants or other establishments.

- Voice payments

Voice payments aren’t just convenient; they also help increase accessibility for users with specific disabilities or issues with hand dexterity.

- Fraud alerts

Fraud alerts produced as push notifications through the mobile app enhance security, ensuring customers are aware of potential fraud as quickly as possible.

- Integration with wearable devices

In the era of smartwatches, offering some of the application's functions to wearable devices can be a competitive advantage.

- Withdrawing funds without a bank card

You can provide your bank customers with the ability to withdraw cash from an ATM through confirmation on a smartphone within the application, making carrying an ATM card unnecessary.

Why building a banking app may be tough: reasons and solutions

When you’re figuring out how to build a mobile banking application, you may encounter a variety of fintech challenges. Fortunately, it’s possible to navigate many of them with ease.

What are the main reasons why creating your own bank application can be difficult? According to the experience of many of our colleagues, here’s what you need to know:

- The application interface should have an extremely low entry threshold. Obviously, your application will be used not only by advanced smartphone users but also by those who experience certain difficulties in mastering new interfaces. Often, creating an intuitive, user-friendly one can be a real challenge, but it’s far easier if you work with experienced UI/UX designers.

- You have to implement anti-money laundering (AML) and know your customer (KYC) tools. Otherwise, you may face stiff financial penalties. Essentially, you’re obligated to exclude the possibility of spoofing the data of your bank's clients and to find a vendor that would be able to develop a truly reliable system of authorization and authentication for users.

- You must guarantee the privacy of your customers' data. Banking applications must comply with a much larger number of security certifications than regular applications, and they face stiff financial penalties if they fail to do so. The challenge is remaining current, but by partnering with security-minded developers, navigating this tricky area is easier.

- You must implement blocking payments. You need to provide the ability to instantly connect to the customer accounting system to block credit or deposit cards in suspicious situations.

- Your product must comply with all relevant regulatory requirements. In addition to compliance with multiple security policies, you will also have to take care of compliance with many other requirements, such as offering a high-level user experience for all user segments, including those with disabilities (for example, 42.5 million people with disabilities live in the United States, and this is a colossal part of your potential target audience).

- You may need a highly specialized project team. To implement specific functionality, such as technology based on blockchain or other cutting-edge tech, you may need a highly specialized team of experts.

CHOOSE A TRUSTED DIGITAL PARTNER TO WORK WITH

EPAM Startups & SMBs has been cooperating with the world's leading financial institutions and now we are ready to take on your project.

Performable tech stack you need to create a banking application

To make a bank application, the technologies you need largely depend on the platforms or operating systems you choose. Here’s an overview of what’s necessary based on different platforms:

For cross-platform development:

- Flutter

- React Native

- Xamarin

For hybrid app development:

- Cordova/PhoneGap

- Ionic

- For iOS development:

- Objective-C

- Swift

- Xcode IDE

- Appcode

- UIKit

- SwiftUI

For Android development:

- Kotlin

- Java

- Android Studio and Android Developer Tools (ADT)

- Jetpack Compose, or you can use branded Android UI software

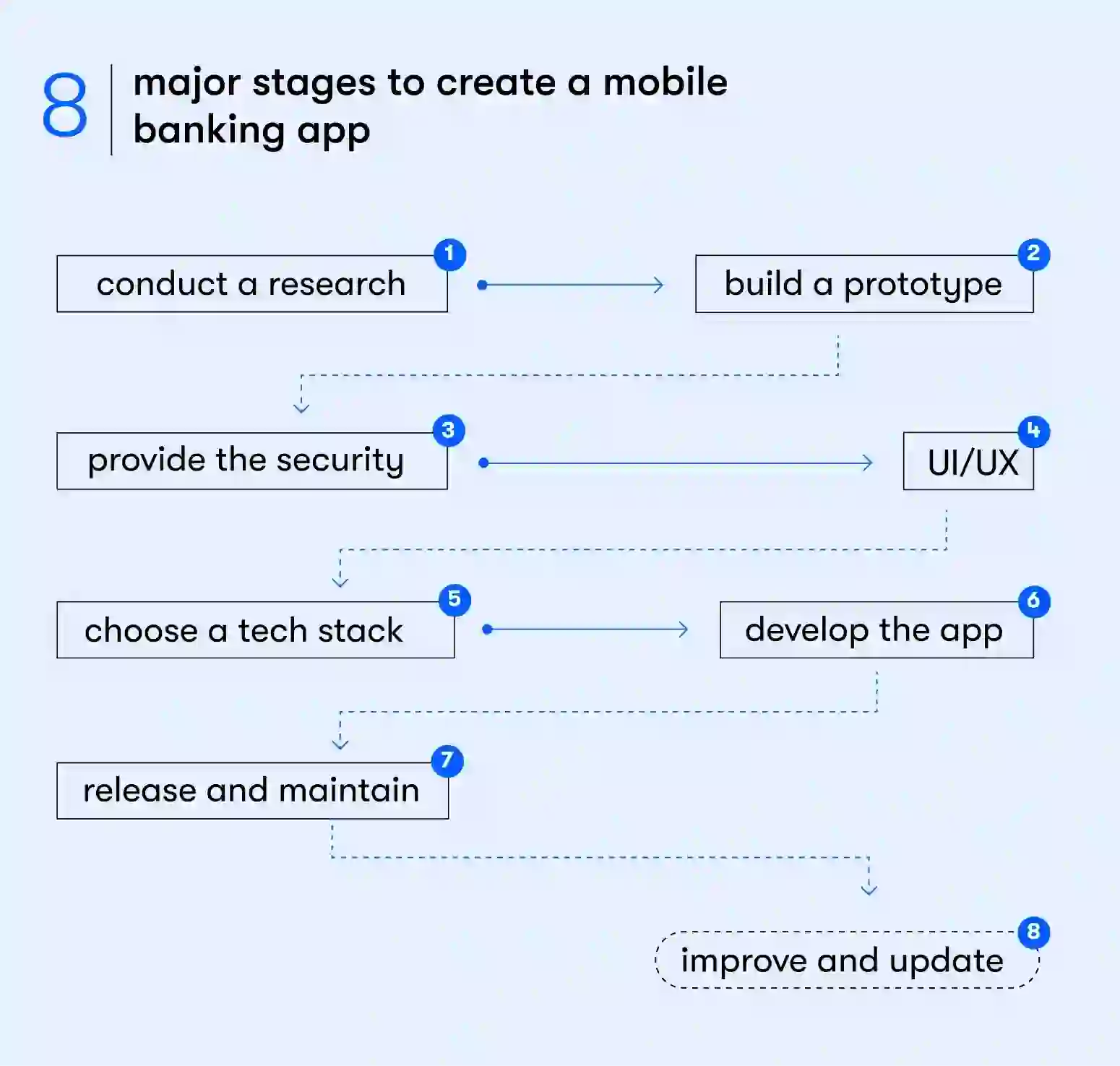

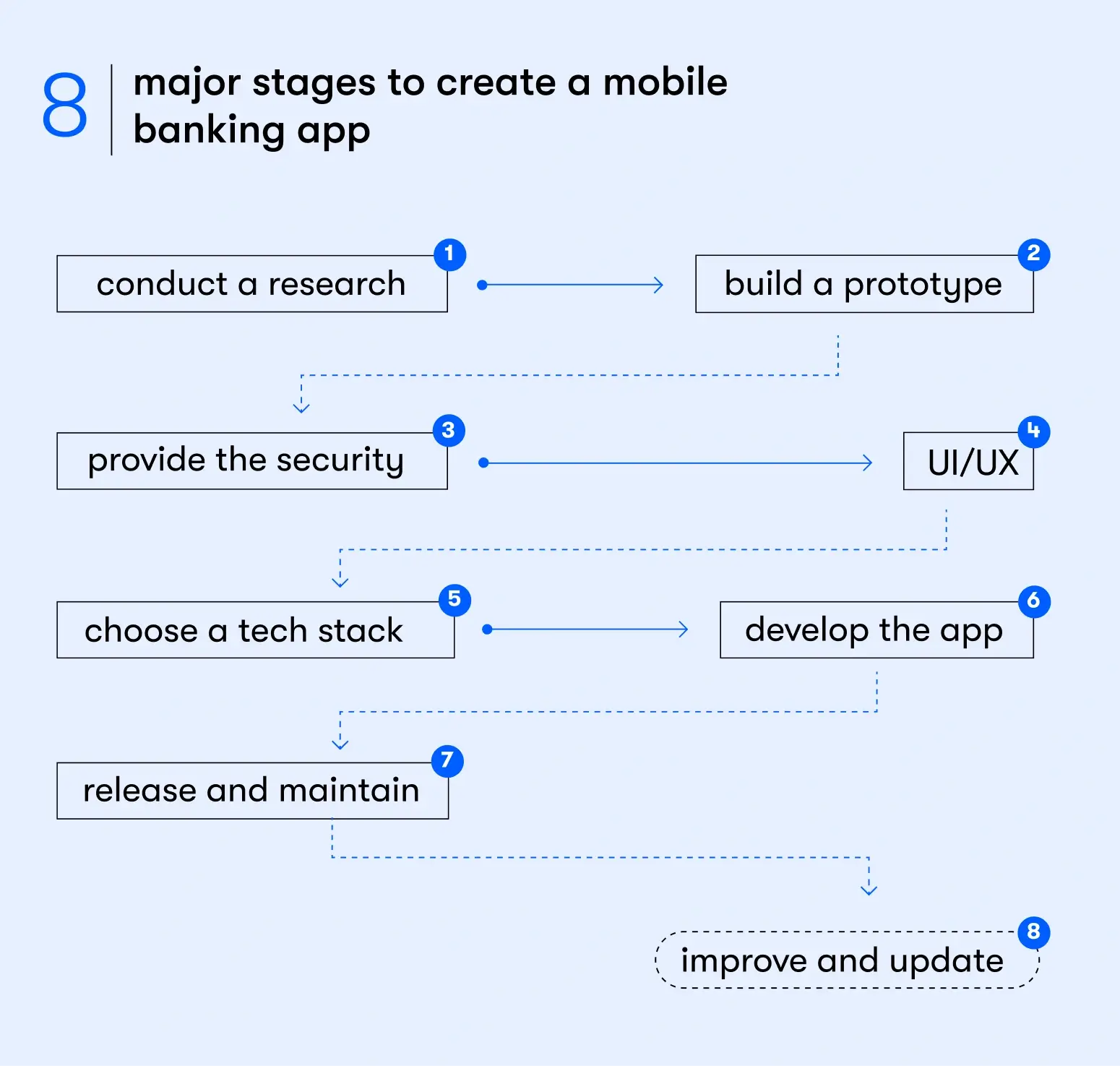

8 major stages to create a mobile banking app

Ultimately, building a capable mobile app provides financial institutions with an array of benefits, but the process also requires a significant amount of planning and expertise. Here’s a step-by-step look at how to create a mobile banking app.

Step 1: conduct research

Before you start mobile banking app development, it is essential to conduct market research to identify the leaders and outsiders of the market, as well as their strengths and weaknesses. Going forward, this will help you compile a winning and differentiating list of specifications for your application.

This stage usually takes a month or two. To optimize it, you can use generally accepted strategies.

For example, SWOT analysis — research aimed at identifying and assessing the strengths and weaknesses of the project, its opportunities, and potential threats — is broadly considered a go-to strategy. Opportunity is defined as something that gives a project a chance to achieve something new: win new customers, introduce new technology, or rebuild business processes. In contrast, threats are factors that can damage the project or deprive it of its existing advantages, such as the emergence of new competitors, substitute products, etc.

Step 2: build a prototype

Since a banking application is a rather complex product, developers usually build a prototype based on specifications drawn up after gathering insights from the client. Only after approving a prototype do the developers begin the software development process.

For the prototype to reflect the functionality of the future product, you need to conduct a number of primary studies:

- Interview with the product owner: During this step, the designer clarifies the expectations and needs associated with the product

- User stories: Typically, there are numerous user stories. The standard formula for a user story looks like this: "being <role or user type>, I want to <perform an action> to <get the result>"

- Jobs stories: This is where you have to focus on the needs of the user. To build them, use the formula: "Situation" -> "Motivation" -> "Expected result"

- Jobs-to-be-done: This is a comprehensive study that determines the scope of the upcoming work and helps to design a product that meets all the needs of the user.

Step 3: provide the security

When it comes to mobile banking applications, you have the type of project that needs much more security guarantors than other public applications. So, to ensure proper compliance, it’s best to hire a team that is experienced in creating similar products.

For example, for banking software, the list of regulatory security requirements to safeguard sensitive data (such as GDPR, PSD2, PCI DSS, CCPA, etc.) is significantly longer than in the case of ordinary applications. This means that before starting to work on a product, it is critical to ensure that the planned functionality complies with all these policies.

Step 4: design the UI/UX

The app design of a mobile banking application usually precedes the implementation of business logic and functionality, and allows developers to demonstrate a primitively functioning version of the product to the client.

When designing mobile banking applications, it is very important for them to provide web accessibility, which is regulated at the legislative level in some countries. Most web accessibility laws are based on WCAG 2.0 guidelines.

Step 5: choose a tech stack

Before starting to implement the underlying technology that supports a banking mobile app’s functionality, the developers choose a tech stack, largely focusing on the client's business goals and budget. Which software tools developers will use depends on the functionality of the application and the chosen mobile OS.

Step 6: develop the app

After the final approval of what’s in place immediately before this phase, developers begin to implement the application functionality. As the separate stages of work on the application are completed, repeated testing is done to ensure the application operates as needed and expected.

In order for the product to meet your expectations as much as possible, it is essential to regularly interact with the development team and give them feedback. This will reduce the number of edits and speed up team workflows. Depending on the complexity of the functionality, product development can take from three to six months.

Step 7: release and maintain

After successful testing, the product is launched into release and is supported by specialists from the developer's side so that technical issues can be promptly eliminated if they occur.

Public applications are typically uploaded into Google Play and the App Store, depending on the OS for which they were created. It is important to remember here that at the stage of transferring the application to public access, the costs do not end: you will periodically have to pay for server capacity, support for some technologies, integration with payment gateways, etc.

Step 8: improve and update

As the client’s business develops and market requirements grow, the application can be optimized and supplemented with new functionality.

New marketing research will help you determine potential areas of improvement or optimization (see Step 1). Thus, the entire software development process can be considered cyclical.

WANT TO CREATE A ONE-STOP SOLUTION FOR YOUR BUSINESS AND INCREASE THE LOYALTY OF YOUR CUSTOMERS?

We will entrust your project to our top fintech engineering team to create your competitive digital product.

WANT TO CREATE A ONE-STOP SOLUTION FOR YOUR BUSINESS AND INCREASE THE LOYALTY OF YOUR CUSTOMERS?

We will entrust your project to our top fintech engineering team to create your competitive digital product.

How much does it cost to make a mobile banking app?

So, how much does it cost to make a banking app? The cost of your future mobile banking application depends on the following:

- The complexity of the hierarchy in the workflows associated with the development of the application (the more logical blocks the application contains and the more specialists in different fields it requires, the more complex the hierarchy)

- The technology stack (especially when it comes to Android software development, with its inherent diversity in mobile devices)

- Deadlines

- Integration with third-party services and API

- The format of interaction between the client and the development team: fixed price, time and materials, dedicated team, team augmentation, or outstaffing.

How a reliable software vendor can keep your development on track

To build a bank application and get a smoothly working product, it’s essential to choose a development team that clearly understands what they are doing and why. The right team will guarantee you the following:

- Cost-effectiveness: Experts with extensive experience will competently prioritize tasks and choose a technical stack to keep the cost of the final solution at the lowest possible point.

- High-quality product or service: The competence of all team members and the well-established interaction between them will help to get a high-quality product in the end.

- Top-quality customer service: A professional project team will remain available after launching the application on Google Play or the App Store and will provide prompt technical support at your first request.

- Ethics and integrity: Good specialists will draw up a competent NDA in which your intellectual property and the private data of your bank's clients will be under complete nondisclosure.

Setting up a development team

Even though developing a mobile banking app may seem complex, a small team of 10-12 people can handle it. It will most likely include the following specialists in the right amount (in general, what’s listed below is the standard set of specialists who create mobile software together, but the exact mix may vary):

- Project Manager

- Business Analyst

- Designer

- Backend developer

- Mobile developer

- QA and testing specialists

- DevOps

Which platforms to choose: native (iOS/Android), hybrid (Flutter), or cross-platform (React Native)?

Hybrid and cross-platform development, which imply the creation of a single application for both mobile platforms, will cost at least 30% less than native app development through most banking software development providers. However, this "one-size-fits-all" approach to building a mobile banking app can make it harder to access native OS functionality.

Note that this statement is more relevant for mobile games than for mobile banking software, which means many financial institutions are best served by favoring cross-platform or hybrid development, except for cases when the main target audience of the application is users of a specific mobile platform. In a nutshell, hybrid or cross-platform solutions are cheaper and have a shorter time to market, but native ones have better performance and UX.

MVP features

If you doubt the choice of functionality for your future neobank application or have a limited budget, it may be better to start with MVP development. In addition to the above key features, we recommend that you also consider the following features:

- Expenses optimization tool

- Chatbot

- Expenses optimization tool

- Bill-splitting

- Personalization

- Voice search

Advanced functionality

If we are talking about advanced products, you will probably also need to use the following technologies when you make a mobile banking app:

- Artificial intelligence (AI). Artificial intelligence in fintech can be used as a basis for chatbots or, for example, intelligently detecting suspicious activity with a customer card.

- Distributed ledger technology (DLT). DLT is an information storage technology. The key features of it are the sharing and synchronization of digital data according to the consensus algorithm, the geographical distribution of equivalent copies in different physical locations, and the absence of a central administrator. In a narrower sense, this is a blockchain (which is used by, for example, Wells Fargo), which is being actively implemented by many banks worldwide.

- P2P transactions. P2P transactions are the easiest way to send money from one individual to another. Such transactions can be used to pay rent, split a restaurant bill between friends, etc.

- Robotic process automation (RPA). RPA is the automation of business processes with the introduction of high-tech approaches and tools, such as machine learning and AI.

- Cloud computing. Cloud computing in banking allows for incremental increases in computing power, provides advanced tools for capturing massive amounts of data, and offers the ability to quickly scale the environment as it grows. Additionally, it can support big data in banking, which is beneficial.

Related services that influence the cost

Technical support and maintenance services significantly affect the budget of your digital product. Along with ensuring ongoing functionality, there can be instances when applications experience issues and need to get back to normal operation as quickly as possible. Due to the urgency, such support services can be quite expensive.

Total sum

So how long does it take to build a banking app, and how much will it cost?

According to the complexity of the final product and the development process, the budget for banking app development can be around $100k-500k. But when it comes to cooperation with an in-house team, it can grow up to $1 million. As for MVPs, they may cost only $100k, depending on the development team you choose. Note that all these rates are applicable to the services of providers from the USA, Australia, Canada, and Western Europe.

If we talk about the time needed to develop an internet banking application, in the case of MVP, it can take around 700 hours, and in the case of a full-fledged product — about 1,250 hours.

Let's summarize this data again in the table below, focusing on the average developer rates depending on their location:

Team | MVP | Full-fledged product |

Local team from the US | $100K | $200K |

Outsourcing in India | $15K | $30K |

Outsourcing in Eastern Europe | $30K | $60K |

The role of EPAM Startups & SMBs in developing a mobile banking application

EPAM Startups & SMBs creates mobile banking applications as part of our IT services for banks using reliable strategies designed to produce exceptional results. Fintech is one of our main areas of specialization. In this niche, we use advanced technologies and innovative approaches to fully meet the needs of both our client companies and end-users, as well as to ensure compliance with all existing banking industry regulations.

Let's take a look at two projects from the fintech niche that demonstrate our experience in developing banking applications.

The case of ImageNPay

EPAM has been working with ImageNPay since 2018. The team has taken responsibility for developing a startup powered by digital payments that eliminates the need for plastic credit and debit cards. The following technologies were used:

- AWS

- Java

- Apple Pay

- SonarQube

- Swift

Since this project is a startup, the main goal of its founders is to offer an environmentally friendly and budgetary alternative to plastic cards, and the EPAM team managed to achieve a 100% result here. Now, the app has a 4.7-star rating on the App Store, showing that real users are highly satisfied with their app experience.

The case of CitiConcierge

The world-renowned bank Citi, with over 200 million customers in over 160 countries, announced a competition to develop a mobile banking application, which ultimately drew in 3,000+ developers. As part of this competition, EPAM created a personalized banking platform called CitiConcierge. The main idea of this software was to provide interaction between the bank's clients and its employees in the digital plane.

The main technological solution used in the process of working on this fintech app was Gimbal beacons connected to local Wi-Fi, as well as tools for native iOS development.

The main goal of this collaboration — to create a cutting-edge, consumer-focused application for Citi’s Digital Banking Platforms from scratch — was achieved. Now the company is working to integrate the solution into its Smart Branch.

Conclusion

As you can see, a multi-functional mobile banking application:

- Is a prerequisite for customer loyalty

- Provides competitiveness for a long time

- Opens new channels for interaction with customers

- Reduces the costs in comparison with hiring new staff

If you want to build your own banking app and would like to partner with a leading mobile banking application development company, contact EPAM Startups & SMBs.

Expert digital communicator and editor providing insights and research-based guides for technology buyers globally.

Expert digital communicator and editor providing insights and research-based guides for technology buyers globally.

Explore our Editorial Policy to learn more about our standards for content creation.

read more