Building an insurance app is a great business idea. If the global pandemic has taught us anything, it’s that mobile apps and other digital tools are no longer a luxury. In the case of insurance, in recent years, the entire industry has been moving towards mobile-first technologies. Today, having an app is a powerful competitive advantage, but it will soon become a must.

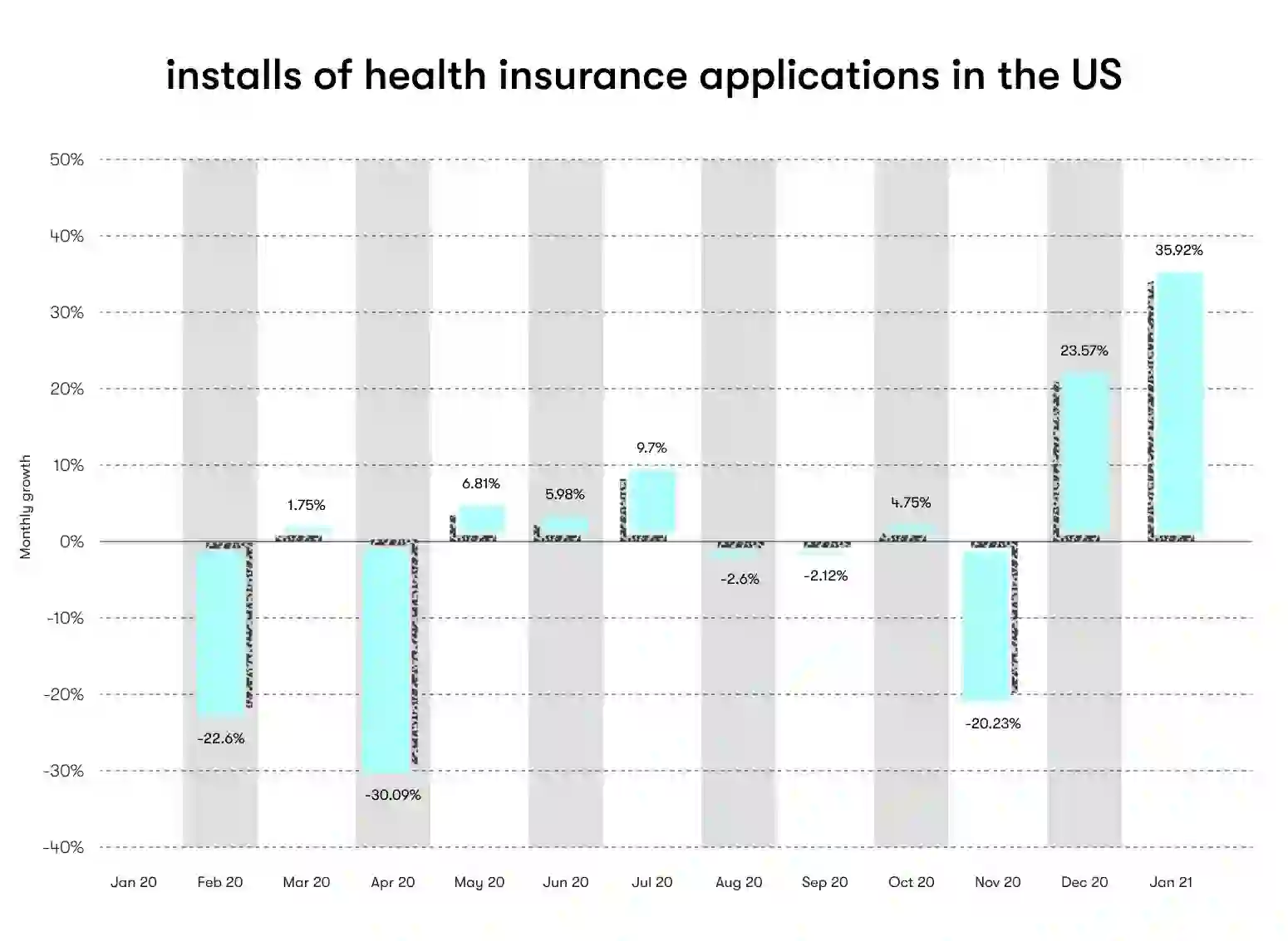

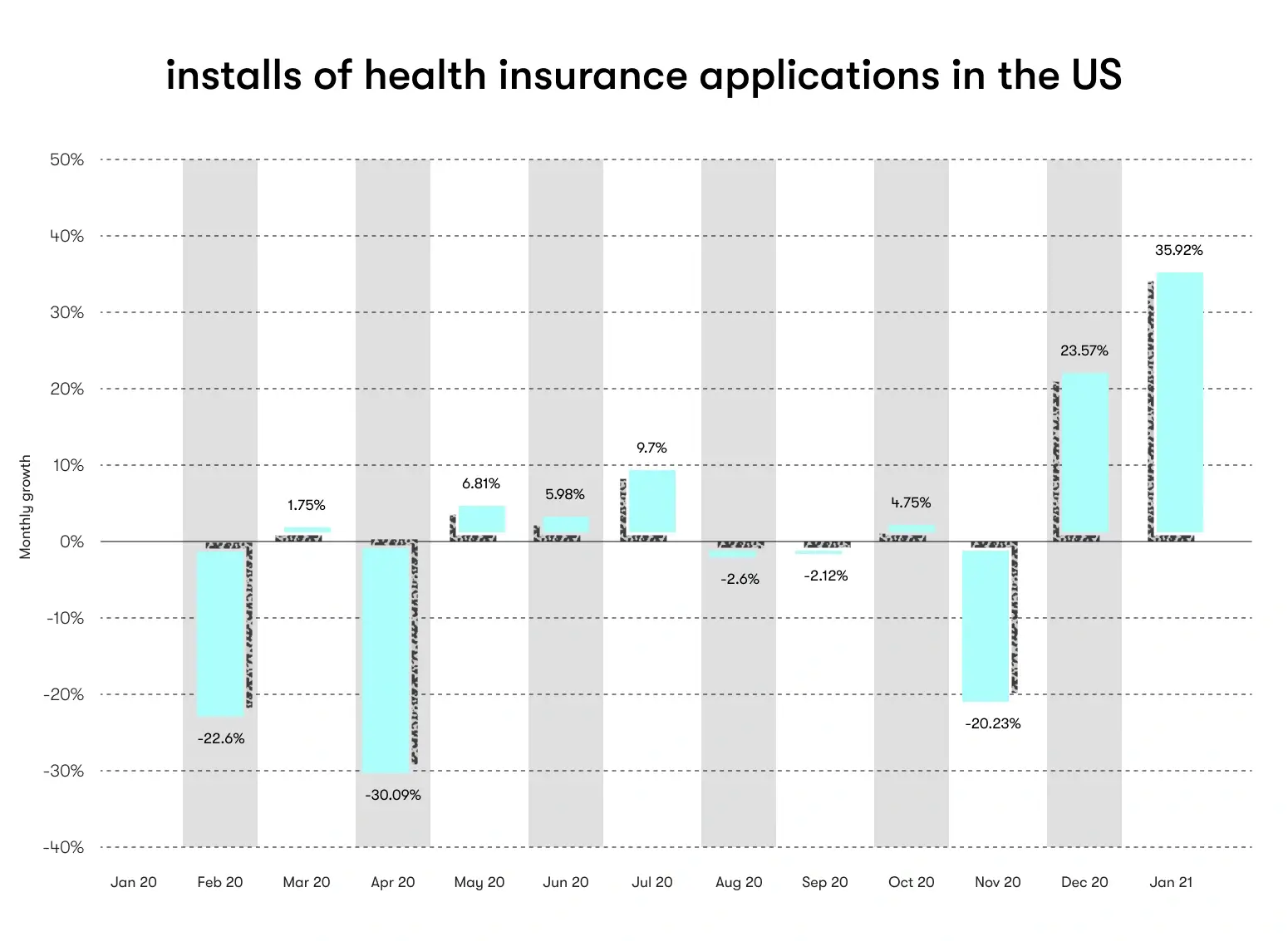

The high market demand and customer requests for insurance applications are confirmed by statistics. From the end of 2020 to the beginning of 2021, the monthly number of installs of health insurance applications among users from the United States increased by 23-36%, respectively. And the trend is that downloads will continue to grow worldwide.

In this article, we tell you everything you need to know about developing a top in-demand insurance application: from the features of how to make a product successful to our step-by-step guide based on global best practices and valuable experience of EPAM Startups & SMBs. Keep reading to find out how mobile app development for insurance agents can scale your business and how to create an insurance app with less time and money.

Why Do You Need to Build an Insurance App?

Building an insurance app may interest both insurance companies and startups that want to try their best in insurance tech. And this interest is quite obvious.

The necessity and vital importance of creating an application are determined not only by global market trends, but also by the practical features of such a tool. The development and implementation of an insurance app offer valuable benefits and opportunities for both sides. Mobile applications provide real-time B2C interaction for agencies and policyholders.

A versatile app is one of the most efficient ways to provide insurance services. This digital tool optimizes support costs and lowers operational expenses, offers more opportunities to collect data and provides detailed insights about the target audience, automates claims processing and other business tasks, enhances user engagement, and increases the income of an insurance agency. The business gets additional opportunities for upselling, reducing the number of employees, and boosting sales.

What’s more, mobile applications are an easy and convenient way to interact with customers. With the help of interactive programs, you can increase user engagement and improve their experience by offering unique digital services. An insurance app allows policyholders to stay in touch, receive on-demand insurance services, access support via live chat or a chatbot, conveniently make mobile payments, and take advantage of self-service. This digital tool makes communication faster, smoother, more effective, and allows receiving insurance services anywhere and anytime.

Creating an advanced insurance mobile application is a win-win solution for satisfying mutual interests and providing the best relevant functions and innovative technologies.

Digital Revolution in the Insurance Industry

Digital transformation affects all areas and industries, and insurance is no exception. This business is in the midst of a digital revolution that needs a change in the way we market, sell, distribute, and service insurance so that a customer is the number one priority.

The digital revolution in insurance provides huge possibilities to leverage the benefits of technology to better satisfy all stakeholders in the insurance lifecycle — policyholders, employees, and insurers.

Thus, creating a mobile insurance application as a digitalization tool introduces future-oriented technologies to optimize all interactions, provide users with excellent services, make employees more efficient and engaged, and increase business value in the insurance market. Insurance apps make the policyholders' experience more efficient, personalized, scalable, and agile.

Digitization takes a whole raft of various forms, and building an insurance app is no longer something unattainable but our today’s reality. And we must accept this and experience all the benefits of the revolution of insurance.

To achieve incredible success, desired business goals, and expected results, insurance market players must embrace cutting-edge technologies and move to digital transformation to deliver value now and drive long-term growth.

New Customers Generation

Today, insurance agents have to look for new solutions and introduce new proposals to keep up with the requirements of policyholders. Any business that wants to stay competitive in today’s marketplace must track and meet the needs of its users.

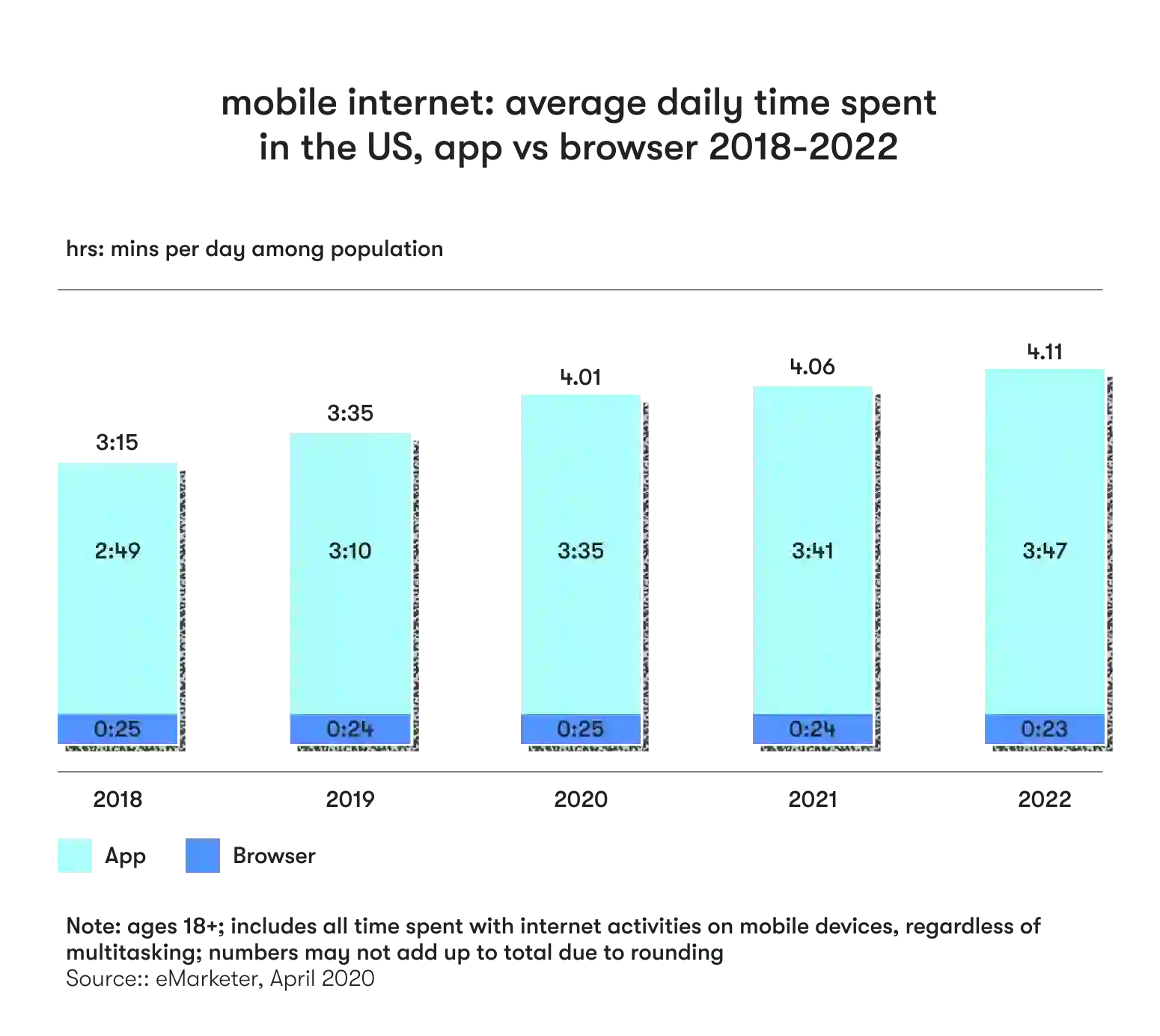

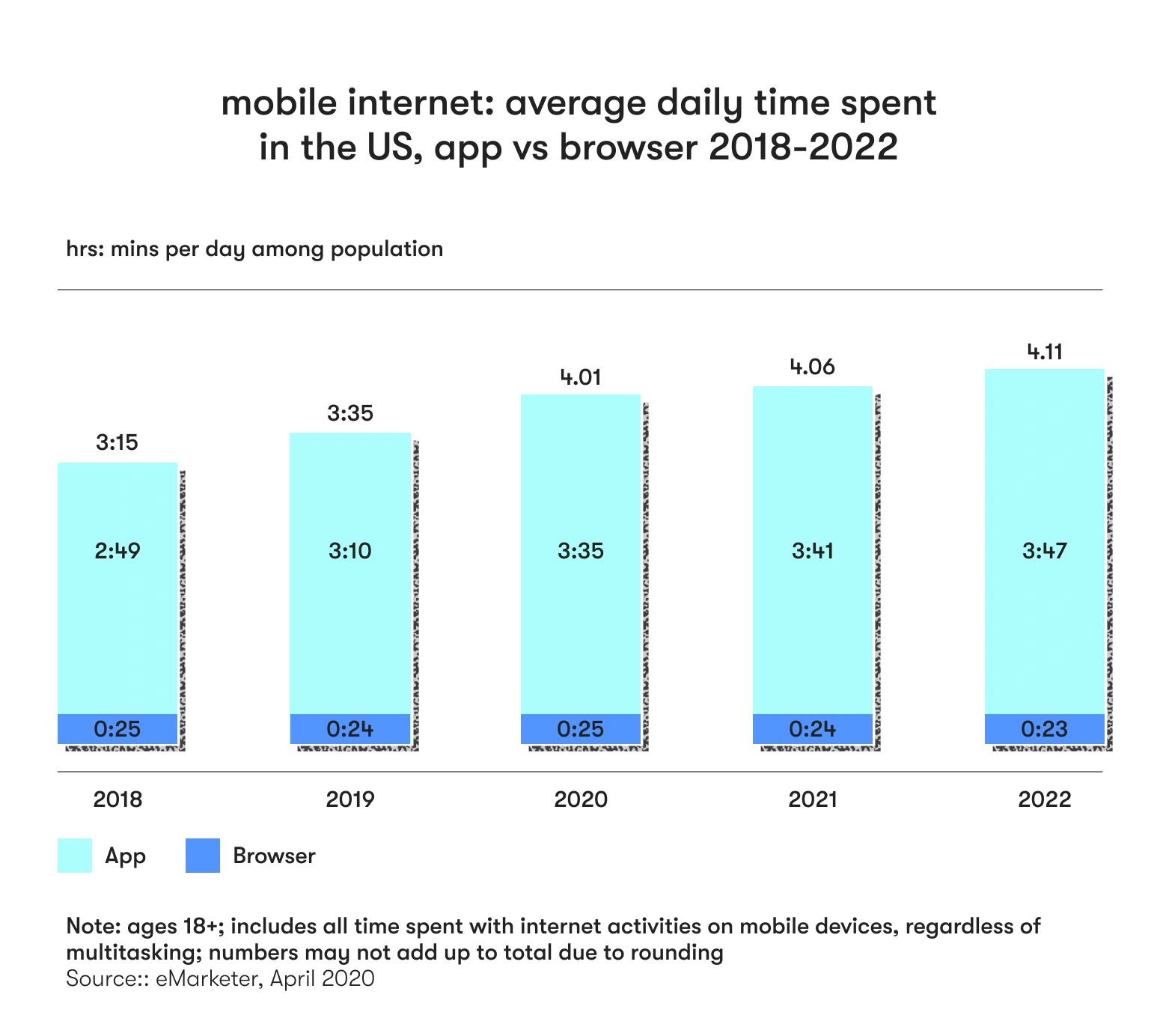

According to statistics, in 2022, the average American checks their smartphone 344 times per day, which is 31% more than the previous year. In addition, studies show that users spend 88% of their mobile time on apps. So this means that the development of a mobile application is exactly what meets the preferences of mobile-focused consumers and satisfies their needs.

Demand for business and financial performance are particularly affected by the quality of customer service; convenience and efficiency are of paramount importance for winning clients.

In the case of insurance, it is vital to constantly maintain multiple touchpoints with customers. And the mobile application plays a key role in this. According to the 2020 J.D. Power Claims Digital Experience study, over the past three years, the number of insured persons who use digital claims tools has increased by 20%, and customer satisfaction is the highest among those who choose digital solutions.

Comfort is a key priority in consumption, and mobile apps do a great job of meeting this need by driving more engagement. In addition, they also increase loyalty, and a high level of customer loyalty is the basis for the viability and growth of any business in the long term. Loyal users bring not only direct income; they become brand ambassadors and attract new audiences.

The fact is that a well-made mobile app can play a critical role in expanding customer reach and enhancing their allegiance. Insurance agents are able to serve one client at one time, and an application can serve hundreds simultaneously or even more.

So, the introduction of a mobile insurance application is, first of all, a victorious solution for improving user loyalty and growing customer generation. It can not only attract new clients, but also help retain existing ones — this is an additional communication channel, a powerful loyalty tool, and an advanced solution to meet changing user needs.

As insurance goes digital, consumers get more possibilities than ever.

Race in a Highly Competitive Business Environment

Customers come first. However, they are not the only ones who create market tendencies and dictate new demands. Another group that sets trends in the business environment along with customers is competitors. They also require "old-school" companies to reconsider traditional practices — new players enter the game, and existing ones are forced to make new moves and apply new solutions.

Today, you have to deal with the new generation of competitors. Progressive insurance startups are betting big on mobile devices. They understand that consumers are spending more and more time on smartphones, so they reach out to them by applying mobile functions and digital options. So, introducing a mobile application is a strong competitive advantage that will put you one step ahead of similar companies.

Those insurers that master the digital revolution, implement transformation programs, and choose cutting-edge technology solutions, gain a solid competitive edge by meeting the future needs of customers, focusing on the long term, and increasing operational agility to fully meet changing market conditions. And you must do so.

Just as having an app can be a huge benefit on the market, not having one can become a huge gap. Therefore, remember the main thing: if you do not offer your customers such a sought-after mobile insurance service, you may start losing them because of those who offer it.

Technological breakthroughs will continue to have an invaluable impact on the highly competitive insurance industry in the near and far future. Now is the time to act, and insurers can do so by investing in cutting-edge digital tools and solutions that will help their business become even more customer-focused and leave competitors behind. Implement an innovative mobile application and prevent the new generation of competitors from winning potential customers and poaching yours.

CONSIDER EPAM STARTUPS & SMBS TO BUILD YOUR INSURANCE APP

Build an advanced insurance app, gain a competitive advantage, and make sure that in the competitive field, the direct-to-consumer business always wins. Go digital with EPAM Startups & SMBs.

Types of Insurance Apps

As we have already mentioned, many areas of our daily life require insurance. So, since the industry has different directions, therefore, there are several types of insurance-related apps — depending on the object of insurance.

You can digitize the customer experience for all of them.

Car Insurance

Movables must always be insured. If the policyholder’s vehicle has an accident, the user must take a photo, film the accident site, and file a claim. After that, an insured client instantly receives a repair estimate.

A car insurance app can become a real helper for a user on the road. Among the unique features of auto insurance that can be optimized by creating a mobile application are accident documentation right on the spot by uploading photos, videos, geolocation, and other data; quick access to documents; calling instant roadside help; information about anything from traffic jams to cheaper gas stations and repair services.

All this and many other functions become available to your customers by introducing an auto insurance application.

Health Insurance

Medicine is one of the most popular categories typically covered by insurance. Health insurance applications are widely used and have a huge number of users. Building such an application is quite complicated, as more complex functionality is required due to confusing insurance policies.

To make a medical insurance application profitable, it must bring valuable solutions to the target audience. An app should offer insured users simplified navigation through practices and facilitated selection of doctors, the ability to contact them and book appointments, reduced paperwork and easy access to documents, full health control, a symptom checker, search for suitable health insurance plans, doctors with the best rates, and pharmacies with the lowest prices. It has become a real digital savior.

Life Insurance

Although this type of insurance service does not require daily interaction between insurers and policyholders, daily permanent communication can significantly increase policyholders' satisfaction and help optimize the insurance business in terms of operating costs. Thus, a life insurance application simplifies and speeds up all processes, such as choosing the right policy, making payments, servicing, and customer support.

Policyholders can choose the right policy and fill in all the data without visiting an insurance agency. They can choose a preferred plan and payment method, make all payments online, and receive regular reminder notifications. The mobile application can automatically calculate the interest rate, allows customers to check their percentages on their own, and, if necessary, contact the support service through the built-in chat, chatbot, or contact form.

Travel Insurance

This is like an airbag that minimizes risks while traveling, covers sudden unexpected expenses and saves policyholders in emergencies. It protects insured persons from trip cancellations, emergency medical expenses, luggage loss, medical evacuation, loss of passport or travel documents, etc.

Since all these situations arise unexpectedly, help in them is required instantly. Travel insurance applications allow applying for a pay-per-day insurance policy, automatically receiving a policy when crossing the border of a new country, canceling insurance on the go if the coverage in a transit country is not needed, and receiving information about flight status updates and other important features for travelers.

Property Insurance

Insuring residential or commercial real estate, works of art, jewelry, technical equipment, and other types of property becomes more convenient with the help of an innovative and advanced mobile application.

In addition to the typical self-service options (choosing a policy, making payments, and filing claims), a property insurance app provides other additional opportunities and functions, such as maintenance reminders to keep a property in good condition, tracking for leaks, damage, and breakdowns, and so on.

Business Insurance

Any business is always about big investments and huge risks. Therefore, business insurance services are popular among entrepreneurs. This policy allows for minimizing losses in a case of an insured event, and the mobile application makes it easier and faster.

A convenient business insurance application will help users quickly buy a policy and settle an insured event. It will allow clients to select an insurance package for a small, medium, or large business that suits their unique internal and external risks.

Digital Insurance Business Model

While the insurance industry has traditionally been slow to modernize, now it is obvious that it is time for insurers to embrace digital transformation. As a result of this wave, existing companies and new startups in the insurance market are exploring the prospects of developing mobile applications and integrating other digital tools.

And market research confirms this tendency. Thus, studies of the progress of insurance companies worldwide who are planning to enhance their digital capabilities show that only 3% of entrepreneurs in Europe, 5% in North America, and 8% in the Asia-Pacific region don’t have plans to implement digital solutions and enhancements to maintain resilience.

The capabilities of the Digital Insurance Business Model enable the implementation of solutions and tools like mobile apps that streamline all business processes, enhance the digital experience, improve efficiency, and transform key functions and features such as new product development, marketing, distribution, security, customer service, and so on. And all this directly leads to an increase in income.

The Digital Insurance Business Model allows all app founders to make money: startups that don’t have any insurance company and won’t, insurance companies that strive to provide another level of service, and financial organizations, like banks or financial foundations, who want to earn some additional money in a “neighboring business.” For this purpose, there can be implemented several money-generating options in mobile insurance applications: Advertising Model, Subscription Model, Commission Model, Referral Model.

The fact is that commercial success and financial performance are directly dependent on the customers' satisfaction and growth. The Digital Insurance Business Model improves the quality of service and experience of users, employees, investors, partners, and other stakeholders, moving towards revolutionary, secure, reliable, and profitable digital solutions.

STEP INTO YOUR DIGITAL TRANSFORMATION WITH EPAM STARTUPS & SMBS

Digitalization is a major change that can completely transform your insurance business model. Experience all the benefits of implementing an advanced mobile app created by real professionals.

Top 5 Best Insurance Apps

Let’s explore the best world practices to find out patterns and randomness that have led these insurance businesses to success.

GEICO Mobile

GEICO Mobile is an insurance app with a rating of 4.8/5 in the App Store based on 3.2M reviews and a rating of 4.7/5 in Google Play based on 428K reviews with more than 10M downloads. The app has about 650K installs per month, with 22.8% monthly download growth.

This innovative car insurance app gives users the following opportunities:

- access to digital ID cards,

- managing accounts and paying bills,

- roadside assistance,

- calling a tow anyplace and anytime,

- submitting and managing claims,

- using GEICO Virtual Assistant,

- complete car care,

- simplified maintenance,

- gas stations or car search using augmented reality, etc.

Lemonade

This is the best real estate insurance application for policyholders who want to protect their homes from accidents. Its functionality allows selecting a policy, making payments, filing claims, receiving support in the chat, and offers other opportunities. Additional features include an AI-enabled chatbot, personalized policies, a choice of charitable organizations to donate unused contributions, and more. The app offers adjustable coverage for your home, car, pets, personal property, liability, and more; its AI runs 18 anti-fraud algorithms.

Lemonade has a rating of 4.9/5 in the App Store based on 55.8K reviews and a rating of 4.6/5 in Google Play based on 11.5K reviews with more than 500K downloads. The app has about 45K installs per month, with 13.6% monthly download growth.

Cuvva

This is the progressive car insurance app that offers fast & ultra-flexible coverage and smart pricing, allowing users to save up to a third on vehicle insurance. It provides 24/7 customer support and driving statistics, offers advanced pricing based on how you drive, gives insight into your driving (scores and feedback on speed, braking, acceleration, cornering, and concentration) to become a better and safer driver, sends you reminders to inspections and taxes, offers discounts for referrals of friends, offers temporary van insurance or temporary learner driver insurance.

The app offers two options: flexible temporary insurance (from one hour to a month), ideal for renting a car or a shared trip, or monthly insurance with bonuses and free cancellation.

Cuvva has a rating of 4.8/5 in the App Store based on 13.6K reviews and 4.9/5 in Google Play based on 7.2K reviews with more than 500K downloads. The app has about 60K installs per month, with 40% monthly download growth.

Metromile

This is the personalized car insurance application that individually customizes each insurance policy to offer users the most relevant options. Among the key features are customizable coverage, rate preview, street sweeping alerts, a trip view to check the mileage, fuel cost, and driving time, search for a car if it was lost or stolen, and others. The app offers pay-per-mile car insurance, which means that users pay for what they use.

Metromile has a rating of 4.7/5 in the App Store based on 21.8K reviews and 4/5 in Google Play based on 1.1K reviews with more than 100K downloads.

Oscar

This is an advanced health insurance application that makes medical insurance easy. The application allows searching for symptoms and drugs, choosing a doctor, and making an appointment, provides access to test results, and saves prescriptions. In addition, Oscar offers Virtual Visits for free, over the phone, anytime, and uses the power of telemedicine to provide medical advice to policyholders.

Oscar has a rating of 4.7/5 in the App Store based on 2.6K reviews and a rating of 2.7/5 in Google Play based on 890 reviews with more than 100K downloads.

Best Features of an Insurance Mobile App

Wondering how to build an insurance app that will meet changing global conditions, win the trust and commitment of your audience, and outperform competitors in the market? Here are the top features on which the success of insurance application development depends.

MVP Features

A minimum viable product must have all the necessary features to satisfy the first customers and can provide feedback. It must also show the unique selling proposition, competitive edge, and value to attract and retain initial users — they must see and believe in the vision of the end product.

The task of an MVP is to study the market demand for a product and determine what an application should have so that users who have the company’s insurance policy want to download it. This will help to understand whether a product is needed and whether it will be used by potential users without having to invest large amounts of money, and will also allow reworking of an idea or even developing a new concept.

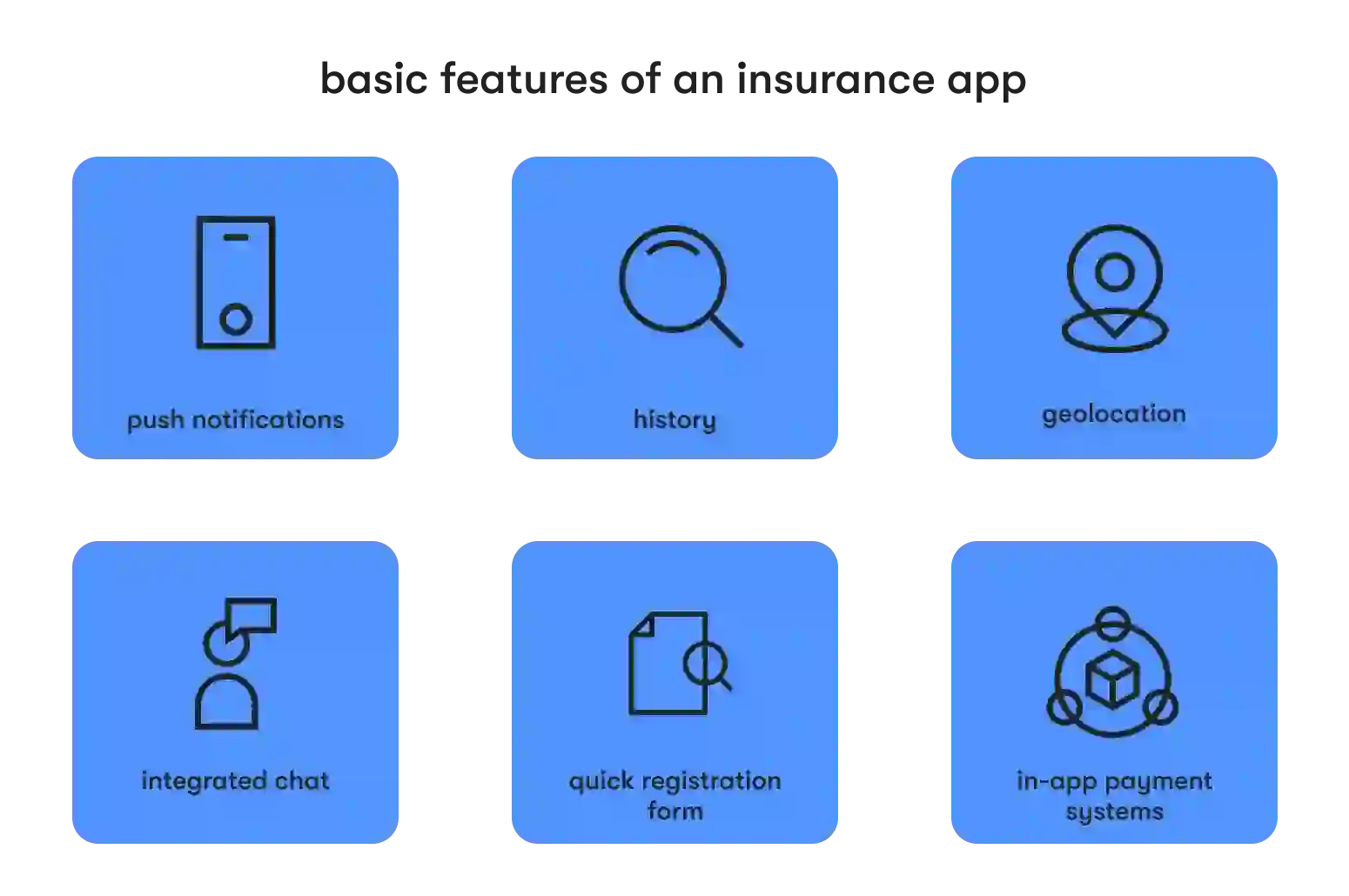

Regardless of the type of insurance application, an MVP should include such must-have functionality as an admin panel and a user profile containing customer data; quick access to policies and ID cards; documentation processing, including access, viewing, and filtering; claims filing; in-app payments, including saving users’ credit cards and protecting personal data; the assistance of insurance agents — urgent advice, emergency calls from an app; user support — live chat and (or) intelligent chatbot; notices of policy termination, discounts, new conditions, or claim status; reminders of regular payments.

It’s always best to build an MVP first. This helps launch faster with a slightly reduced application and attract early adopters. In addition, building an MVP is, of course, significantly cheaper than building a full-fledged application from the very beginning.

CONTACT EPAM STARTUPS & SMBS TO FIND OUT HOW MUCH YOU NEED TO INVEST

Entrust the development of your app MVP to us and get a minimum viable product to launch quickly, gain first users, get feedback, and avoid costly mistakes. Make your final insurance app development useful, in-demand, and successful.

Income Generating Features

Policyholders and insurance agents mobile application development provides several monetization possibilities and money-making options. Let’s explore available usage-based insurance revenue models and traditional monetization concepts that can be implemented in any insurance application.

- Advertising Model. This strategy offers to generate income by providing an app to other companies as a platform for advertising.

- Subscription Model. This option of making money on an insurance application requires users to pay for a subscription to access premium functions and additional opportunities for a month, half a year, a year, or another period.

- Commission Model. This way of generating revenue is best suited for aggregator apps that provide the ability to compare insurance plans, match policies, and search for suitable insurance companies. For these services, both users and insurance agencies pay a commission to an app.

- Referral Model. This mode of marketing is a kind of commission model, which allows increasing income, attracting new users, and boosting the number of app downloads by incentivizing users to share an insurance application with friends for a reward.

Security Features

Absolute security is vital when developing any type of insurance application, and providing a safe experience for users is the number one priority. It is necessary to consider all potential dangers and protect an app from fraud, phishing, theft, loss, hacking, and other vulnerabilities.

Among the options available to improve data security are encryption features, advanced bio-authentication, two-factor authentication, an encrypted communication layer, tiered app and database access, secure SSL connection protocols, and more.

Remember that an insurance application deals with users’ personal confidential data, corporate information, payment cards, and other sensitive details. In addition, the claims process is not as transparent, and therefore it becomes not so simple to provide a secure and individualized experience for customers. Therefore, it is essential to invest in the latest security systems and complete data protection following the latest safety practices.

Tech Stack for Building an Insurance App

The mobile technology stack options available for building an insurance app are conditioned by the platform and the chosen development approach, depending on your business requirements and your project goals. The right technology stack is the basis of any successful project.

Stack Overview

The technology stack is a set of instruments for bringing the desired IT idea to life, which includes languages, frameworks, libraries, dev toolkits, as well as programming approaches. The combination of all this determines the prosperity, durability, and stability of any application, its performance, flexibility, security, and further maintenance.

So, in the case of developing a mobile insurance application, you can make a separate native app for the Android (Java, Kotlin) or iOS (Objective-C, Swift) platform. You can also choose a cross-platform approach (React Native, Xamarin, Flutter) that will be displayed on both OSs and save development resources, which is vital for reaching the market faster.

The condition for choosing the right stack when designing the client and server parts is a thorough preliminary study of the basic functions, the purpose of an insurance application, key requirements, and other characteristics of the tool that is being created.

The Best for Fast Delivery

The speed of project development is one of the most important factors. If an insurance app must be built in a short time, the best option would be to choose ready-made technical stacks that provide easy integration. Such combinations of technologies reduce overall development time through third-party integrations. These solutions provide easy integration and reduce project time to a minimum.

However, remember that these stacks are not universal: they cannot be applied to absolutely all projects — insurance applications of all types require a creative approach, not the common one.

Ease and high speed of development are what will provide the insurance company with quick adaptation to the market, immediate feedback from the market and the audience, as well as quick changes and reframes if they are really needed (usually they are).

The delivery speed is usually the key decision-making point for startups that strive to enter the market and reach their first customers quickly. So, if you need to release a product as soon as possible, consider a stack with many ready-made development solutions, such as social media integration and authentication.

In the case of mobile applications, React Native, Xamarin, or Flutter should definitely be preferred. Technologies for cross-platform development will not only save your money, but also deliver your application faster. Pay special attention to Flutter, because there are several IDEs for it that can make development even faster.

The Best for Scalability and Turnaround

The architecture of an insurance application must be scalable, as it is vital for further development. Scalability determines whether an app can handle the load. For example, if the number of policyholders increases, the technology stack must allow an insurance app to handle this growth.

There are two types of scalability — horizontal and vertical. The first means the ability to work on different devices and allows coping with an increasing number of users. Vertical scalability means the ability to add new features or elements to an application in the future.

Powerful languages like JavaScript provide a great level of scalability via various libraries and structures that keep the language flexible. Scalability and turnaround are important for ease of support and thus for quick additional features and fixing users’ bugs (troubleshooting).

Flexibility is usually crucial for big companies that start the app project to keep in mind a big scale soon. And for this aim, it is better to choose native development since cross-platform stacks provide insufficient scalability. Consider Kotlin for Android or Swift for iOS if scalability and turnaround are your top priority.

Enhanced Security Stack

The security of the user’s personal data is important for any application, and especially for insurance services that provide for the storage of confidential information and online payments. So, when forming a stack, it is worth giving preference to the choice of technologies that provide maximum security and inaccessibility to attacks.

Every insurance business needs high-quality and reliable application protection against external cyber threats. Like any other technology, cybersecurity includes a combination of approaches and software tools, one of which is the Cybersecurity Technology Stack. Its implementation allows protecting privacy and data, saving on backup and disaster recovery, and thus dedicating resources to detect and handle potential and active threats to insurance app security.

Any policyholder wants to be sure that their personal data is safe. You spend a lot of money on an insurance app, so you need it to be secure. This point is vital for both insurance startups and big companies and in terms of safety, confidentiality, and reliability, native development is ahead of all its competitors. Make a choice in favor of Kotlin for Android or Swift for iOS to ensure enhanced security in the insurance application development.

6 Steps to Develop an Insurance App and Grow a Successful Business

Wondering how to create an app for an insurance agency? Here is our ultimate guide for everyone who wants to launch an insurance app that will meet the digitalized industry, fill the market's needs, meet consumer requests, and remain competitive.

Strategy Development

So, what points are crucial for development and to save development costs?

The first step in building an insurance application (like any other) is research. Here it is necessary to determine short-term and long-term goals and choose an approach to achieve them.

To develop the right customer-oriented strategy, you must fully understand the target audience’s preferences and behaviors, determine how to attract users, how policyholders will interact with the application, what requests it will satisfy, and what will motivate customers of an insurance company to download it.

Equally important is a competitive analysis. In order to determine your value, form a unique selling proposition, and realize your competitive advantage, you need to study similar offers that are already on the insurance market and explore their pros and cons.

When developing a winning strategy and creating a vision for the final product, consider not only the must-have functionality, but also keep in mind the additional opportunities and trends of recent years. Think about such features as personalization, telematics, chatbots and AI/ML, self-service, APIs, cybersecurity, and so on. This is exactly what can lure users away from competitors.

The success and future of a mobile insurance app entirely depend on developing the right strategy — on understanding why you, as an insurer, need this app and why your policyholders need it.

Business Model Determination

At this stage, we determine how your insurance business will benefit from developing a mobile application. Among the most common business models are a free app with ads, freemium (combination of free and paid premium features), a paid app, subscription, and sponsorship.

To make a choice, you must answer several questions. What problems and how does this application solve? Why is it unique? Why will policyholders download it? How well can the chosen monetization method work for this app?

It is also important to strike a balance between the desire to attract more users with the desire to receive money. Some monetization methods allow you to start earning immediately after the release of the application, while other models provide a gradual growth of audience with monetization after a certain period. How much time do you have? Can you refrain from monetizing an app for a while to gain a user base?

Remember, a monetization plan must be developed and implemented in the application prior to release. At the same time, monetization methods can be combined; it is not necessary to use only one of them.

So, to ensure a good implementation of the business model in the application and reduce development costs, the business model must be chosen before the MVP phase. However, if this did not happen, this does not mean that the startup failed. A new business model can be integrated into an app later.

And always remember that to save costs, you can develop three versions instead of one and test your MVP business ideas three times faster to determine the best for you and go further.

Design

You already know what kind of insurance application you want to create. Now it’s time to move on to the implementation of the design because creating the best user experience in the market is a crucial task when building a new app. At this stage, it is necessary to clarify the requirements, plan the UX (determine the architecture and prepare a prototype with all the main interface features), and design the user interface.

This is where fast prototyping comes in. Prototyping allows mobile developers to test ideas, determine the best features, and realize if a potential product is functional and workable. A lightweight prototype is also crucial to see if the project has access to the necessary technologies that will help achieve the goals of an application from the very beginning.

Thus, since prototyping allows you to test a business idea before starting the MVP development, it is better not to skip this stage. The correctness of the implementation depends entirely on this phase, as well as the ability to save time and costs for the project during the development process.

Development

Now, you are ready to make an insurance app MVP to test your business model before moving on to the next development steps. So, at this stage, make sure that potential and existing policyholders need your product; collect feedback, assess the need for improvements, and correctly prioritize them; understand the optimal direction for further development after various iterations; attract the first users and start monetization.

For an MVP to show the real picture, it is necessary to approach its development correctly. A “raw” product created in a hurry will not allow confirming the hypothesis about its demand. However, on the other hand, MVP should be created as quickly as possible, with a minimum of money spent, and it should include only the critical functions (the user need for which we must check).

The first thing you need to determine before developing an MVP is what tools, features, and capabilities will be key for your insurance app. The rest of the functionality can be added later, when policyholders start testing the system and giving feedback. After confirming the formulated hypotheses, processing feedback, and evaluating key performance indicators, you can develop a full-fledged insurance application.

The creation of a minimum viable product helps to avoid developing unnecessary functionality that will not bring value to the consumer but at the same time, will waste your resources. Hence, an MVP reduces the time and cost of insurance app development.

Quality Assurance

Before an insurance application is released to the public, it needs to be tested for usability, bugs, compatibility, safety, and satisfaction of insurers and policyholders. Although QA takes just about a quarter of development time, this is a decisive phase. High-quality and thorough testing can help you save money in the long run by tracking and fixing all possible failures before public release. In addition, QA ensures reliability and stability, which is exactly what users of insurance applications are looking for.

App Release and Post-release Support

The application development life cycle does not end with the release of the end product. You not only have to deliver it to the app stores, but you also have to keep in mind that iOS and Android are updated regularly. Thus, you must always be sure your app is up-to-date and works correctly on the latest platforms. The insurance industry and market are changing rapidly, which may require new features to be added to your product. In addition, you must promote your app to attract new users and constantly process their feedback to maintain the satisfaction level.

High-quality post-release support and maintenance ensure scalability, new features, better interaction, and improved user experience.

GET FULL-CYCLE INSURANCE APP DEVELOPMENT SERVICES WITH EPAM STARTUPS & SMBS

Want to create an insurance agency app that will achieve all your business goals and stay ahead of the competition? Get a full range of services from research and strategy development to launch and post-release services with reduced time and money.

EPAM's Experience in Insurance Mobile App Development

EPAM has successfully provided insurance mobile app development services for several years. EPAM has implemented hundreds of projects in different insurance industries, and satisfied clients from all over the world are exactly what confirms our valuable expertise.

Let’s look at EPAM's most notable cases in the insurance industry that we are extremely proud of.

Transforming one of the UK’s Insurance Leaders from the top down

Tech stack: Azure, Sitecore, Cloudflare, Terraform, SearchStax.

EPAM team was challenged to make a fundamental digital mindset shift within the LV= General Insurance company to expand its offline customer experience and the business itself.

EPAM team has developed a successful and innovative three-year transformation concept, roadmap, and business case that delivered essential incremental change in the insurance business. To bring the strategy to life, EPAM has designed and built a new platform for digital products and services. As a result of the project, LV= General Insurance has risen from eleventh to third-largest personal lines insurer in the UK.

In addition, EPAM helped the client achieve the following results: a 38% increase in auto insurance starting rate, a 31% increase in mobile conversion, a 30% increase in online quotes, a 25% increase in home insurance starting rate, and a 12% increase in mobile revenue.

Capability academy approach for IT executive education

EPAM was tasked with providing the client company's top IT leaders with the technical, informational, and leadership capabilities needed to drive digital transformation.

Main challenges: motivating the company to change, fostering a culture of learning, expanding the technical and leadership capabilities of IT leaders in five focus areas, managing implementation, and problem-solving.

The project resulted in an innovative and advanced training program. Since its implementation, the client’s team has achieved the following outcomes: a 22% increase in knowledge, improved preparation for transformation among more than 90% of IT leaders, enhanced speed and participation in other initiatives related to the tech vision.

EPAM's team has taken all the challenges and developed cutting-edge solutions to meet the needs of the market, industry, and customers. Now, we at EPAM Startups & SMBs successfully transform insurance businesses and will develop a competitive digital tool for your company.

Conclusion

COVID-19 has accelerated the natural transition of the insurance industry to more advanced technologies, and this trend continues under the influence of other factors and global transformations.

Today we are dealing with a new generation of users — Gen Zers, who are our future and current customers. Generation Z consists of 65 million people in the US, 98% of them own a smartphone, and all of them change the desktop product to the mobile one. Influenced by representatives of Gen Z, the whole market is going towards digital mobile-first experiences. And insurance companies, as one of the key players, must now move to updated business models by launching digital tools.

So, in today’s market conditions, insurance mobile app development is a necessity rather than a choice. Insurance applications are attractive to businesses in terms of generating revenue, increasing the number of users, meeting the market trends, and outperforming competitors.

To get the most out of implementing this tool, remember that hiring a reliable and trusted contractor is always half the battle.

Want to entrust the development of your insurance app and focus on your business goals? Book a 30-min call to choose us. We at EPAM Startups & SMBs understand your requirements to provide the best solution.

FAQ

Expert digital communicator and editor providing insights and research-based guides for technology buyers globally.

Expert digital communicator and editor providing insights and research-based guides for technology buyers globally.

Explore our Editorial Policy to learn more about our standards for content creation.

read more