The fintech revolution has ushered in an era where the boundaries between traditional and digital banking are becoming increasingly blurred. Mobile banking applications offer users unprecedented convenience, accessibility, and control over their financial operations. However, developing these sophisticated applications involves a meticulous process, encompassing everything from idea to execution, including secure transaction protocols, intuitive user interfaces and robust backend infrastructures.

As we delve into the cost of developing a mobile banking app, our aim is not just to understand the investment into hiring software developers and maintenance teams but to illuminate the intangible complexities that define the very essence of these digital financial solutions.

The mobile banking apps market now

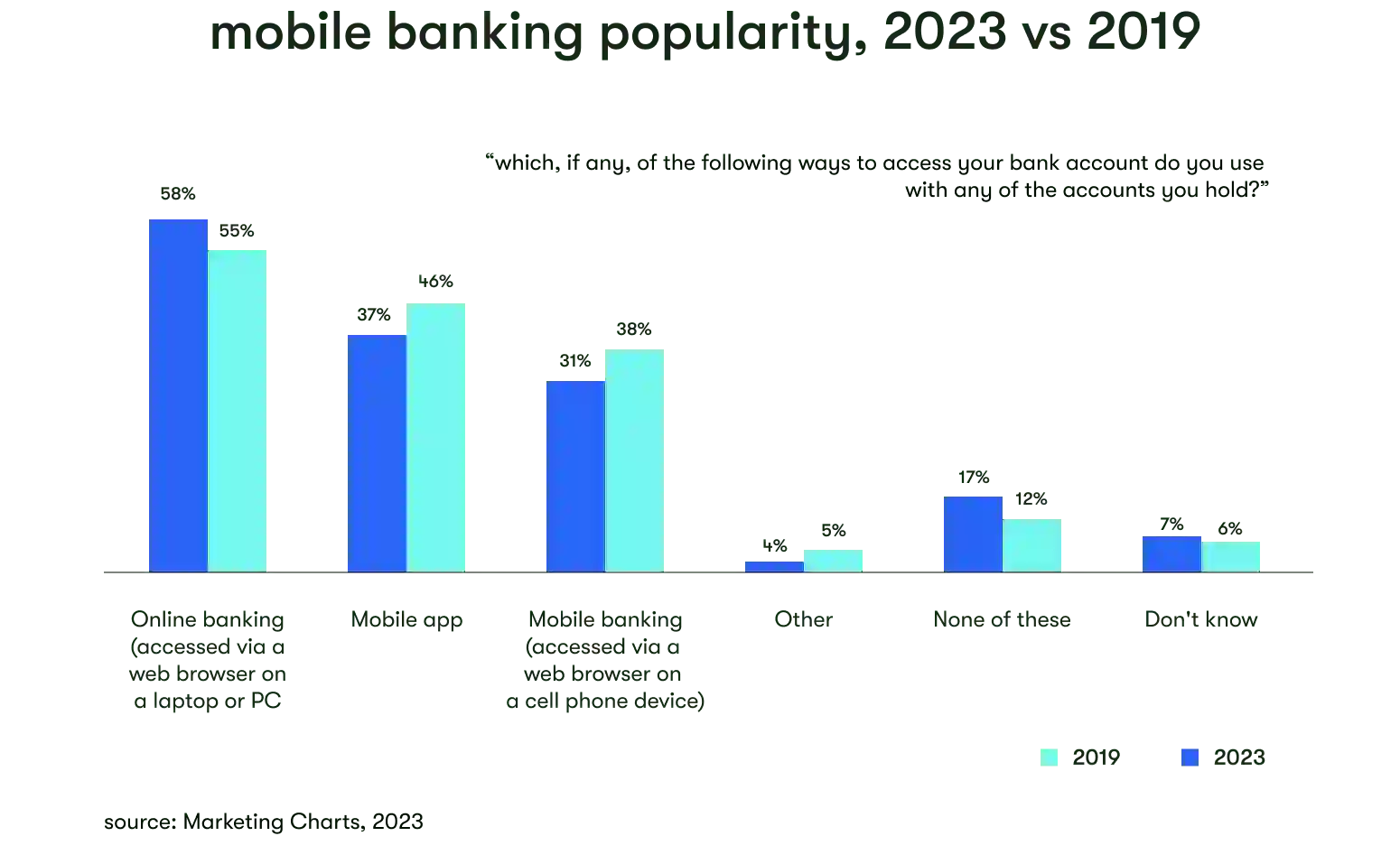

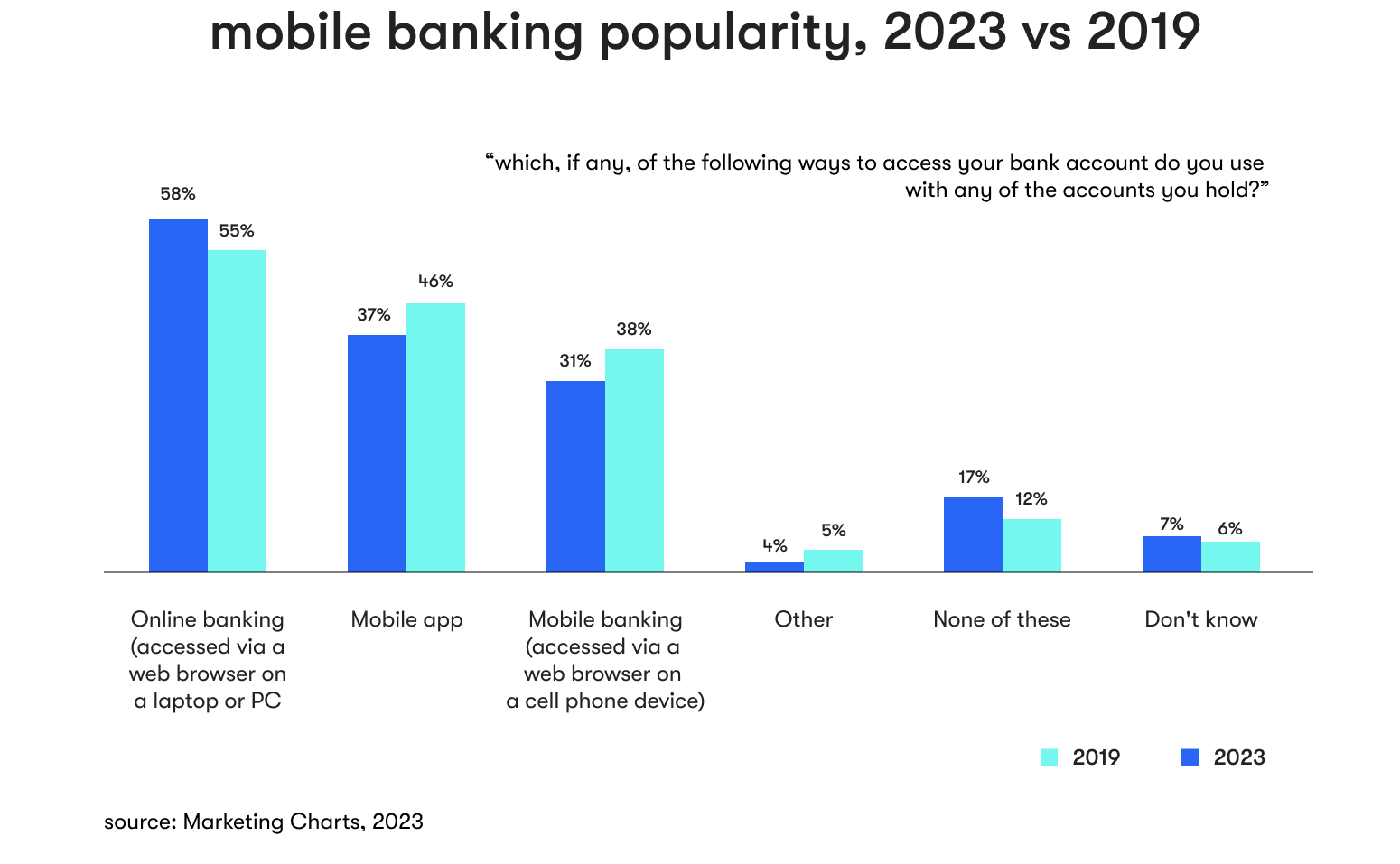

The landscape of fintech software development is witnessing an unprecedented revolution, and at the forefront are mobile banking applications. The convenience and accessibility offered by mobile banking apps have led to widespread adoption among consumers, with a notable shift towards using mobile devices as the primary channel for banking activities.

The mobile banking apps market is continually evolving, driven by technological advancements, regulatory changes, and shifting consumer preferences. As institutions strive to differentiate their offerings and establish trust among consumers, the market dynamics will continue to shape the future of mobile banking. According to a report by Allied Market Research, the global mobile banking apps market was valued at $1.5 billion in 2022 and is projected to reach $7 billion by 2032, growing at a CAGR of 16.8% during the forecast period. Mobile banking apps have experienced widespread adoption among consumers due to the convenience and accessibility they offer.

One of the key dynamics shaping the mobile banking app market is the continuous evolution of technology and its impact on consumer behavior. As smartphones become more advanced and secure, consumers are increasingly comfortable managing their financial activities through mobile apps. This has created a competitive landscape among banks and fintech companies to develop innovative features and functionalities that enhance their mobile banking apps' user experience and security.

The market dynamics are also influenced by regulatory changes and compliance requirements, which play a crucial role in shaping the mobile banking landscape. As regulatory bodies impose stringent security and data privacy standards, banks and fintech companies must invest in robust security measures and compliance frameworks to ensure the safety of customer data and transactions.

Features to include in your banking app

A banking app's success is tied to how much it costs to develop a banking app, including pivotal features that cater to user needs and expectations. This section navigates through the key functionalities that should form the bedrock of your fintech mobile app development and strategy, ensuring not just functionality but indispensability in the eyes of the users.

Payments and money transfers

Enabling swift fund transfers between domestic and international accounts is essential for providing users with convenient transfer methods. Whether users split bills with friends, settle debts, or make recurring payments, your app must facilitate effortless peer-to-peer transactions.

Integrating a mobile wallet further enhances the user experience, providing a digital alternative for quick and secure transactions. A comprehensive bill payment system should be included, allowing users to manage and settle their financial obligations conveniently, supported by automatic payment options and timely reminders. Additionally, including QR code payments ensures modern and contactless transactions, aligning with the evolving trends in digital payments.

App accessibility

App accessibility is a collection of essential features and user experience factors that influence how easily your users can interact with the app and how successful is your banking mobile app development in general:

- Optimal user experience: Balancing stringent security measures with an optimal user experience is crucial. The registration and login journey should be intuitive, minimizing friction while ensuring the highest security standards.

- Efficient navigation: The mobile banking app should feature a user-friendly interface with intuitive navigation. Users should be able to easily locate key functionalities such as account overviews, transaction histories, fund transfers, and bill payments. A well-organized menu system and clear iconography create an efficient and seamless user experience.

- Responsive design: The app should cater to various devices and screen sizes, ensuring responsiveness across smartphones and tablets. A responsive design not only enhances accessibility but also contributes to a consistent and enjoyable experience for users across different platforms.

- Customization options: Allowing users to personalize their app settings enhances the overall user experience. This may include theme customization, font size adjustments, and the option to set notification preferences. Allowing users to tailor the app to their preferences promotes a sense of ownership and increases user satisfaction.

- In-app support and FAQs: A comprehensive system is essential for addressing user queries and concerns. Integrating a frequently asked questions (FAQs) section, live chat support, or a direct link to customer support services ensures that users can easily find assistance within the app, reducing the need to navigate to external channels.

- Offline functionality: While the app relies on internet connectivity for most features, providing essential functionalities in offline mode ensures users can access critical information even in areas with limited or no connectivity. This feature is particularly beneficial for checking account balances or recent transactions when internet access is temporarily unavailable.

- Regular updates and enhancements: Continuous improvement is vital for keeping the mobile banking app relevant and secure. Regularly updating the app with new features, security enhancements, and performance improvements demonstrates a commitment to user satisfaction and safety.

- Feedback mechanism: Encouraging users to provide feedback within the app allows the development team to gain insights into user preferences and pain points. A well-established feedback mechanism helps identify areas for improvement and guides future updates, ensuring the app evolves in line with user expectations.

DEVELOP A LEADING BANKING APP WITH US

Build your team from the 100+ tech capabilities that we offer, and have our experts join your project within 1-3 weeks.

Account management

User interfaces for account management take center stage, exploring the design elements that enhance accessibility and clarity. From intuitive visualizations to user-friendly navigation, the aim is to present account information in an informative and effortlessly digestible manner.

Customization options become pivotal in tailoring the user experience. Whether arranging information hierarchies, setting display preferences, or opting for personalized alerts, custom-developed software can contribute to a sense of ownership and adaptability within the app.

Transaction history

Monitoring financial activities becomes a seamless endeavor with a comprehensive transaction history feature.

- Transparency: By providing a transparent account of past transactions, users are empowered to track, analyze, and understand their spending patterns, thereby fostering a sense of financial control and responsibility.

- Design: Transaction logs are not just records but a dynamic representation of financial narratives. From categorizing transactions to incorporating visual elements that aid quick comprehension, the goal is to transform a list of transactions into a user-friendly timeline.

- Efficiency: Search functionalities and filters emerge as essential tools in facilitating efficient user navigation through transaction histories. Whether searching for specific transactions, applying filters based on dates or categories, or extracting summarized reports, these design elements create a seamless user experience.

Push notifications

Central to the effectiveness of push notifications is the ability to tailor them to individual preferences. Whether it's updates on account transactions, balance thresholds, or special promotions, customization ensures that notifications align with users' unique needs and preferences, enhancing the overall user experience. Users can promptly respond to notifications and address anomalies through real-time security alerts, reinforcing trust in the bank's commitment to safeguarding their financial well-being.

App security

Encryption protocols play a crucial role in safeguarding sensitive information. Using advanced encryption standards, a mobile banking app should secure data during transmission and storage.

Secure APIs (Application Programming Interfaces) further contribute to a protected environment, enabling secure data exchange between the app and external services. Opting for cloud-based solutions and prioritizing banking cybersecurity can be pivotal for a successful banking app and help your team strategize a multi-layer security system.

- Account recovery protocols: In the event of forgotten passwords or compromised accounts, well-defined recovery protocols ensure users can regain access securely, striking a balance between convenience and security.

- Biometric authentication: Incorporating fingerprint scans, facial recognition, or even iris scans, biometric authentication adds an extra layer of security by validating users based on unique biological characteristics.

- Two-factor authentication (2FA): This feature requires users to provide two separate forms of identification before gaining access — typically a password or PIN and a secondary method, such as a temporary code sent to their mobile device.

- Multi-layered security: A comprehensive approach involves integrating multiple security layers, such as device recognition, IP tracking, and behavioral analytics, to scrutinize and validate user access.

- Secure password policies: Establishing strong password policies, including length requirements and the inclusion of special characters, contributes to the overall security posture of app access.

- Compliance standards: Adherence to industry compliance standards, such as GDPR or PCI DSS, adds an extra layer of assurance, indicating a commitment to data protection and user privacy in the app access ecosystem.

Bank branches and ATM locations

For an enhanced user experience, integrating maps of nearby bank branches and ATMs is essential. Geolocation services are pivotal in this integration, allowing the app to determine the user's location accurately. Seamless connections to physical locations ensure that users can quickly locate the nearest bank or ATM, facilitating convenient and quick access to in-person services. Map integrations provide visual representations, making it intuitive for users to find and navigate to nearby financial institutions. Geolocation features enhance convenience and contribute significantly to user engagement and overall satisfaction.

In-app chats

Integrating an in-app chat feature places responsiveness at the forefront and transforms the user experience into a dynamic and user-centric journey.

- Seamless assistance and query resolution: The in-app chat feature serves as a dedicated space where users can seamlessly seek assistance, inquire about transactions, or resolve issues — all within the confines of the app. By offering a direct channel for communication, users are spared the inconvenience of navigating away from the app or resorting to external communication methods.

- Real-time communication channels: Real-time communication channels further enhance the immediacy of customer support. Users can connect with customer support representatives instantly, fostering a sense of accessibility and reliability. This real-time interaction contributes significantly to user satisfaction and establishes the app as a responsive ally in their financial journey.

- Efficiency amplified with chatbots: The integration of chatbots adds an efficiency layer to the customer support landscape. Chatbots are designed to respond quickly to common queries, offering immediate solutions to routine issues. This automation accelerates the support process and ensures users receive timely assistance outside regular business hours. While chatbots handle routine queries, customer support representatives can focus on more complex issues, creating a symbiotic system that optimizes efficiency and user satisfaction.

Hands-free banking

Voice-activated functionalities are becoming increasingly important in the era of smart technology. Integrating voice commands into the features of a banking app allows users to perform hands-free functions. Natural language processing enables the app to understand and respond to user commands, enhancing accessibility. Voice recognition technology ensures accurate identification of user instructions.

AI integration

The integration of artificial intelligence (AI) marks a transformative leap in the capabilities of banking apps. AI-driven features surpass conventional functionalities, ushering in a new era of personalized insights, predictive analytics, and streamlined customer interactions and payments.

- Personalized financial insights: One of the key facets of AI integration in banking apps is the ability to provide personalized financial insights. AI algorithms analyze user behavior and discern patterns, preferences, and financial habits. This deep understanding enables the app to offer tailored recommendations, guiding users in optimizing their financial decisions. Whether it's budgeting advice, investment suggestions, or savings strategies, AI transforms the banking app into a personalized financial advisor, enriching the user experience with valuable, individualized guidance.

- Predictive analytics: Powered by AI and big data, predictive analytics is a dynamic force in enhancing user engagement. From suggesting suitable financial products to offering timely reminders, the predictive prowess of AI enriches the app's user engagement, making it an indispensable companion in users' financial journeys.

- Streamlined customer interactions: AI-powered chatbots revolutionize customer interactions within banking apps. These intelligent virtual assistants offer instant and intelligent responses to user queries, creating a seamless and interactive communication channel. AI-powered chatbots enhance customer satisfaction and free up human resources to focus on more complex tasks, optimizing the overall efficiency of customer support within the app.

- Fortifying security measures: Integrating AI in banking apps is pivotal in fortifying security measures, particularly for fraud detection. AI algorithms continuously analyze patterns in user behavior and transaction data to identify and prevent suspicious activities. Balancing the advantages of AI with ethical guidelines ensures a highly secure and trustworthy AI integration process.

GET OUR TEAM OF BANKING APP DEVELOPERS ON BOARD

Our expert app developers are ready to answer all your questions and make sure your vision is 100% met.

How much does it cost to build a banking app? Factors to consider

The cost of developing a basic banking app with fundamental features can range from $50,000 to $150,000. However, incorporating advanced functionalities like AI-driven chatbots, multi factor authentication, or blockchain integration may elevate the banking app development cost to $150,000 to $300,000 or more, depending on the complexity.

Developing a banking app is a multi-faceted process with numerous factors and challenges influencing overall development costs. Each element plays a distinctive role in shaping the financial landscape of the banking app development cost. Now, let's delve into these key factors to analyze their potential impact on the total cost of building a banking app.

Wireframes and prototypes

The initial step in app development involves creating a wireframe — a visual representation of the app's structure and functionality. The complexity and detail of the wireframe significantly impact the overall architectural design and development cost. After the wireframes are finalized, the next crucial step is creating interactive prototypes. Prototypes provide a tangible and dynamic preview of the app's user interface and functionality. They allow stakeholders to experience the app's flow and interactions before the actual development begins, providing an opportunity for feedback and refinement.

The approximate banking app development cost breakdown based on the market averages is the following:

Wireframing:

- Basic wireframes: $5,000 - $10,000

- Detailed wireframes: $10,000 - $20,000

Prototyping:

- Basic prototypes: $10,000 - $15,000

- Interactive prototypes: $15,000 - $25,000

- High-fidelity prototypes: $25,000 - $40,000

UI/UX design

User interface (UI) and user experience (UX) design ensure a seamless and intuitive app interface. The intricacy and sophistication of the design directly affect the development cost. Design costs vary widely, with simpler designs costing between $10,000 and $30,000, while more sophisticated designs may range from $30,000 to $50,000 or more.

The choice of platform

The choice between developing a native or hybrid app influences the banking app development cost.

Native apps are designed for a specific platform (iOS or Android), offering optimal performance but requiring separate development for each platform. On the other hand, hybrid apps are cross-platform, reducing development time but potentially compromising on performance.

Developing a native app for a specific platform (iOS or Android) can cost between $20,000 and $50,000 per platform. Opting for a hybrid app, while more cost-effective, may range from $40,000 to $80,000, considering the need for cross-platform compatibility.

Team size

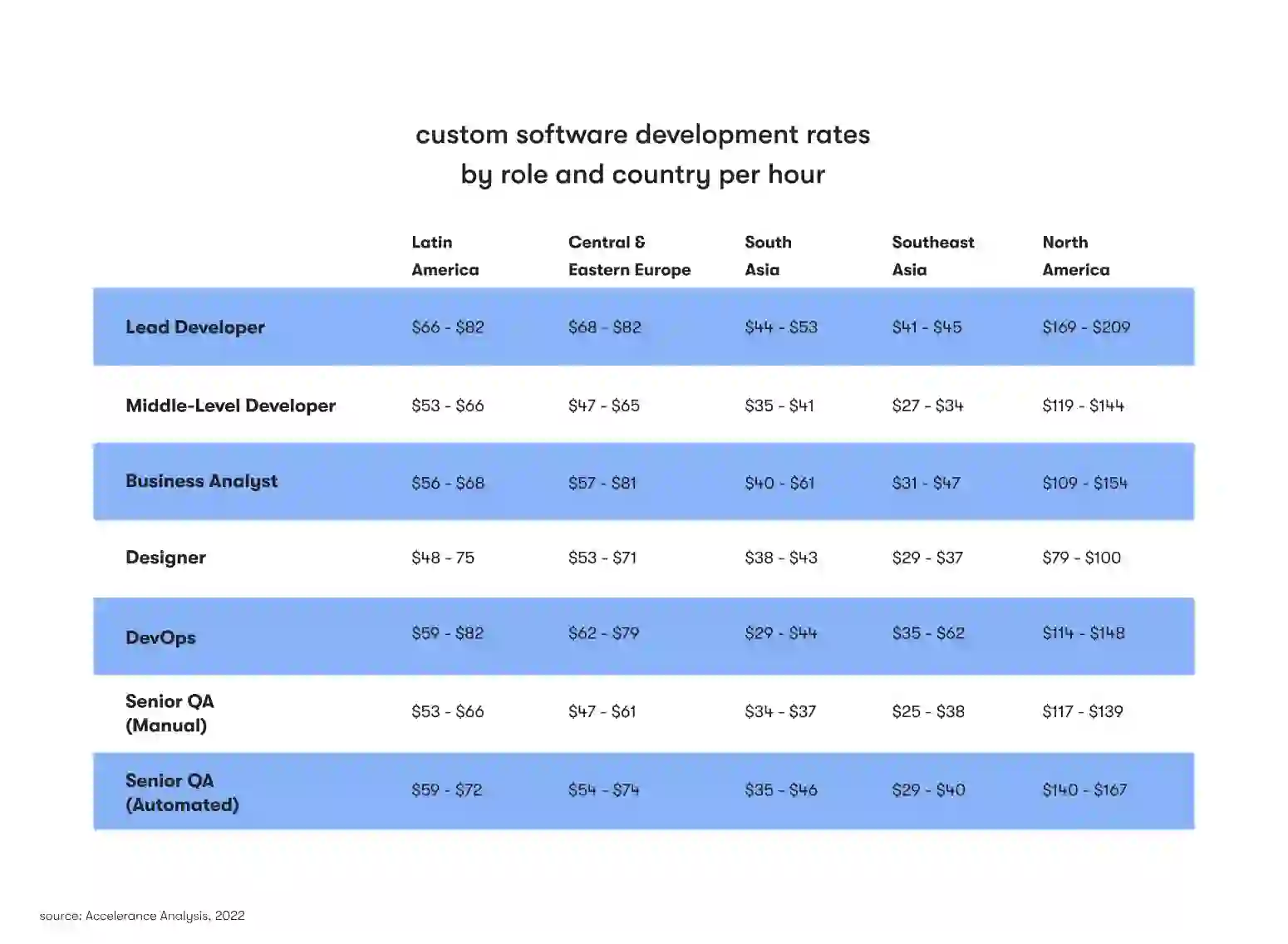

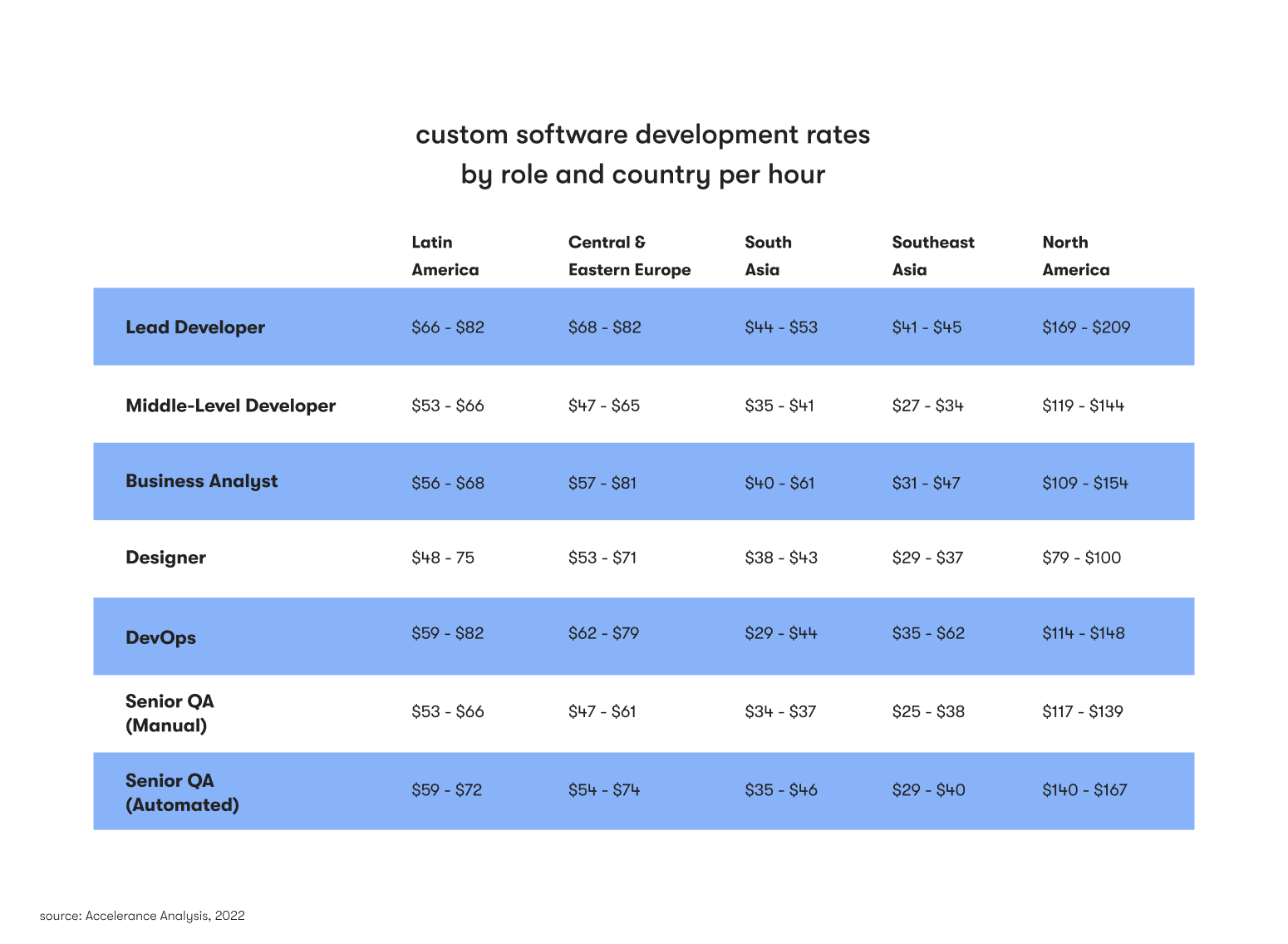

The size and expertise of the development team directly correlate with the project's cost. Balancing team size with the project's scope is essential for banking app development cost optimization. A larger team with specialized skills may incur costs ranging from $80 to $150 per hour per person, while a smaller, more cost-effective team may charge between $40 and $80 per hour per person.

Developer location

The geographical location of the development services provider plays a significant role in banking app development cost determination. Vendors in regions with higher living costs may charge $100 to $200 per hour, while exploring outsourcing options in regions with lower living costs can result in savings, with hourly rates ranging from $30 to $80.

App maintenance

App maintenance is an ongoing expense that includes updates, bug fixes, and security enhancements. Maintenance costs can range from $10,000 to $30,000 per year, depending on the complexity of the app and the frequency of updates.

Required integrations

Incorporating advanced features, such as biometric authentication, AI-driven chatbots, and blockchain integration, adds a layer of complexity to the development process. While these features enhance the app's capabilities, they also increase development costs. This may result in additional expenses ranging from $20,000 to $50,000 or more, depending on the depth of integration.

ESTIMATE BANKING APP DEVELOPMENT COSTS

Use our calculator tool to estimate the average cost of banking app development for your project.

Main steps to build a mobile banking app

Building a robust and user-friendly mobile banking app, whether in-house or with the help of a banking software development company, involves a systematic approach from research and design to deployment and ongoing maintenance. Here's a breakdown of the main steps in crafting a successful mobile banking app:

Step 1: Conduct research

Before diving into the development process, thorough research is essential. Identify your target audience, analyze competitors, and understand the legal and security requirements of the banking industry. This step sets the foundation for the entire development journey.

Step 2: Build a prototype

Creating a blueprint for your app is crucial to visualizing its structure and functionality. A prototype helps refine ideas, stream features, and get early feedback. Utilize wireframing tools to sketch out a basic version of your app, providing a tangible reference point for further development.

Step 3: Design the user interface

Designing a seamless and visually appealing user interface (UI) is pivotal for user satisfaction. Prioritize user experience (UX) and adhere to design guidelines for the targeted platforms, ensuring a consistent and intuitive experience for your users.

Step 4: Develop the app

Selecting the right technology stack is crucial for the app's performance and scalability. Focus on implementing core features such as user authentication, account management, and transaction processing. Additionally, prioritize security measures such as encryption and secure APIs to safeguard user data.

Step 5: Testing

Thorough testing is the bedrock of a reliable mobile banking app. Conduct functional, usability, security, and performance testing on various devices and operating systems. Rigorous testing ensures that your app meets industry standards and provides users with a secure and smooth experience.

Step 6: Deployment

Once testing is completed, it's time to deploy your app. Publish it on relevant app stores, ensuring compliance with documentation and store guidelines. Consider phased or beta releases to gather valuable user feedback and make necessary improvements.

Step 7: Post-launch marketing

To ensure your app gains traction, develop a robust marketing strategy. Utilize social media, online advertising, and strategic partnerships to promote your mobile banking app. Collect and analyze user feedback to make continuous enhancements.

Step 8: Ongoing maintenance and updates

The journey doesn't end with deployment. Monitor your app's performance, user feedback, and analytics regularly. Roll out updates to fix bugs, enhance features, and address security concerns. Stay abreast of changing regulations and security standards, collaborating with legal and security experts to maintain compliance.

Conclusion

The costs associated with building a digital banking application are not just monetary; they encompass time, research, and a commitment to delivering a secure, user-friendly, and compliant solution. As we've explored the various facets of banking app development costs, from the initial research and prototyping phases to the deployment, marketing, and ongoing maintenance, it's evident that success in this space hinges on a comprehensive and systematic approach. Striking the right balance between innovation and regulatory compliance, coupled with a keen focus on user experience, is paramount in this dynamic landscape.

While financial investment is a critical aspect, it's equally important to recognize the investment in trust and reliability that users place in a banking application. Security breaches and usability issues can erode this trust quickly. Therefore, the cost to build a banking app incurred in robust testing, security measures, and continuous updates is an investment in safeguarding the integrity of the financial ecosystem you're contributing to.

FAQ

Anush has a history of planning and executing digital communications strategies with a focus on technology partnerships, tech buying advice for small companies, and remote team collaboration insights. At EPAM Startups & SMBs, Anush works closely with subject matter experts to share first-hand expertise on making software engineering collaboration a success for all parties involved.

Anush has a history of planning and executing digital communications strategies with a focus on technology partnerships, tech buying advice for small companies, and remote team collaboration insights. At EPAM Startups & SMBs, Anush works closely with subject matter experts to share first-hand expertise on making software engineering collaboration a success for all parties involved.

Explore our Editorial Policy to learn more about our standards for content creation.

read more