Digital transformation in finance is quickly becoming a critical business strategy for ongoing success. By transitioning away from antiquated and cumbersome paper-based business processes, greater efficiency is achievable. Plus, finance digital transformation can elevate the customer experience, support compliance, streamline operations, and address a variety of fintech challenges.

For CFOs looking to leverage digital technologies strategically, here’s a roadmap for success.

What is digital transformation in finance exactly?

Digital transformation for financial software services and financial institutions is a strategy that embraces current and new technology as a means of streamlining operations, enhancing decision-making, improving workflows, and reducing costs. The goal of financial transformation is to boost operational efficiency while increasing profitability, all while meeting customer expectations in a post-pandemic landscape.

Precisely which technologies are involved may vary depending on the needs of the financial services organization. The banking financial transformation journey can include fintech software development with such technologies as artificial intelligence (AI), machine learning (ML), blockchain, robotic process automation (RPA), real-time data analytics, cloud-based computing, enterprise resource planning (ERP), chatbots, internet of things (IoT), and many others.

However, digital transformation in finance doesn’t mean you need to fully reimagine the ecosystem and shift away from all tried-and-true processes. Even when introducing cutting-edge technology to an organization, initiatives should focus on introducing digital tools strategically, allowing a finance team to enhance its function without complete disregard for the user experience. The decisions should align with the profile of the finance organizations adopting the changes, ensuring it’s a net gain for finance leaders, relevant stakeholders, finance professionals, and customers alike.

BEGIN YOUR DIGITAL TRANSFORMATION TODAY

Our extensive digital transformation experience makes adopting cutting-edge solutions a breeze, allowing you to leverage the newest technologies quickly and efficiently.

Why should finance companies invest in digital transformation?

Improved customer experience

Digital transformation enables finance companies to offer seamless and personalized experiences to customers. From online account management to intuitive mobile apps, improved customer interactions increase satisfaction and loyalty.

Streamlined operations and reduced costs

Integrating digital technologies streamlines internal processes, automates routine tasks, improves operational efficiencies, and reduces operational costs. This allows finance companies to allocate resources more efficiently and focus on strategic initiatives.

Fostering a culture of creativity and innovation

Embracing digital transformation fosters a culture of creativity and innovation within many finance organizations. This mindset encourages the development of novel business solutions, leading to enhanced products and services.

Increase in sales

Digital finance transformation strategy opens new channels for sales and revenue generation. Companies can take digital initiatives to expand their reach and attract new customers through online platforms, mobile applications, and innovative financial products.

Improved analytics

Digital tools provide finance professionals with advanced analytics and data-driven insights. This enhances decision-making processes, enabling the finance team and companies to adapt quickly to market changes and make informed strategic choices.

Enhanced security and risk management

Digital transformation strengthens security measures and risk management protocols in the finance sector. Robust cybersecurity frameworks, tools and real-time risk assessments protect sensitive financial data and build client trust.

Seamless regulatory compliance

Digitalization facilitates agile adaptation to the evolving regulatory financial services landscape. Finance companies can easily implement and update compliance measures, ensuring adherence to industry regulations without disrupting operations.

Top business cases of digital transformation for finance

Insurance

Insurance companies operating in the finance industry have a lot of gain from a successful digital transformation:

- Using an omnichannel approach to communication makes it easier to connect with current and prospective customers, ensuring their needs are met.

- Automation reduces operating costs while enhancing the user experience

- Analytics can assist with financial reporting and supply chain management. Insurers can also easily gather data from respondents for analysis, making it easier to identify industry trends within the industry and adapt to shifting conditions quickly.

Retail banking

The retail banking industry strongly benefits from digitalization. Today’s customers are increasingly reliant on smartphones, and digital transformation in banking creates opportunities to help them leverage their devices while increasing convenience. Developing apps with APIs that connect to third-party providers can enhance the digital banking experience. Introducing contactless payments or “buy now, pay later” (BNPL) services expands functionality, too.

From the standpoint of operational efficiencies, cloud migration and computing can streamline processes, improve banking cybersecurity, and support scalability. Plus, it can reduce costs, allowing retail banks to offer better pricing to their customers.

Trading & investing

Cloud adoption, automation, and APIs all have the ability to make trading and investing more efficient, both from a customer perspective and that of the companies providing the services. By using the right frameworks, algorithms, and technologies for forecasts, it’s easier for investment services providers to provide customers with cutting-edge access to capital markets.

Wealth management

The wealth management financial sector can also benefit from digital transformation tools. Automation can streamline various tasks, enhancing the employee and customer experience. Analytics make sound decision-making easier, while cloud solutions can speed up the delivery of services without sacrificing security.

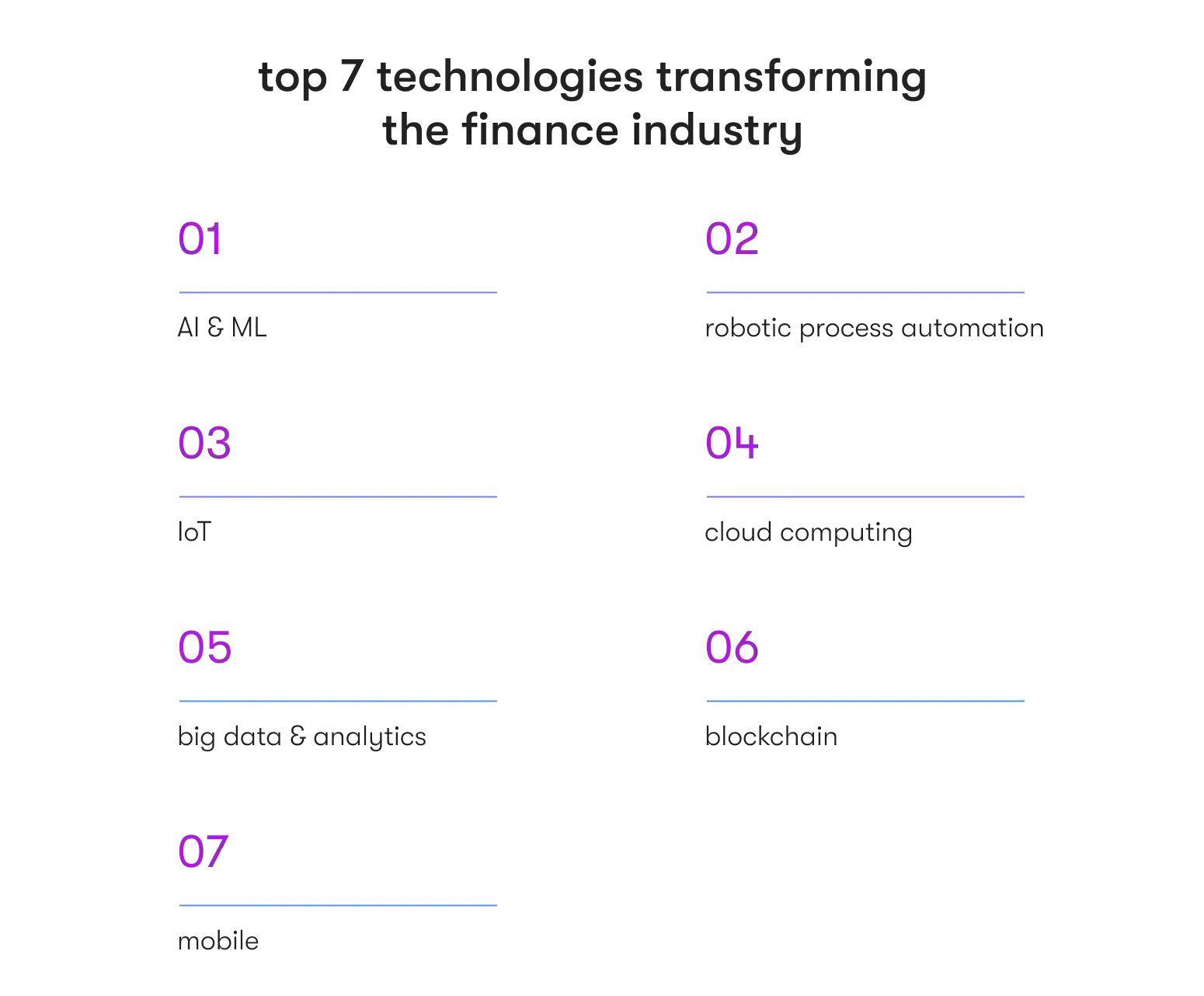

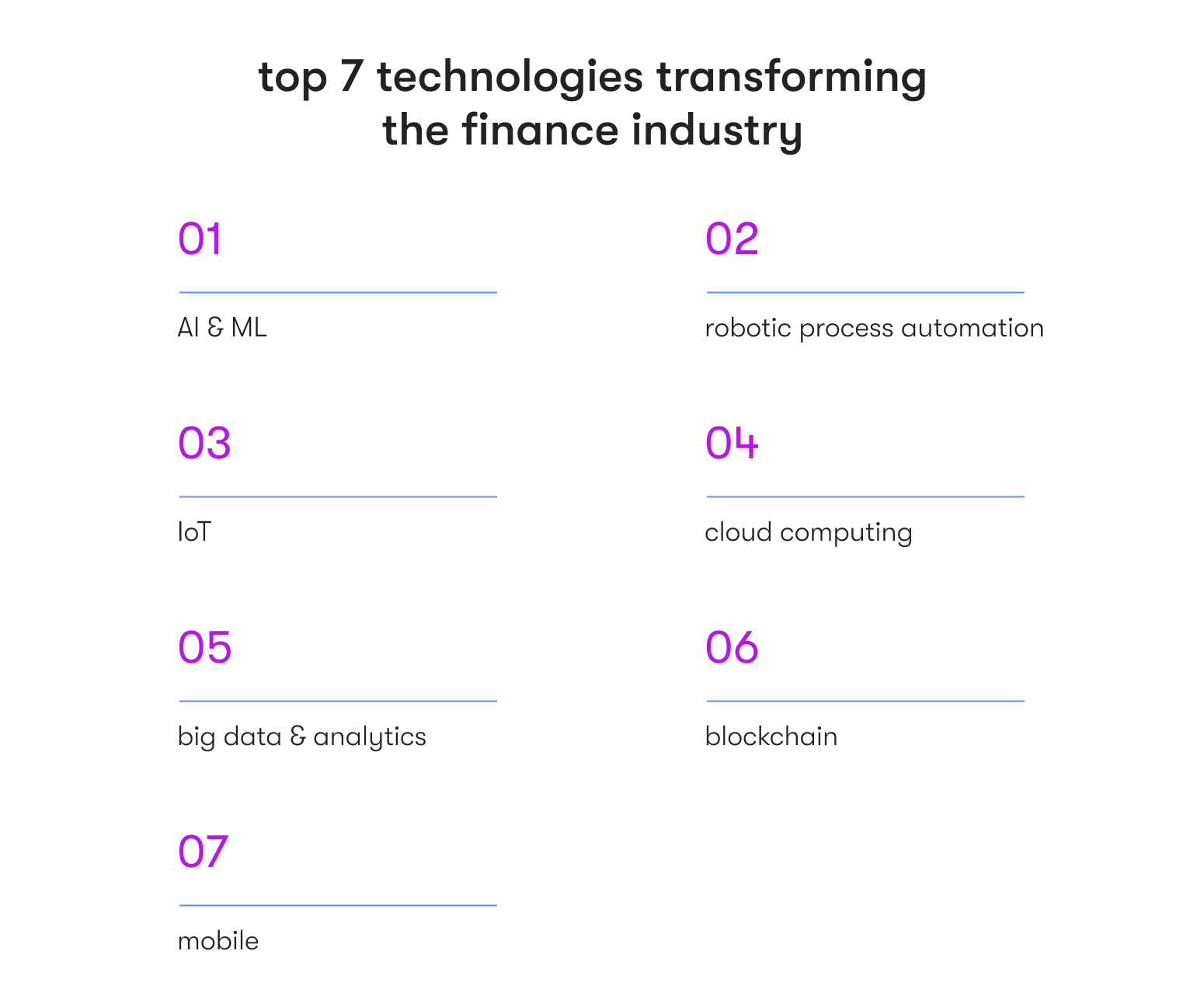

7 digital transformation technologies disrupting the finance function right now

When it comes to digital transformation and the finance function, specific technologies are undeniably making waves. Here’s a look at which ones are disrupting the finance function most significantly, making them wise starting points for organizations interested in digitalization in finance.

1. AI and ML

AI and ML technologies can substantially reduce the risk associated with fraudulent transactions. AI is particularly adept at identifying anomalous activity, while ML allows the system to adapt over time, ensuring it’s able to detect newer threats as they emerge. When properly designed, an AI and ML-supported fraudulent activity detection system can even take action when suspicious actions are identified, safeguarding accounts immediately to limit or avoid potential theft.

2. Robotic process automation

Robotic process automation (RPA) allows technologies to handle tasks that are highly repetitive, ensuring financial professionals can focus their energies on duties that genuinely require their expertise. Plus, RPA can boost the customer experience by allowing customers to handle specific tasks themselves without the need to contact an employee. With process automation, it’s also possible to replicate data across connected systems, which can reduce errors by eliminating tedious data entry.

3. IoT

IoT devices can gather data in real time, ensuring financial companies are well-informed about customer activity. For example, vehicle sensors can collect information for insurers about customer driving activity, creating opportunities to adjust pricing based on customer behavior. Smart ATMs can provide immediate alerts about malfunctions or low levels of available cash, leading to better experiences.

4. Cloud computing

Cloud technology has been a boon in many industries, including finance. Along with offering heightened security in many cases, cloud solutions are incredibly agile, offering exceptional scalability and agility. Additionally, many cloud services providers offer solutions for improved business continuity and disaster recovery.

5. Big data and analytics

In the finance sector, big data and analytics provide exceptional value. Data scientists are able to harness collected data for predictive purposes, making it easier to anticipate future digital finance needs. Trends analysis can help financial institutions identify potential opportunities, allowing them to increase their profitability by offering next-gen solutions for evolving customer needs. With analytics, it’s also possible to adjust marketing approaches to target specific audiences, boosting customer acquisition.

6. Blockchain

The decentralized finance (DeFi) landscape is evolving, and many traditional financial institutions are incorporating blockchain to harness some of the more intriguing features. Speedier transactions and highly secure records can both improve the customer experience. Similarly, smart contracts featuring blockchain can provide significant benefits.

7. Mobile apps

Today’s customers often prefer using their smartphones to engage with their financial institutions over other mechanisms. Since that’s the case, financial institutions of all types are developing capable mobile apps to allow customers to access information, conduct transactions, and engage with customer service using their preferred devices.

What challenges to expect on your way to finance digital transformation

Undergoing a digital financial transformation does come with challenges. As a result, financial institutions need to prepare for the journey ahead, ensuring they’re in the best possible position to succeed. Here is a quick overview of some of the biggest challenges associated with digital transformation in the financial industry.

Legacy systems

Replacing or integrating legacy systems is often one of the more cumbersome parts of digital transformation. While the new IT solutions typically offer far more capabilities, managing the transition requires significant preparation and planning, as well as the right know-how.

Cybersecurity

While many updated technologies perform well when it comes to cybersecurity, any update to a tech ecosystem can introduce vulnerabilities. As part of a digital transformation, financial institutions need to fully evaluate their new security position to ensure it’s suitably strong.

Compliance

Another issue that can result from updating a tech ecosystem is non-compliance. Financial institutions need to ensure that any solutions or systems under consideration meet all legal requirements for the industry before they’re fully implemented.

Adaptation

A digital transformation means the financial institution is undergoing a significant change. As a result, organizations often need to upskill or reskill employees to make sure they’re ready to use the new systems, solutions, or procedures. Additionally, process updates are a must, ensuring any established protocols are revamped based on the digital updates.

NEED A DIGITAL TRANSFORMATION PARTNER TO SOLVE THESE CHALLENGES?

Leverage our experience to make your finance digital transformation achievable.

Key benefits of the financial digital transformation

While corporate finance digital transformation is a significant undertaking, financial institutions that undergo it have a lot to gain. Here are the benefits of digital transformation in finance and accounting.

Better customer experience

Today’s customers are highly tech-savvy, and they have specific expectations about how their experience should unfold. By embracing the digital transformation of the finance function, institutions are better equipped to meet or exceed those expectations. They can offer the features and services today’s discerning customers prefer, making it easier to maintain customers and attract new ones.

Greater operational efficiency

One of the core motivators for digital transformation in the finance industry is increased operational efficiency. Through digitalization, financial institutions can streamline processes, reduce workloads, eliminate waste, improve accuracy, and much more.

Higher profitability

Digital transformation can increase profitability in several ways. By boosting efficiency, financial institutions are more productive, creating more opportunities for revenue generation. Reducing waste can cause operational costs to drop while offering services and features that attract new customers and boost revenue. As a result, most financial institutions experience a strong return on investment (ROI) after their digital transformation.

Agile operations

Cloud technologies, automation, and other types of digital transformation can make financial institutions more agile. For example, cloud computing offers greater scalability than in-house alternatives, while automation allows repetitive tasks to be handled by technology, freeing up employees to focus on activities that genuinely require the human touch.

Data-driven decision-making

By incorporating AI and data analytics, financial institutions can harness the power of their data to support wiser decision-making. They can analyze trends and patterns to identify unique opportunities, allowing them to capitalize on shifting customer sentiment and remain ahead of the competition.

Digital transformation in finance and accounting: a CFO’s action items

Define your goals

Well-defined goals are at the core of a finance digital transformation strategy. Determine what your financial institution wants to achieve and the business areas you’re hoping to improve, giving you specific targets.

Identify potential obstacles

Even an ultimately successful digitalization in financial services will encounter roadblocks and challenges along the way. Identify the potential obstacles early in the planning phases, allowing you to outline possible solutions before moving forward.

Create a strategic plan

Once you understand your goals and know about potential obstacles, it’s time to create a formal strategic plan. Outline how you envision the CFO digital transformation unfolding, determine the expertise you’ll need along the way, and work out an initial timeline. Additionally, make sure to factor in your budget.

Choose partners wisely

Whether you have an internal workforce that can spearhead a digital transformation or need everything handled by a digital consulting agency, choose those partnerships carefully. Digital transformations require a significant amount of expertise, so it’s best to focus on experienced partners with strong reputations, ensuring you’ll have the best possible experience.

Real-world case studies of successful financial digitalization

Explore the transformative journeys of global financial leaders, JPMorgan Chase and Square, as they harness cutting-edge technologies to redefine the financial landscape. From JPMorgan Chase's implementation of AI and automation for elevated customer experiences to Square's financial technology integration empowering small businesses, learn more about the profound impact of digital transformation on customer satisfaction, operational efficiency, and financial inclusion.

JPMorgan Chase: Elevating customer experience through AI and automation

JPMorgan Chase, one of the premier global financial institutions, embarked on a comprehensive digital transformation initiative to elevate customer experiences and optimize internal processes. By harnessing advanced artificial intelligence (AI) and automation technology, the bank aimed to create a more efficient and personalized banking experience.

Key digital initiatives:

- AI-enhanced customer service: JPMorgan Chase implemented a virtual assistant with natural language processing (NLP) capabilities to handle routine customer queries and provide rapid responses. This alleviated the workload of human customer service agents and significantly enhanced response times.

- Automation in operations: The bank integrated robotic process automation (RPA) to automate repetitive and rule-based tasks in back-office operations. This increased operational efficiency, diminished errors, and accelerated processing times for various financial transactions.

- Tailored financial insights: Utilizing machine learning algorithms, JPMorgan Chase developed a personalized financial advisory platform. The system analyzed customer transaction data to offer tailored insights, investment suggestions, and budgeting tips, fortifying customer engagement.

Results:

- Heightened customer satisfaction: AI-driven customer service substantially improved customer satisfaction scores. Customers appreciated the prompt and accurate responses provided by the virtual assistant.

- Operational excellence: The incorporation of automation in back-office operations significantly reduced processing times, minimized errors, and reduced operational costs. The bank reported improved efficiency in handling routine tasks, allowing human employees to focus on more intricate and strategic activities.

Square: Transforming small business finance with fintech integration

Square, a fintech company led by Twitter co-founder Jack Dorsey, embarked on a transformative journey to empower small businesses through innovative financial solutions. The company's digital transformation centered around providing small business owners with a seamless and integrated financial ecosystem, encompassing payment processing, point-of-sale solutions, and financial management tools.

Key digital initiatives:

- Integrated payment systems: Square introduced a suite of integrated payment systems that enabled small businesses to accept various forms of payments, including credit cards and mobile payments. This streamlined the payment process, offering convenience to both merchants and customers.

- Data-driven financial insights: Leveraging data analytics and machine learning, Square developed tools to give small businesses actionable insights into their financial performance. This included real-time sales data, inventory management suggestions, and personalized financial reporting.

- Expansion into banking services: Square expanded beyond payment processing by offering banking services tailored to small businesses. This encompassed business loans, payroll services, and business debit cards, providing a comprehensive solution for financial needs.

Results:

- Empowered small businesses: Square's integrated financial solutions empowered small businesses by providing them with tools traditionally accessible only to larger enterprises. This democratization of financial services contributed to the growth and success of many small businesses.

- Enhanced financial inclusion: The expansion into banking services addressed the financial needs of underserved small businesses, promoting financial inclusion. Square's approach showcased how fintech integration can bridge gaps in traditional banking services and cater to a broader spectrum of businesses.

Get started with EPAM Startups & SMBs

Digital transformation in finance is a significant undertaking, but it’s far easier with the right partner. EPAM Startups & SMBs has substantial experience with finance digital transformation. If you’re ready to start your journey, we can guide you through the process, connect you with fintech engineering talent, and design the technologies you’ll need to succeed.

READY TO START YOUR DIGITAL TRANSFORMATION?

Let our experienced team assess your current position and create custom solutions designed specifically for your needs.

FAQ

Anush has a history of planning and executing digital communications strategies with a focus on technology partnerships, tech buying advice for small companies, and remote team collaboration insights. At EPAM Startups & SMBs, Anush works closely with subject matter experts to share first-hand expertise on making software engineering collaboration a success for all parties involved.

Anush has a history of planning and executing digital communications strategies with a focus on technology partnerships, tech buying advice for small companies, and remote team collaboration insights. At EPAM Startups & SMBs, Anush works closely with subject matter experts to share first-hand expertise on making software engineering collaboration a success for all parties involved.

Explore our Editorial Policy to learn more about our standards for content creation.

read more