Trading software development is the process of designing and building software applications specifically for facilitating and automating trading activities in financial markets. This includes creating tools for real-time market analysis, trade execution, risk management, and portfolio management, ensuring they are secure, reliable, and efficient. Such software can cater to individual traders, brokerage firms, and financial institutions, enhancing their trading capabilities and decision-making processes.

As a result, software development companies are now responding to ever-increasing market demands by rolling out trading applications for personal and corporate use. But before you venture into trading software development, you must understand the stock market.

In this article, we’ll discuss the current state of stock trading software development. We’ll also explore how to develop stock market software and the best practices for building a market-worthy application for trading.

The 2024 trading software market overview

Fortune Business Insights estimates that the current market value of automated trading software is expected to rise from $2.19 billion in 2023 to $3.56 billion by 2030.

Research from Mordor Intelligence shows that companies are adopting algorithmic trading practices, which account for around 70% of the overall volume of equity trading in the USA. The same research also shows that this growth rate will clock an 11% CAGR increase by 2026.

According to Markets and Markets, the global cryptocurrency market could experience a 7.1% CAGR, with the crypto market rising up to $2.2 billion in 2026.

Technological advancements like blockchain, machine learning, big data analytics, automation, and artificial intelligence (AI) have further shaped the financial sector. Like big data, automation, machine learning, and AI in banking, these cutting-edge technologies enable traders to analyze vast amounts of data, identify patterns, and make data-driven investment decisions.

Additionally, the market has shifted towards mobile trading, with increasing numbers of traders using smartphones and tablets to execute trades on the go. Mobile trading apps provide clean interfaces and reliable connectivity, all while making portfolio management and retroactive and predictive data analysis intuitive. Plus, they offer convenience, accessibility, functionality, and real-time updates based on current market data, attracting many retail traders.

As these figures predict an upward trend in trading software development, it makes sense for financial and fintech companies to invest in a custom trading system.

Types of trading platforms

With the help of trading platforms, investors and traders can trade and monitor stocks and financial markets in real-time. This platform could be a mobile app, a website, or a desktop application.

Before you decide to learn how to create a trading platform or move on to develop trading software, you should know the two main types of platforms available.

Commercial platforms

These systems have user-friendly features for day traders and investors, including news feeds, user guides, and exchange portals. Stock and cryptocurrency exchange trading apps like Robinhood and Binance fall under the commercial platform category.

Proprietary platforms

These are custom systems tailored to a brokerage’s specific trading style and requirements. You can find prop platforms like FTMO in massive financial institutions and banks.

Advantages of trading software development for professional traders

Before you commit to building a new application for trading, check out the potential benefits of trading platform software development for traders and brokerage firms.

Access to the global stock market

In the past, brokers could only buy and sell stock options within their locale or country of origin. But with modern apps like eToro and FXPro, traders can purchase and monitor stocks worldwide. These trading solutions also allow traders to manage multiple accounts simultaneously using numerous trading apps.

Stress-free trading

The trading software makes it easy for investors to access their portfolios and trade from any device they prefer without stress. Further, features like advanced search filters offer diverse customization options to personalize the experience.

Real-time alerts

When trading time-sensitive assets with high volatility, trading software solutions allow users to set reminders to remain up-to-date. Price alerts can also notify them about movements in the market, creating opportunities for just-in-time stock and cryptocurrency trading.

Advanced data

Some investment applications allow users to access as much information as possible, more than what human stockbrokers can provide. On-demand forecasts and technical analysis are often factored into application development, ensuring users can get critical details quickly. Users can even monitor what others are doing to determine if the market is “bullish” or “bearish” over a certain period.

Better decision-making

Trading apps provide users with up-to-date charts and backtesting capabilities. Access to multiple data sources allows them to make informed, properly-timed trading decisions instead of relying on emotions and instincts. Apps like FxPro even offer warnings when you are trying to initiate high-risk trades, creating a degree of risk management for users of all experience levels.

How does stock trading software make money?

The primary aim of venturing into brokerage software development should be to make real money — which should come as a by-product of offering value to consumers.

However, monetization is different in stock market software development. For example, you cannot make trading software for sale in the App Store; all your potential competitors are (or will be) offering free services. So, that takes app purchases out of the equation.

Let’s figure out lucrative ways to develop trading software that’s not just high-quality but will rake in funds for your company.

Transactions

Bloomberg defines this monetization model as payment for order flow (PFOF). Essentially, you receive a fraction of every transaction you direct to a market maker. This model helped Robinhood generate $486 million in Q2 of 2023.

Fees and interests

Modern trading apps allow traders to borrow money or securities at specific interest rates. Interest can help custom trading platforms become more lucrative. For example, Robinhood earned $234 million in new interest revenue in Q2 2023, which showcases its potential as a revenue stream.

You can also monetize your trading app by charging fees for specific transactions. But before fixing commissions to any transaction, analyze your competitor’s fees to ensure you stay within a rational limit.

Here are some of the fees charged by the trading platform eToro:

- Contract for differences (CFDs) on cryptocurrencies, FIAT currencies, and other assets.

- Overnight fees — for CFD positions that stay open overnight relative to the value of the position.

- Withdrawal fees — for international transactions.

- Inactivity fee — for accounts dormant for more than 12 months. Caveat: this particular charge could discourage users from using your application in the future.

In-app advertising

Most free apps rely on advertisements to make money. But with trading apps, ads can become intrusive and even harmful to the overall user experience, driving people away from your platform. That said, you can consider them as you move forward with app development. Here are various ad formats for trading apps:

- Banner ads

- Pre-roll video ads

- Native ads

- Rewarded video ads

Freemium model (subscriptions)

Paid subscriptions offer another means of monetizing a trading app. Under this model, you can make certain advanced features accessible only to premium subscribers.

NEED A DEVELOPMENT PARTNER TO CREATE YOUR STOCK MARKET SOFTWARE?

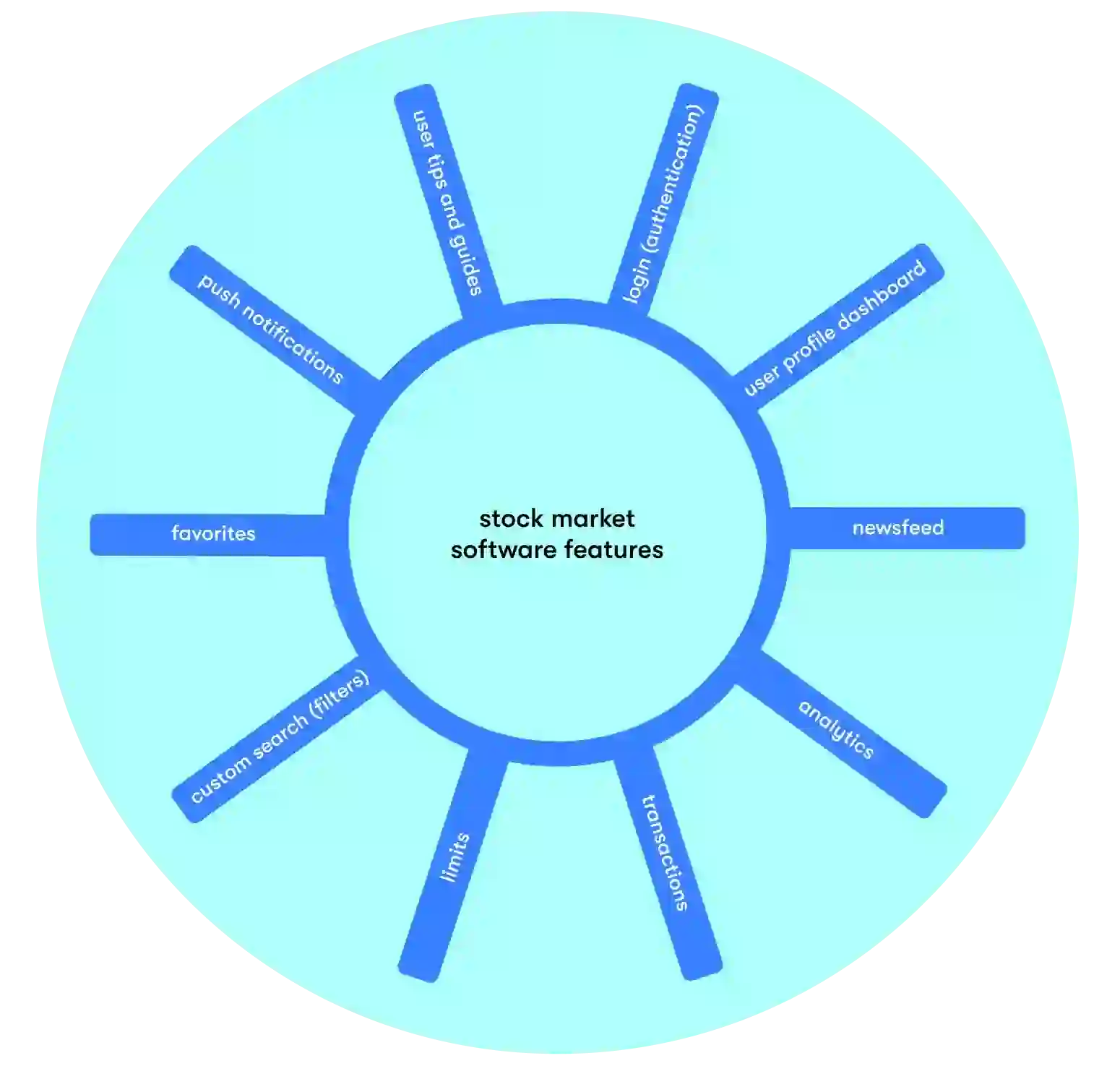

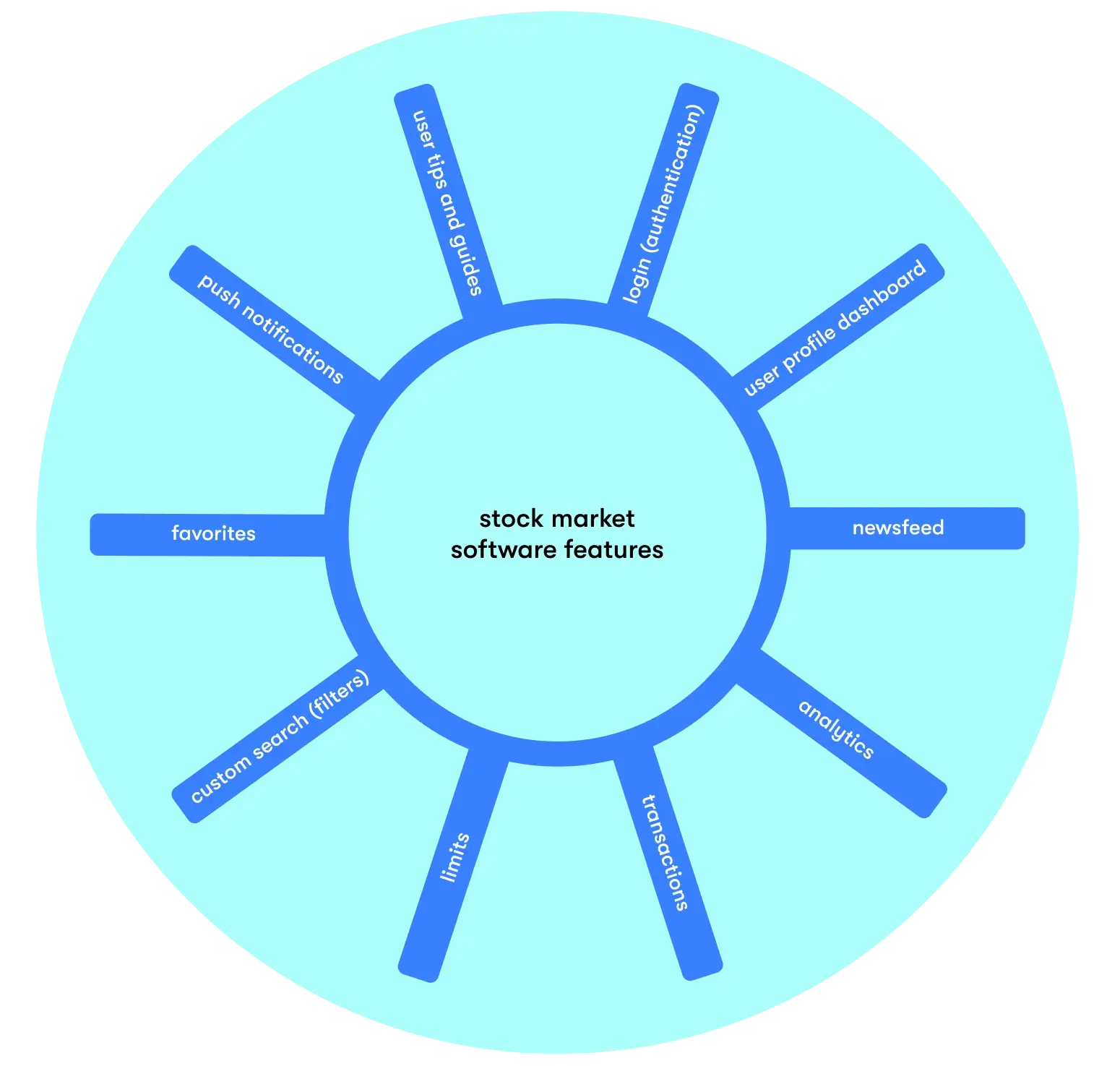

Essential features to consider when developing stock market software

When you make stock market software, you must consider some core functionalities to make the app viable in an already saturated marketplace and possibly tackle existing fintech challenges. Let’s go through some of these features and explore how they affect how stock investors use your application.

Login (authentication)

Just as with any mobile banking app, before trading with the app, users have to create an account and confirm their identity — as part of Know Your Customer (KYC) regulations. Subsequently, they can log in with their details while also having some protection for the contents of their portfolio, reducing the odds of it falling into the wrong hands.

In addition, your platform must enable two-factor authentication. This way, even if someone gets access to the trader’s login details, they’d still need to scale an extra wall to access the dashboard.

User profile dashboard

Trading systems must contain a customizable dashboard where users can update their personal profiles as well as monitor their trading activity.

Newsfeed

Equities trading relies on gathering valuable information and acting on it promptly. With that in mind, apps used to trade stocks should contain a curated news feed for information and updates.

Analytics

The platform should provide users with access to trading charts, indicators, and other analytical data, at a bare minimum. The data chart can also appear at the top of the news feed.

Transactions

Along with having a payment gateway to ensure users can bring money onto the platform, the software should allow traders to buy and sell their assets freely to support a reasonable degree of liquidity. Additionally, the more trading options available, the better the application.

Limit

For brokers running automated trading strategies, limits can help you tread the fine line that often exists in a volatile stock market. eToro automatically allows traders to withdraw their gains using the “Take Profit” feature. Other limit functionalities, like “Stop Limit,” also help high-risk traders minimize their losses.

Custom search (filters)

Scrolling through the entire catalog of assets and stocks is a time-suck, but with custom search tools, traders can look up specific stocks instantly.

Favorites

This option should allow traders to add their favorite stock options and assets to a dedicated, easily accessible folder.

Push notifications

Since traders need real-time stock market updates, adding push notifications to the app will help them keep track of market movement and asset volatility.

User tips and guides

The application should have an educational page with helpful resources for people looking to boost their trading knowledge.

6 steps to create a trading platform

When you create trading software for commercial or personal use, outline and follow these essential steps during the development cycle.

Research and ideation

When making stock trading software, always kick off the project with extensive research. Your first port of call should be to determine the platform of choice.

If you want to build proprietary trading software, focus your project scope on the desktop version. If you create a commercial application, focus on mobile devices. You could also build a cross-platform application to reduce development costs.

Why make these distinctions? Traders who use proprietary platforms work in brokerage firms, which means they will spend more time on their laptops. Conversely, individual traders will most likely trade on their phones and tablets. So, you need to identify your target audience for the trading app to build a convenient platform for them.

After choosing the optimal platform, craft a marketing strategy and monetization models to ensure you profit from the trading app.

Idea validation

Garnering results from your well-founded research, you can now develop a minimum viable product or proof of concept to present your ideas to upper management. If you are the product owner, you can send the MVP to a financial expert for evaluation and feedback.

Design

The role of UX designers is to convert those groundbreaking ideas into a visual representation using graphic and material design elements. In some cases, the UI/UX designer can create a dynamic prototype for usability studies — or as proof of concept.

Development

This is the most important custom trading software development aspect. At this stage, your project manager and team of developers or the trading software development company you partner with should analyze and convert the designs to code.

For frontend development, you can hire JavaScript developers. And for the backend aspect, languages like Python, .NET, Ruby, React, and PHP can do the work, so you need a dedicated software engineer team that can cover the desired language bases.

Always base your choice of programming languages and tech stacks on the expertise of your stock market software developers and the available resources. Highly-skilled engineers can also help you determine the best third-party APIs to integrate into the platform to improve performance and bolster cybersecurity. Bringing in DevOps specialists is also wise, as it can streamline how the project unfolds.

In addition, hiring financial experts with industry experience to create brokerage software for your fintech startup will help you avoid breaking financial regulations and other compliance standards.

For example, in 2021, the Financial Industry Regulatory Authority (FINRA) fined Robinhood $70 million for misleading users — this issue resulted from flouting financial regulations during development.

Testing

The last thing you want when you create your own trading software is to release a bug-filled product into the market. A case in point is the Robinhood “infinite money” saga that skewed the trading algorithms, almost plunging the company into a financial hole.

Hire QA testers to conduct end-to-end testing for every product before deployment to avoid legal action and customer outrage. Check the software infrastructure to ensure it is bug-free and impregnable to DDoS attacks.

Deployment and maintenance

Once you have a working app, it’s time to ramp up the marketing. Create marketing outreach campaigns to inform your target audience about the product’s benefits. Pay special attention to your platform’s unique value proposition and communicate it in the marketing pitch.

After generating enough buzz for the application, you can deploy it on the cloud or any locally-hosted server. When the product goes live, you’ll still need to process user feedback and run upgrades to maintain the system.

By the way, you could also release the beta version first to gauge market reception before launching the final version.

READY TO BUILD YOUR CUSTOM TRADING PLATFORM?

How is developing stock trading software different with EPAM Startups & SMBs?

Over the years, EPAM Startups & SMBs has helped many startups and budding businesses adopt fintech solutions for stock trading and personal finance. Our engineers have extensive experience in developing software platforms that meet industry standards and address consumers’ needs.

If you want to work with us, please contact us to review the specifics of your project and all other essential details.

Conclusion

Building profitable trading software is a challenge that requires painstaking attention to detail and a systematic approach throughout the development cycle. Along with understanding how to create trading software, knowing the fundamentals of stock trading is essential, ensuring you can make informed decisions regarding your custom trading software development.

FAQ

Expert digital communicator and editor providing insights and research-based guides for technology buyers globally.

Expert digital communicator and editor providing insights and research-based guides for technology buyers globally.

Explore our Editorial Policy to learn more about our standards for content creation.

read more