The fintech industry has undergone a significant transformation with the rise of digital banking. Traditional banking models have become outdated, and the need for innovative strategies has become more apparent. The digital banking revolution has led the way for banks that struggle to take a customer-centric approach, where banks aim to provide an exceptional digital experience to their customers.

To achieve this, banks implement various digital banking strategies, such as mobile banking, online banking, and virtual banking. Mobile banking has become increasingly popular, with customers using their smartphones to transact. Online banking has also seen significant growth, with customers preferring to perform online banking activities. Virtual banking has emerged as a new trend, where banks offer customers a fully digital banking experience without needing a physical branch.

The future of digital banking looks bright, with experts predicting continued growth in the industry. Artificial intelligence and machine learning are expected to revolutionize the customer experience, making banking more personalized and efficient. Blockchain technology is also expected to play a significant role in the finance industry, enabling secure and transparent transactions.

To succeed in digital banking, banks must adopt winning strategies focusing on customer experience, innovation, and agility. Banks must provide their customers with a seamless and personalized banking experience while leveraging technology to improve operational performance and efficiency. Banks that can quickly adapt to changing customer preferences and market trends will emerge as winners in digital banking.

What is digital transformation in banking?

Digital transformation has become a popular term in the banking industry, and for good reason. It is a comprehensive process integrating digital technologies to change how financial institutions operate and provide value to their customers. This process includes a variety of changes, such as using digital payment methods and advanced analytics for customer insights, as well as deploying artificial intelligence and blockchain technologies to streamline operations and improve security.

The goal of digital transformation in banking is to enhance operational efficiency, improve customer experiences, and remain competitive in the ever-changing financial landscape. By utilizing digital technologies, banks can automate tedious tasks, decrease operational expenses, and increase the speed and accuracy of financial transactions. As a result, customers can access their accounts and perform transactions faster and more securely than ever before, resulting in a better customer experience.

The benefits of digital transformation in banking are vast and far-reaching. Banks that embrace digital transformation can offer their customers more personalized services by adapting to their specific needs and preferences. They can also use big data and advanced analytics to gain insights into customer behavior and preferences, which can help them make more informed business decisions. Ultimately, banking's digital strategy and transformation are not just about adopting new technologies but about transforming the entire banking ecosystem better to serve customers' needs in the 21st century.

DEVELOP A DIGITAL BANKING STRATEGY THAT FITS YOU

Craft a personalized digital banking strategy tailored to your unique needs and preferences with our expert guidance.

Is digital banking the future?

Technology has significantly changed how we conduct financial transactions in our fast-paced world, particularly in the banking industry. Digital banking has become a preferred choice for financial institutions and consumers due to its unparalleled convenience, accessibility, and efficiency.

Digital banking offers many advantages that traditional banking cannot match. With digital banking, customers can access their accounts, transfer funds, pay bills, and even apply for loans from the comfort of their homes. This level of convenience has become an essential aspect of modern life, especially for busy individuals.

Furthermore, digital banking has allowed financial institutions to streamline operations and reduce costs significantly. By leveraging the expertise of full-stack developers to create and maintain digital technologies, banks can automate many of their processes, such as account management, loan processing, and transaction monitoring, reducing the need for manual intervention.

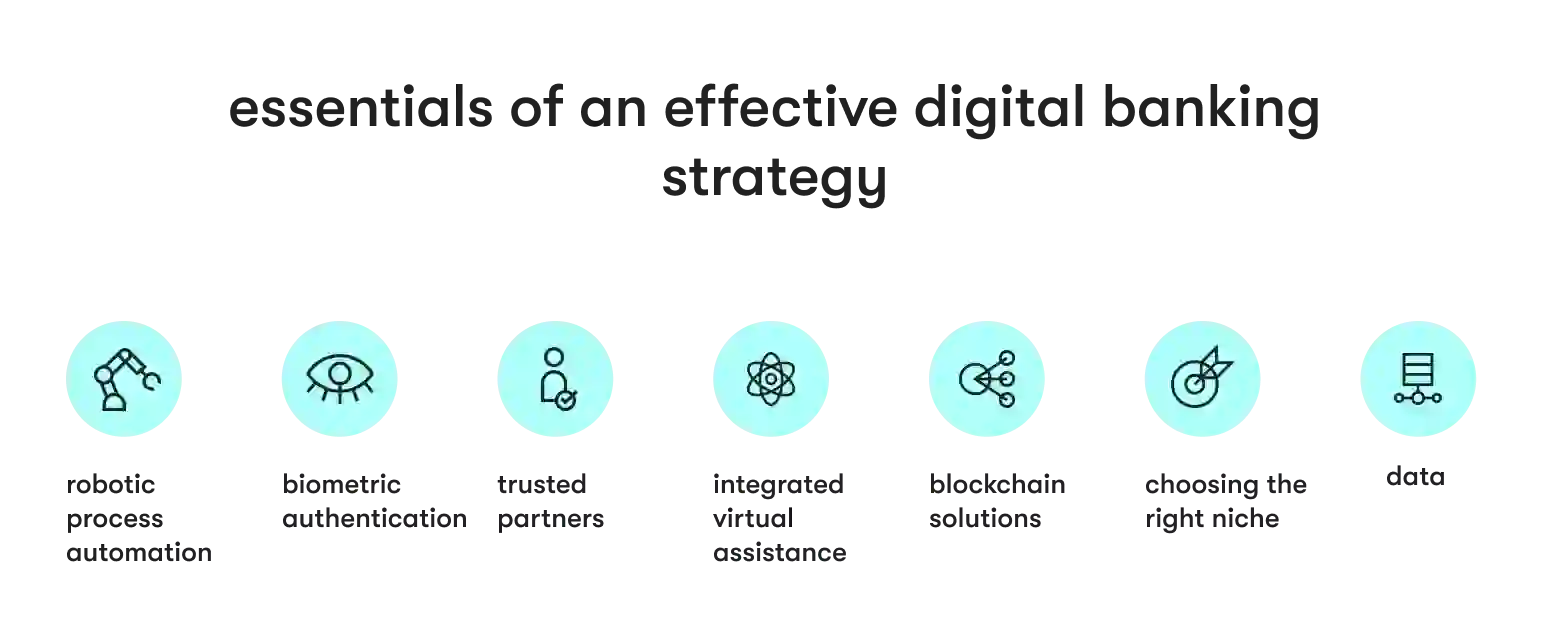

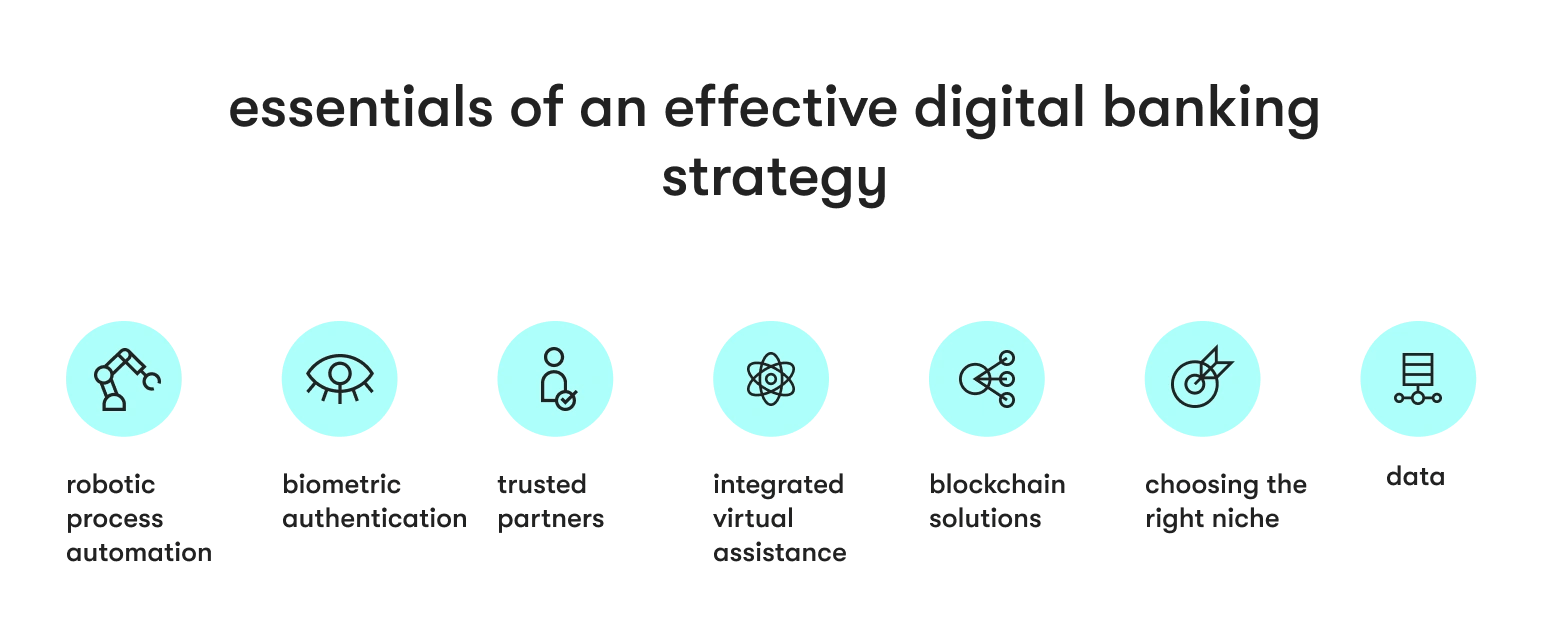

Winning strategies to be successful in the future

Implement robotic process automation

In recent years, robotic process automation (RPA) has emerged as a major game-changer in the digital banking industry. It is a software technology that leverages artificial intelligence to automate many repetitive and rule-based tasks, resulting in streamlined banking processes and significant cost savings.

By implementing RPA, financial institutions can optimize their operations by automating customer onboarding, account maintenance, transaction processing, and data validation tasks. These tasks are highly repetitive and time-consuming, often requiring significant human resources. By automating them, banks can free up their human resources to focus on more complex and strategic tasks, such as fraud detection and prevention, risk management, and customer service.

Moreover, RPA has been instrumental in enhancing the accuracy and reliability of banking processes. It eliminates the risk of human error, one of the biggest challenges in the financial industry, and ensures that data is processed consistently and accurately. By reducing the risk of errors and inconsistencies, RPA helps banks deliver better customer experiences and maintain compliance with regulatory requirements.

Enhance biometric authentication

Due to the increasing reliance on digital banking, ensuring the security of customer identities has become a top priority in the banking industry. Biometric authentication, which uses unique physical characteristics such as fingerprints and facial recognition, has emerged as a robust and secure means of verifying customer identities. This technology is considered an advanced form of authentication, providing a higher level of security than traditional methods such as passwords and PINs.

The implementation of biometric authentication technology has a significant impact on both security and user experience. It eliminates the need for customers to remember complicated passwords, which can be easily guessed or stolen, reducing the risk of fraudulent activities. Moreover, biometric authentication provides a seamless and user-friendly experience, allowing customers to access their accounts quickly and easily.

When it comes to digital banking, trust is crucial. Implementing advanced biometric authentication measures can help banks build trust with their customers by ensuring their data is safe and secure. This technology also ensures that the digital bank's systems and networks are protected against unauthorized access, which is critical to maintaining the integrity of digital banking systems.

Select the right technology partner

As a reliable and experienced partner in the financial services industry, our track record speaks volumes about our commitment to driving digital success for our clients. With over a decade of experience serving leading financial institutions, we have successfully delivered digital banking projects to 200+ clients worldwide, demonstrating our deep domain expertise. Our team consists of 5,000+ seasoned professionals who understand the intricacies of the financial services landscape, enabling us to deliver tailored solutions that meet your specific needs.

Through strategic partnerships with industry-leading technology vendors and service providers, we leverage the latest tools and technologies to deliver best-in-class core banking solutions for our clients. These partnerships ensure you have access to the most advanced capabilities in the market, keeping you ahead of the curve.

Innovation is at the core of everything we do. We continuously invest in research and development to explore emerging technologies and trends, ensuring our clients are always at the forefront of digital innovation. Whether it's blockchain, machine learning, or IoT, we have the expertise to help you harness the power of these technologies to drive your digital banking strategy forward.

We understand the risks and challenges associated with digital transformation. We follow established processes and frameworks to mitigate risks and ensure successful project delivery. Our solutions are also designed to be cost-effective, helping you achieve your digital goals without breaking the bank.

PARTNER WITH US FOR STATE-OF-THE-ART DIGITAL BANKING SOLUTIONS

Contact our team to consult and plan your digital transformation strategy with top fintech experts in the industry.

Integrate chatbots and virtual assistants

Customer engagement is a key factor in digital banking success. Chatbots and virtual assistants are increasingly becoming integral components of customer service strategies. These AI-powered tools offer instant responses to customer queries, provide personalized assistance, and enable seamless interactions. By implementing chatbots and virtual assistants, financial institutions can enhance customer satisfaction and streamline communication channels, improving customer experiences and greater operational efficiency.

Implement blockchain technology

Blockchain technology is a revolutionary innovation that has the potential to transform the security and transparency of the digital banking experience. A distributed ledger technology ensures the integrity of transactions and data by decentralizing them across a network of nodes. This decentralized approach makes tampering with or manipulating data almost impossible, thus creating a more secure and trustworthy financial ecosystem.

Smart contracts, built on blockchain, are self-executing digital contracts that automate verifying and enforcing an agreement's terms. They enable secure and automated execution of agreements, reducing the risk of fraud and enhancing operational efficiency. Smart contracts ensure that parties involved in a transaction adhere to the agreed-upon terms of the contract. This automation also reduces the need for intermediaries, such as lawyers, who can add to the cost and time involved in executing a contract.

Integrating blockchain into digital banking strategies can create a more transparent and efficient financial ecosystem. It can help reduce the risk of fraud, money laundering, and other financial crimes. By leveraging blockchain, banks can create a decentralized, secure, and transparent system that can be accessed by all parties involved in a transaction. It can also reduce the time and costs associated with transaction settlements and increase the speed at which transactions are processed.

Choose the right niche

In a highly competitive digital banking landscape, finding the right niche is essential for success. Tailoring services to a specific market segment or demographic allows financial institutions to differentiate themselves and meet the unique needs of their target audience. Whether focusing on millennials, small businesses, or specific geographic regions, choosing the right niche enables banks to deliver more personalized and relevant services, fostering customer loyalty.

Use data

Analyzing and interpreting data provides financial institutions with valuable insights into customer behavior, preferences, and trends. By leveraging the power of big data analytics, banks can personalize their services, optimize their operations, and make informed strategic decisions.

Data helps banks understand their customers better, and by doing so, they can identify opportunities to improve their products and services. It also enables banks to identify patterns in customer behavior, such as changes in spending habits or preferences, which can help them predict future trends.

To build a data-driven culture within the organization, banks must have the necessary infrastructure and tools to collect, store, and analyze data effectively. This requires a comprehensive data management strategy that includes data governance, security, and privacy policies.

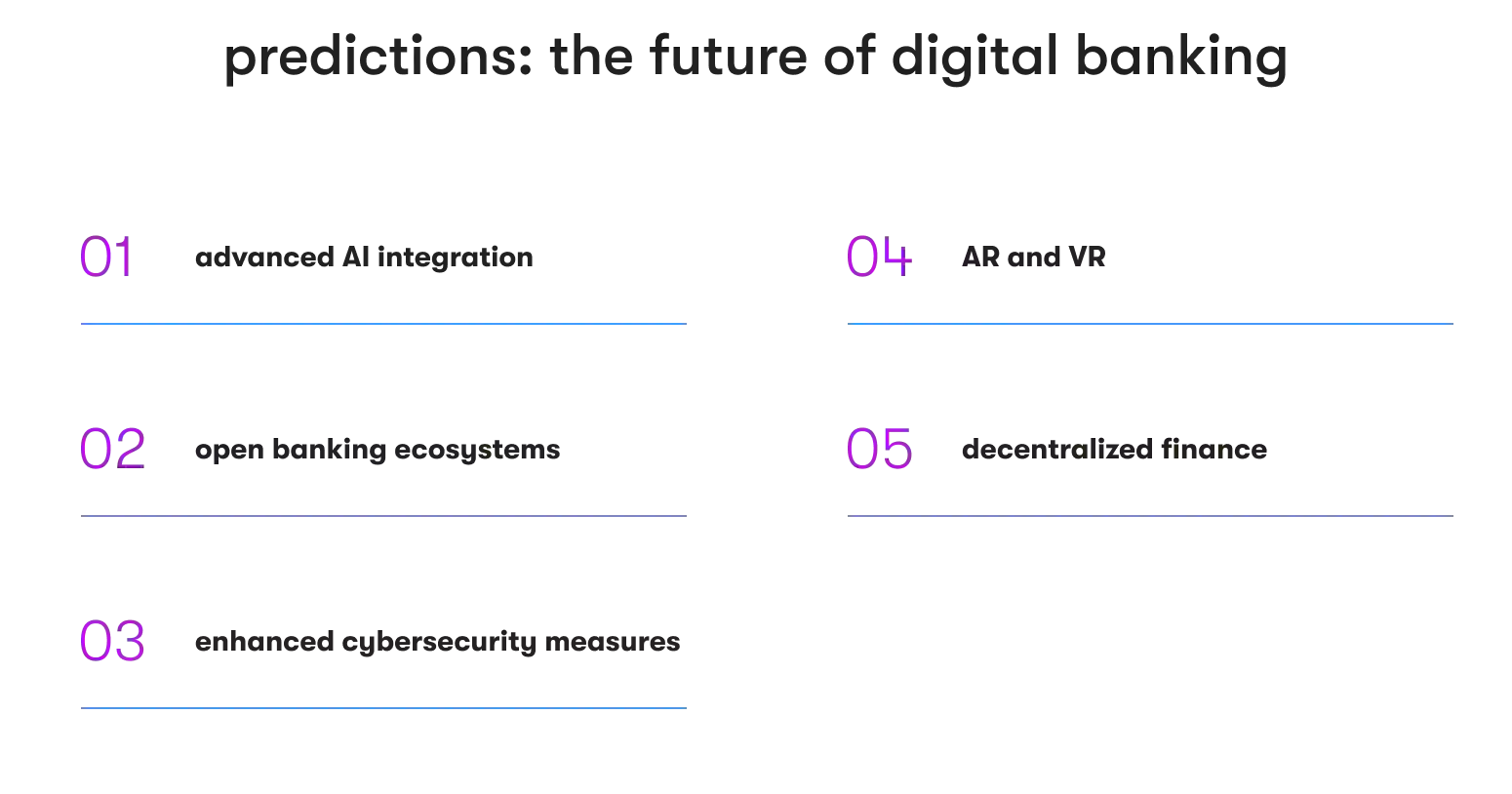

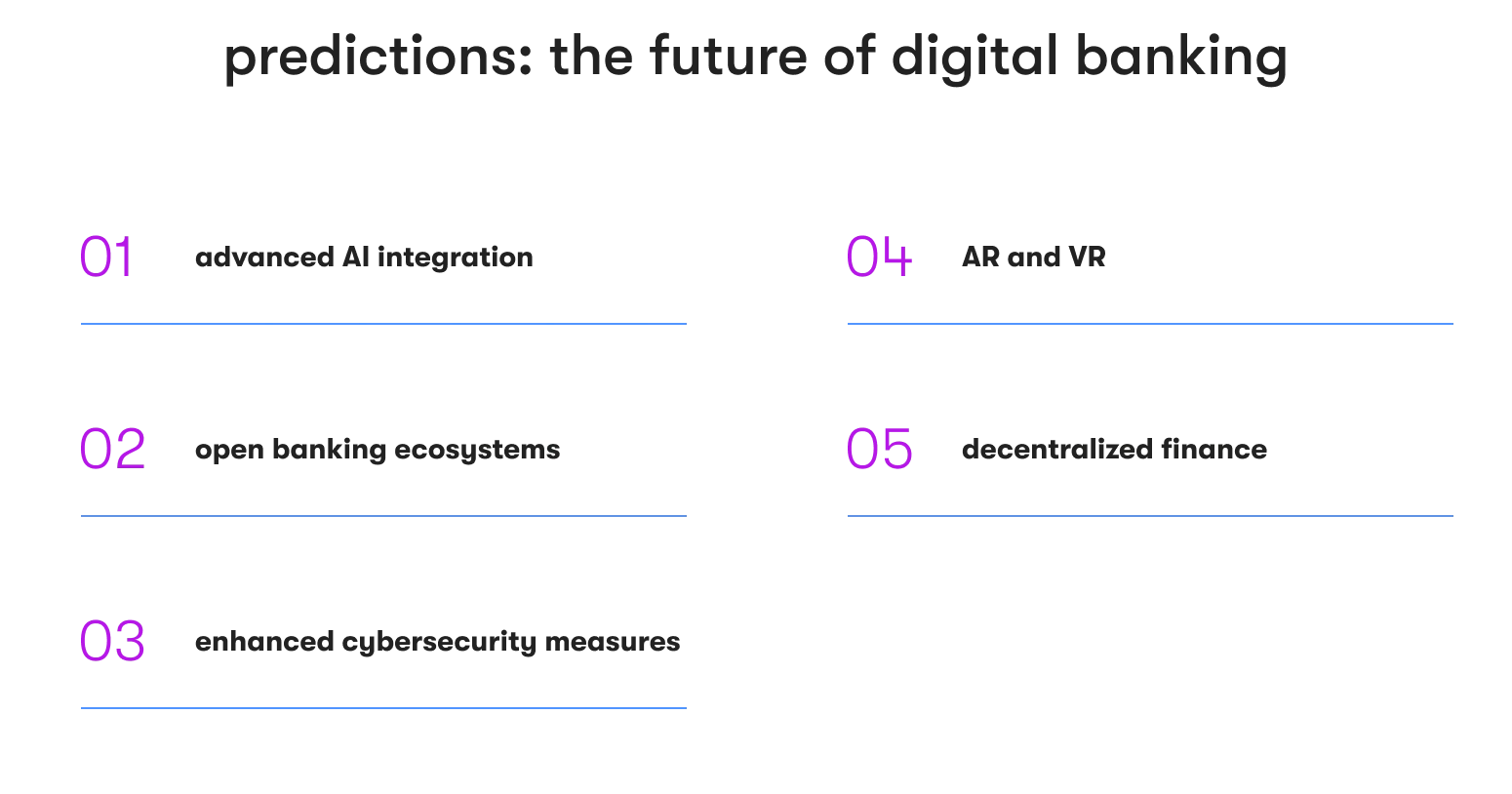

Top digital banking future predictions

The future of digital banking holds exciting possibilities. As technology advances, we can expect further innovations that will redefine the industry. Some key predictions for digital bank strategies include:

Advanced AI integration

Artificial intelligence will play an even more significant role, with advanced AI algorithms powering more intelligent decision-making processes, personalized services, and predictive analytics.

Open banking ecosystems

The rise of open banking will foster collaboration between financial institutions, software-centered startups, and third-party developers, creating a more interconnected and innovative financial ecosystem.

Enhanced cybersecurity measures

With the increasing threat of cyber attacks, digital banking will see continuous advancements in cybersecurity measures, ensuring the protection of sensitive customer information and data.

Augmented reality (AR) and virtual reality (VR)

Integrating AR and VR technologies may redefine how customers interact with their finances, providing immersive and engaging experiences.

Decentralized finance (DeFi)

The concept of decentralized finance, facilitated by blockchain technology, may gain more prominence, offering new opportunities and challenges for traditional banking models.

Conclusion

The future of banking is undeniably digital, and success in this landscape requires strategic foresight and adaptability. By embracing robotic process automation, enhancing biometric authentication, selecting the right technology and partners, leveraging chatbots and virtual assistants, implementing blockchain technology, choosing the right niche, and harnessing the power of data, financial institutions can position themselves for success in the evolving digital banking era. As the industry continues to innovate, staying informed, agile, and customer-centric will be key to thriving in the dynamic world of digital banking.

Anush has a history of planning and executing digital communications strategies with a focus on technology partnerships, tech buying advice for small companies, and remote team collaboration insights. At EPAM Startups & SMBs, Anush works closely with subject matter experts to share first-hand expertise on making software engineering collaboration a success for all parties involved.

Anush has a history of planning and executing digital communications strategies with a focus on technology partnerships, tech buying advice for small companies, and remote team collaboration insights. At EPAM Startups & SMBs, Anush works closely with subject matter experts to share first-hand expertise on making software engineering collaboration a success for all parties involved.

Explore our Editorial Policy to learn more about our standards for content creation.

read more