Today, there’s one core reason why figuring out how to create a payment gateway system is worthwhile. As the pendulum continues to swing from in-person transactions to virtual contactless payments, many companies are looking to expand ways to tap into this new trend.

A study by the Federal Reserve shows that cash and check transactions have been gradually waning in popularity since 2019, coinciding with the start of the pandemic in 2020. With the proliferation of contactless transactions, experts projected the total transaction value of digital payments to reach $15 trillion by 2027.

If you are a business owner or software development expert, knowing how to create a gateway solution lets you leverage the shift to capture financial gains. Continue reading to learn how to build a payment gateway system from scratch that can compete with top providers in 2024.

How does an online payment system work?

Before we dive into the ins and outs of a payment system, let's establish a clear understanding of its definition. An online payment system is a digital platform or service that enables the transfer of funds between parties, individuals or businesses. This system uses the internet as its primary transaction channel, eliminating the need for physical money or checks. It provides a convenient, fast and secure way for users to pay for goods and services, transfer money, or carry out any financial transaction online.

For an online payment system to function seamlessly, it requires the following key components:

- Point of Sale (POS): This is the starting point of the transaction. It is where the user initiates the payment. This could be a physical device like a credit card reader in a store or an online shopping cart on an ecommerce website.

- Payment gateway: This is the intermediary between the POS and the payment processor. The payment gateway encrypts sensitive data, such as credit card numbers, to ensure the information is securely transmitted.

- Payment service providers: These entities manage the overall process. They could be banks, credit card companies or independent financial service firms. They handle the flow of transactions, ensure compliance with various regulations and manage the settlement of funds. Their role is crucial in ensuring that online transactions are conducted securely and efficiently.

Here is how the system works:

The customer initiates the transaction at a point-of-sale (POS) system or terminal. The merchant bank obtains information from the payment card (a credit card or debit card), digital wallet, or similar payment methods and forwards it to the payment gateway solution. It also uses tokenization and encryption to safeguard card numbers and similar sensitive data before transferring it to the issuing bank of the card for payment processing.

Once the payment processor (often under the control of the card issuer) receives the request and card data, it goes through a series of authorizations and security measures. Those confirm whether the transaction details from the source match the destination account (merchant account) details.

The payment processor also verifies the bank account balance or available credit line before authorizing or declining the transaction. If the processor approves the transaction, the acquiring bank will receive the approval to release or accept funds for the transaction.

While relying on a payment gateway service created by another company can provide that functionality, that doesn’t make it ideal for managing debit or credit card payments (or other digital payments). When you make a payment system from scratch, you’ll have more control over how it works and the features you can integrate, allowing you to have the ideal payment platform for your specific needs.

Who needs a custom payment system?

Every company in retail and ecommerce will need fintech app development services at some point. But when it comes to custom payment systems, numerous businesses can benefit from choosing to create their own payment gateway, regardless of niche and industry.

Here are companies that should consider building a payment system with custom features:

- Large corporations looking to complete all aspects of their business processes, including avoiding redirects and having full control over how they will process payments.

- Ecommerce and retail companies (including mid-sized and small businesses) looking to upgrade their internal payment systems, mobile app checkout processes, and website checkout pages for online transactions.

- IT companies expanding their business models into payment services, such as by offering branded systems or white-label solutions to companies looking to support Visa, Mastercard, or other card transactions.

- Banks, credit unions, and other financial institutions.

If you fall within those categories, continue reading to discover the pros and cons of developing your own custom solution.

WANT TO BUILD A CUSTOM PAYMENT GATEWAY?

Hire the services of our fintech developers right away.

Benefits and challenges of custom payment gateway development

Custom development is always a mixed bag when it comes to fintech services. Before deciding to create an online payment gateway, consider the following factors.

Benefits of building custom payment gateways

- When you create your own payment gateway, you save on development costs and subscription and transaction fees.

- Custom gateways allow you to modify the infrastructure to suit your business needs or support advanced or new features. For instance, you can add extra verification modules to boost the security of the system infrastructure.

- You can sell the custom gateway as a white-label solution to other companies.

- Custom payment systems are more versatile because they allow multi-currency transactions.

- Since you don’t rely on third-party apps, you’ll end up paying less in fees for the gateway solution, which means more profits.

Challenges of building custom payment gateways

- Custom fintech software development is expensive because you have to make everything from scratch, as well as pay for licensing and other miscellaneous services.

- Building a custom solution that is compatible with multiple systems and PSPs is a time-consuming challenge, and those who aren’t familiar with how to make a payment gateway may incorrectly estimate the development timeline or time to market.

- The cost of maintaining a custom payment gateway is significantly higher than the price of buying a ready-made, provider-maintained solution.

- Creating a secure payment system requires the expertise of cybersecurity experts. Otherwise, you might install security modules and protocols with exploitable flaws, putting users at risk, and come up short during security audits.

- Becoming a standout gateway service is an uphill task because you will be going against established companies that have strong reputations in the world of payment and credit card information processing.

Now that you’ve seen both sides of custom payment gateway development, let’s get down to the core components of the system’s infrastructure.

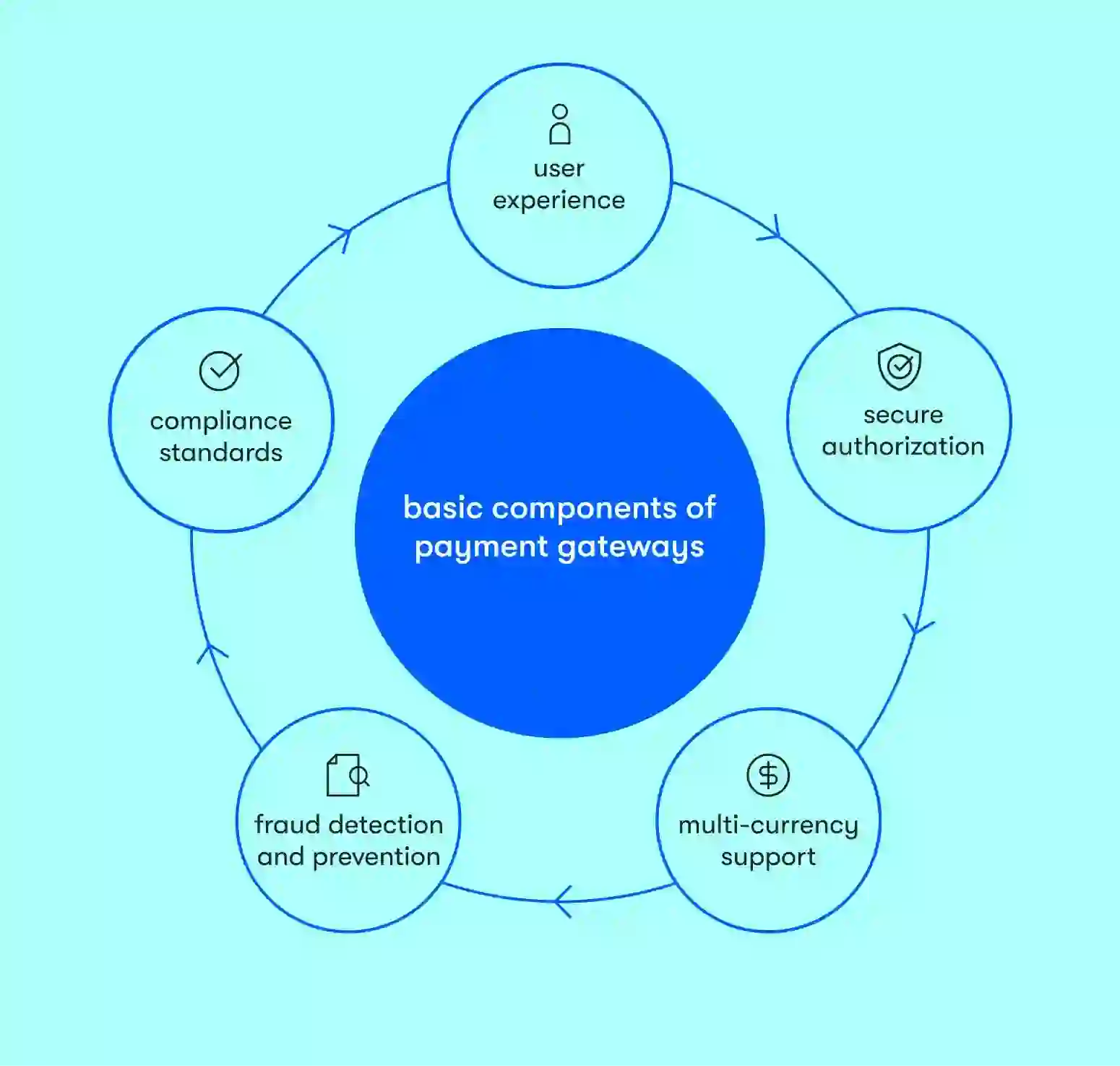

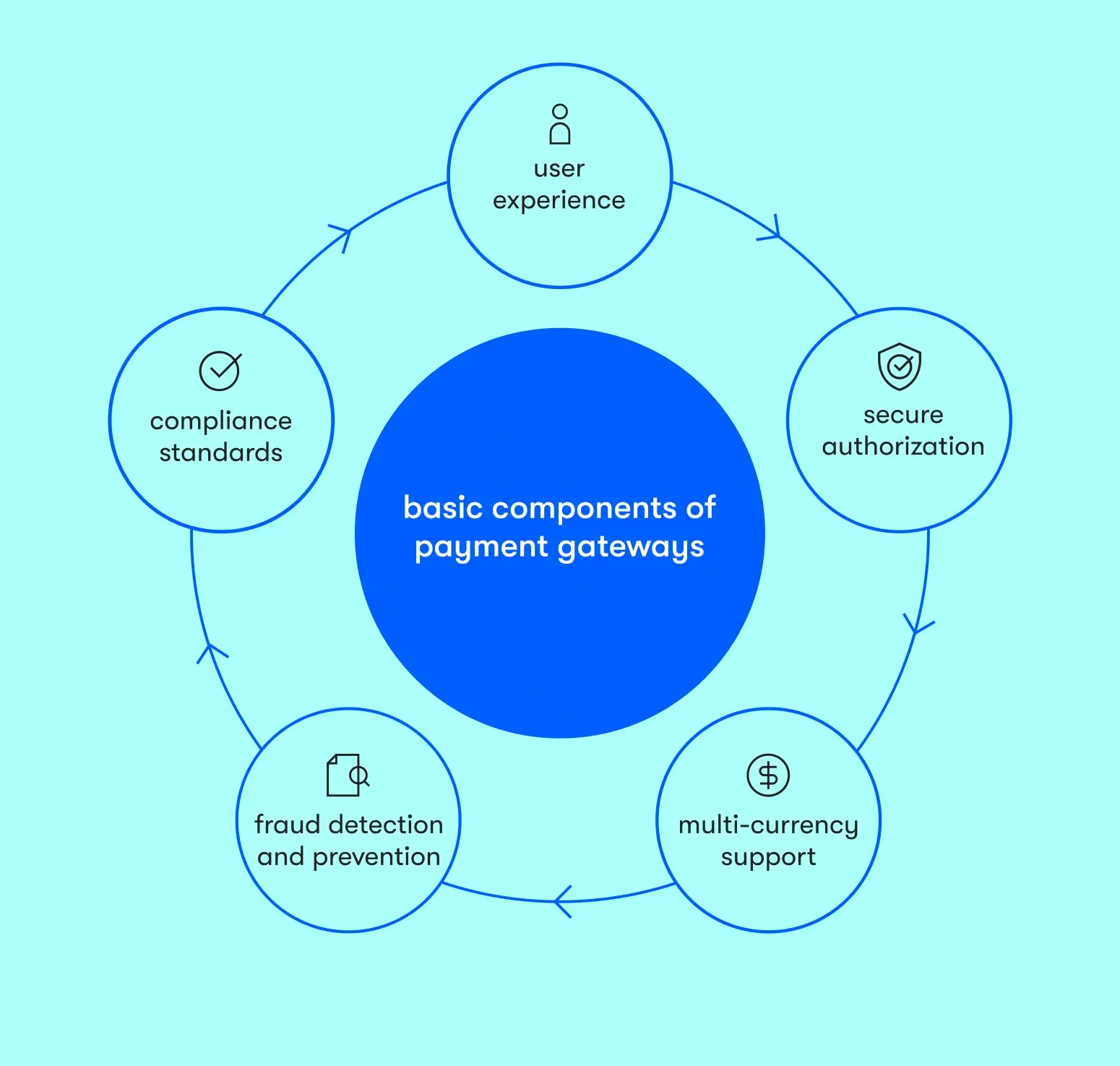

Basic components of payment gateways

Check out the key considerations and features before you build your own payment gateway.

User experience

A critical component of how to create a payment gateway is to factor in the user experience. Your payment gateway should make it easy for customers to conduct payments, ensuring it can handle their needs without them feeling any frustration. You also need to label all essential features to make them usable for users of all demographics. Work with UX researchers to ensure that the interface is intuitive and easy to use.

Secure authorization

In the age of increased cyber threats, any gateway you build must incorporate an array of mechanisms to safeguard data. Don’t forget to include two-factor authentication and other forms of authorization in the framework.

Multi-currency support

When you build a fintech app or launch a fintech startup, you also need to create a payment gateway that supports multiple currencies. To save costs, focus solely on common currencies like USD, EUR, and GBP or those widely used by your target market. You can get accurate data regarding currencies used by analyzing your user demo and choosing options based on locale. If possible, explore cryptocurrencies as well.

Fraud detection and prevention

Although most PSPs use anti-money laundering (AML) and know-your-customer (KYC) practices to detect fraud, you still need to factor in these regulations when you create an online payment system. Use advanced verification systems to authenticate users’ identities before they can use your gateway to make transactions.

Compliance standards

Apart from the regulations mentioned earlier, your system must meet GDPR and PCI DSS compliance standards before release. Otherwise, you will not get the official license in your local country or abroad.

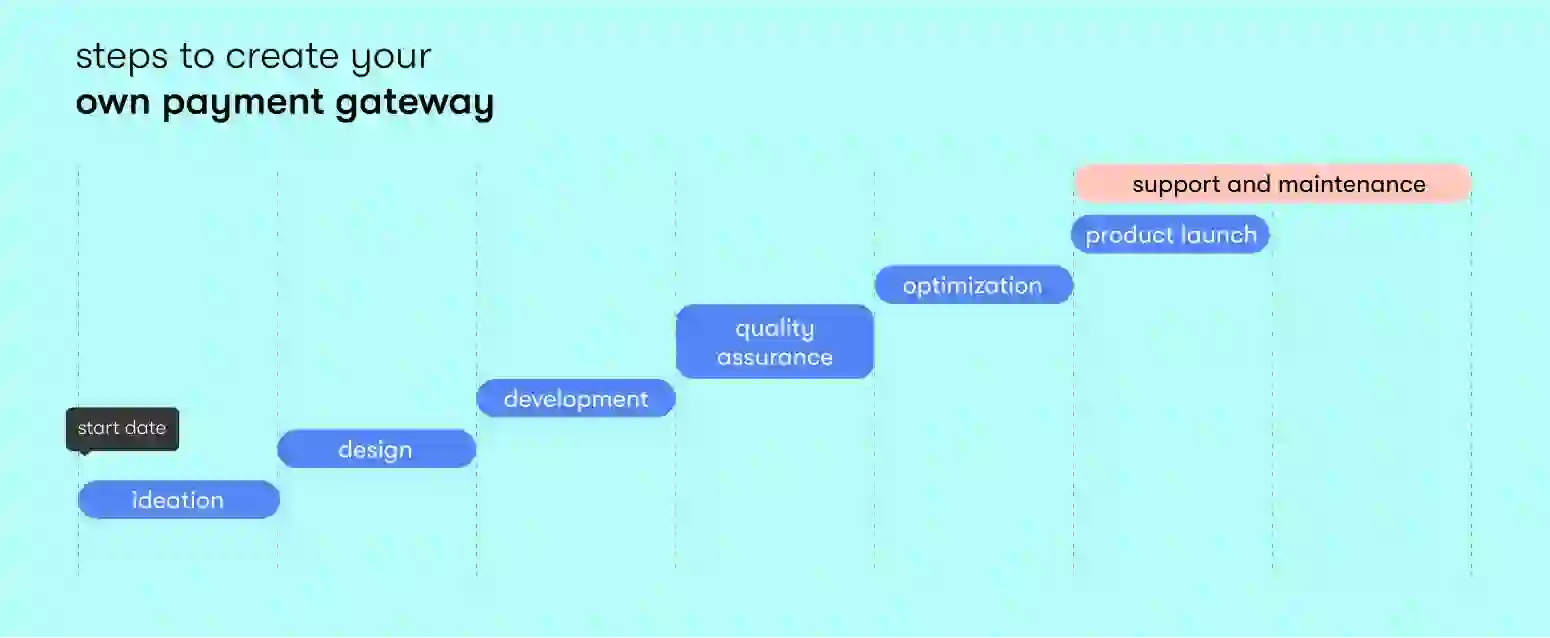

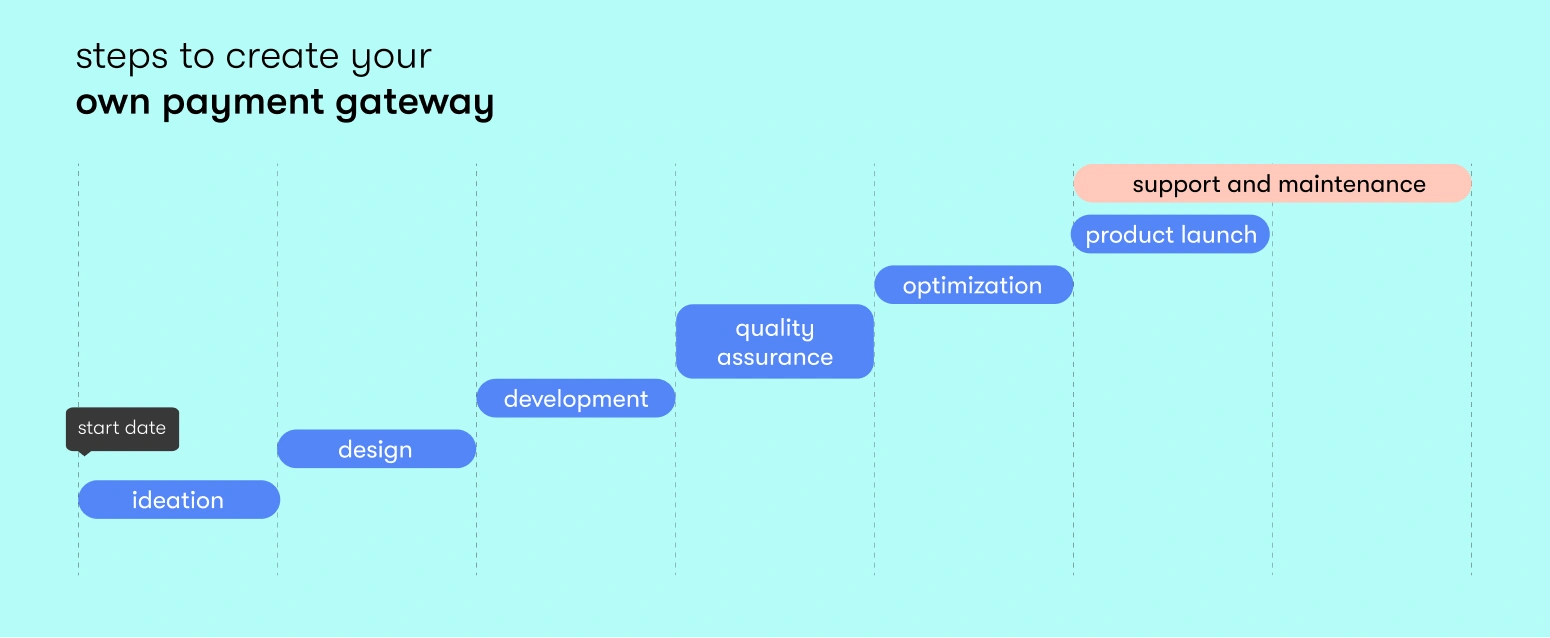

How to create your own payment gateway

Similar to any other software development process, building a payment gateway requires careful planning and execution. Here are the integral steps of how to create a payment gateway that you need to follow.

Ideation

Coming up with an idea for a payment system is only the first step; you’ll still need to hash out the plan with experts to determine if it is feasible or requires changes.

If you want to build a competitive financial payment system, you must conduct extensive market research to highlight existing opportunities and where your competitors are falling short, creating pathways for differentiation.

Design

With your ideas becoming more coherent, it is time to hand the project over to the designers. A team of experienced UI/UX and graphics designers can help you create your product's interface and brand identity. They can also build a working prototype that you can use as proof of concept. After several iterations, you will end up with a feasible product design that developers can start building.

Development

The core infrastructure of your payment system will start taking shape during this period. The development team will collect the material design elements from the prototypes and use them to code the product. Depending on the technical requirements, developers can also integrate third-party APIs in compliance with industry standards.

Most companies handle frontend and backend development processes simultaneously, though others start with frontend development before moving to the backend stage. Regardless of your preferred method, always choose the right tools to create a robust system infrastructure for your gateway service.

Quality assurance

Uncrushed bugs and poor error handling can condemn your payment system before it even gets off the ground, and they can cost you a lot of money over time. To avoid these extra expenses, give your QA specialists the leeway to test the software rigorously to ensure that everything is in perfect shape. After testing, they should generate a detailed report for further changes.

Optimization

If the flaws are critical, re-address some of the earlier development stages to plug all loopholes. The DevOps teams can address minor issues to make the payment gateway flawless. And while optimizing the final version, don’t forget about compliance standards.

Product launch

Depending on your timeline, you may have time to release the beta version for user feedback. After implementing the changes, prepare to launch it as a standalone software program — or sell it to other financial institutions as a white-label software solution.

Support and maintenance

After the product’s release, you still need to provide support to the users of the payment system. Set up a team of live support agents to answer users’ questions and resolve conflicts. Chatbots can also respond to frequently asked questions. Your developers should also continue working on updates to keep the platform running with as little downtime as possible.

READY TO START BUILDING YOUR OWN PAYMENT GATEWAY?

Reach out to us, and we will help you start the development process.

Tips for building a payment system and becoming a key player in fintech

Payment systems are flooding the market today, but most of them have been unable to replace top players like PayPal, Stripe, and Square. If you want your custom payment gateway to stand out, here are some vital tips to keep in mind.

Add advanced features

Doing the bare minimum when building a payment system prevents you from differentiating your solution in the broader market. Instead of only adding core features, use advanced tools to attract a new audience to your gateway solution.

For example, you can create a crypto payment gateway that supports transactions on verified DeFi platforms. This feature alone will give you access to a blossoming market in the financial sector.

Integrating AI in fintech solutions is another way to remain at the cutting edge. Similarly, ensuring your application functions as a budgeting app makes a difference when attracting users.

Use scalable architecture

Build your platform for the future. Instead of relying on legacy software that runs on a monolithic architecture, build a new system that relies on several microservices to function. By doing so, you can scale your system architecture as your user pool expands.

Increase payment security

Standard security protocols like EMV 3-Dimension Secure (3DS) and P2P encryptions can protect transactions, but you can always add another layer of security. Use multi-factor verification to protect users from fraud and cyber threats. For example, you can connect the new payment system with authenticator apps from both Google and Microsoft.

How much does it cost to make a payment system?

When you create a payment system, you have to factor in all expenses related to each stage of development. These will determine the overall cost of making the payment gateway.

Basic costs of payment system development: market benchmarks

- Ideation. You can come up with an idea for free. But if you want to hire a team of experts to conduct in-depth competitor research and analysis, market average prices range from $5K to $7.5K.

- Design. Depending on the project's scope, you might need one graphic designer and two UI/UX designers on your team. As per market averages, you can plan to allocate from $10K to $15K.

- Development. The payment gateway development cost might take between $200K and $250K. But if you want to pay for APIs and other third-party features, add an extra $20K to $30K for integration.

- Testing and QA. To ensure that your team creates a secure payment gateway, you might need to invest up to $10K in quality assurance and testing. You’ll also need to pay for automated testing tools and report generators.

- Licensing. When you start your own payment gateway, the cost of licensing varies depending on your locale and the licensing agency. For instance, your PCI DSS license will cost you between $15K and $40K, depending on the project’s size and your company’s location.

To sum up, based on the typical market rates, your budget size might range between $300K and $400K to start a payment gateway. If you want to outsource fintech software development services, reach out to experts at EPAM Startups & SMBs to get a detailed quote.

Hidden costs and how to cover them

Fees will creep up on you from all angles when you develop a payment gateway for commercial use. Licensing fees, monthly subscriptions, authorization fees, early termination fees, and address verification fees are all potentially part of the equation. Fortunately, most of them come from payment processors.

Since you are working on a custom payment service, you don’t need to fret about the fees above. You only have to worry about paying for APIs and cloud servers if you use them in building the infrastructure.

Other hidden costs connected to the development process can come from omissions and mistakes in planning. Some sources of these extra costs include:

- Omitting usability testing before handing the design to developers.

- Working with developers who lack the required experience for building gateways.

- Making several changes and additions mid-project.

EPAM's experience in online payment gateway development

At EPAM Startups & SMBs — a software engineering services platform for startups and SMBs launched by EPAM — we have a talent pool of fintech development experts with industry-relevant knowledge about creating payment gateways. We also work in a diverse array of niches, providing full-cycle development services to our clients.

In 2018, EPAM partnered with ImageNPay to create a personalized platform that allowed users to acquire virtual credit card customization on any smartphone. EPAM's team handled the frontend and backend development stages before building an SDK that achieved PCI DSS certification.

Similarly, EPAM helped CitiGroup build an innovative, customized, and transformative banking experience called CitiConcierge. This software program provides interconnected experiences for customers and branch personnel.

LOOKING FOR THE BEST PAYMENT GATEWAY DEVELOPERS?

Let us help you assemble a team from our talent pool.

Conclusion

Developing a custom feature-packed payment system is a surefire way to elevate your company’s reputation in fintech. Combine brainstorming with solid research to figure out the type of gateway you want to build, and follow the guidelines in this article to fine-tune your product roadmap. When creating your own gateway, don’t forget about testing and compliance standards. And — as important as any other aspect, if not more so — make the system scalable and secure enough to handle massive transaction volumes safely.

FAQ

Expert digital communicator and editor providing insights and research-based guides for technology buyers globally.

Expert digital communicator and editor providing insights and research-based guides for technology buyers globally.

Explore our Editorial Policy to learn more about our standards for content creation.

read more