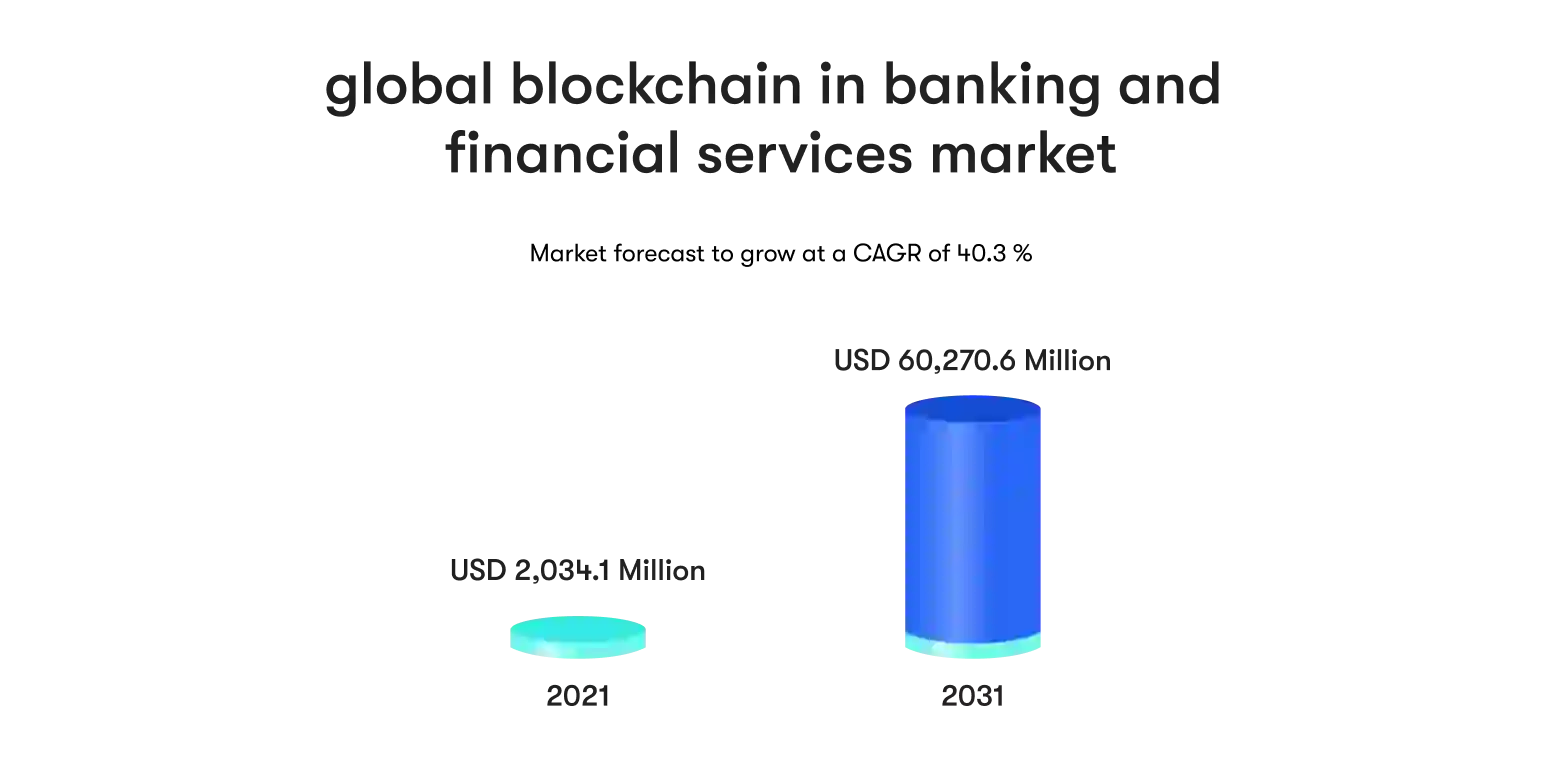

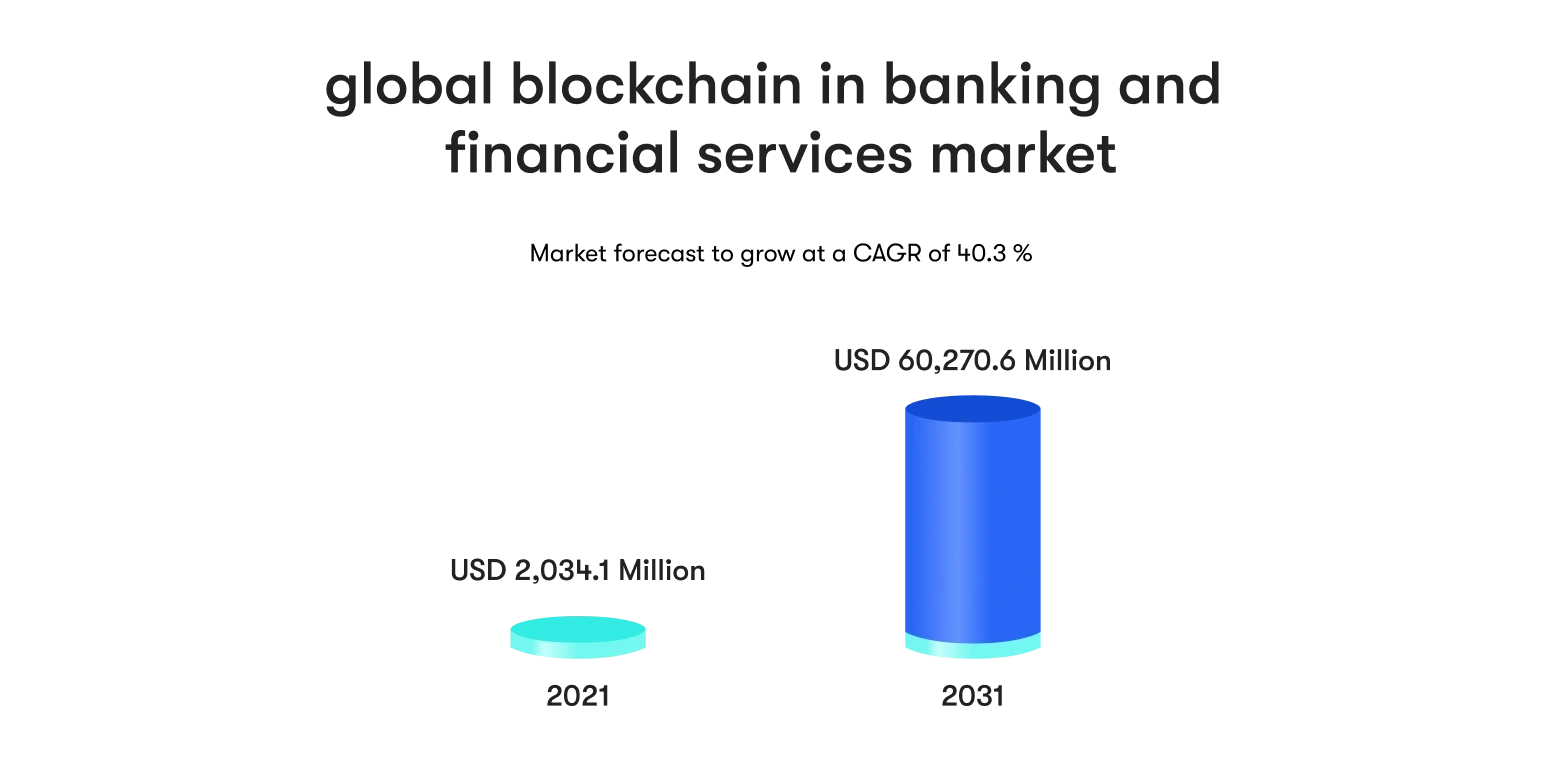

When we talk about technology in financial institutions we often limit our thoughts to online banking and cross-border payments. However, there are more ways to use technology in the financial markets. One such way is implementing blockchain in banking and financial services.

Now, you might be wondering how blockchain, the technology behind digital currencies or digital assets, can be used in financial services. Till now we know blockchain facilitates faster, more secure, and transparent transactions through the use of digital assets. The world looks forward to the promising benefits blockchain can bring to the banking and financial sector while addressing its challenges linked to trust and fraud prevention.

What’s the role of blockchain in banking?

When blockchain became mainstream, it was considered as a disruptive technology that was here to eliminate intermediaries, whereas banks or other financial institutions served as the intermediaries for people. So, this technology technically contradicted and disrupted the concept of the financial industry. Today, however, blockchain technology is making its mark on traditional banking systems.

But, what is blockchain technology in banking specifically? Well, this technology records transactions in a secure, transparent ledger, aka a distributed ledger. It works as a digital record book that everyone can see and verify but no one can edit. That's blockchain in a nutshell.

Its main purpose includes but is not limited to keeping track of every transaction without the need for a central authority or central banks. It further automates processes with smart contracts — the self-executing agreements. These smart contracts eliminate the need for manual verification and intermediaries, making transactions faster, cheaper, and more reliable.

Blockchain uses cryptography which makes the transactions uneditable or inaccessible by any third person. This encryption method keeps data secure and makes it impossible for hackers or cybercriminals to fiddle with transactions or confidential data. At the same time, every step of a transaction is recorded on the blockchain, ensuring data integrity with transparency and auditability.

For the most part, blockchain technology in banking is used for payment services and settlements. As it offers the ease of cross-border transactions, it makes transactions relatively faster and cheaper as compared to the alternative options.

Banking on blockchain comes with many perks for the trading sector as the transaction processing time is much lower than usual. Why is that so? The paperwork is digital, reducing fraud risk, and providing greater transparency in the movement of goods or asset transfers.

Plus, it provides faster transactions and loan processing with peer-to-peer lending options that allow improved credit scoring. All of this is without security vulnerabilities because sharing customer data is done through a private key in line with KYC/AML compliance.

GO BLOCKCHAIN WITH US

We consult on and implement custom blockchain solutions in the banking and financial industry.

What are the benefits of blockchain technology in finance?

Data integrity and increased security are some of the prominent features that blockchain in finance offers. However, blockchain implementation keeps on varying as the technology is still developing. Private or commercial banks already using blockchain or on their way to using it are guided by these promising benefits:

Security

Your transactions, data, and on a bigger level the global economy are safe with blockchain. Do you know how blockchain secures money transfers? By storing them on a distributed ledger, making them tamper-proof and resistant to fraud.

In this immutable ledger, the transactions are encrypted under cryptographic protection, ensuring the confidentiality and integrity of financial data. To reduce risk, blockchain also removes the need for intermediaries, minimizing the risk of single points of failure.

Transparency

You might be wondering if the security is so strict how transactional transparency is made sure? Well, the transactions recorded in the blocks are publicly visible so that it shows accountability and prevents corruption.

When the transactions are publicly visible it provides a detailed record of them simplifying audits and investigations. This increases the people’s trust in financial institutions with complete transparency.

Trust

Why trust blockchain? Because it is made by you for you. Blockchain technology is completely decentralized which means no single entity owns or controls it. That decentralized nature makes sure there are no risks of manipulation or abuse of power.

People might trust this virtual technology more than any physical being because it improves data verification. No one can take the origin and ownership of financial assets from you as your assets can be easily traced.

Programmability

Now, we take it to the technical benefits of blockchain. Blockchains work on smart contracts that are automated agreements based on predefined conditions and can eliminate manual processes and human error.

Since these smart contracts offer automation, the transactions can be automatically triggered and executed based on specific criteria. This automating of tasks reduces costs and improves the speed of financial transactions.

High performance

Since this is a virtual tech, you can expect a huge storage capacity. Huge storage means it can handle a high volume of transactions quickly and efficiently. This implies faster and cost-effective transactions.

Blockchain’s fast processing reduces settlement times. The transactions can be settled in real time, eliminating the need for intermediaries. Also, digital currencies can be easily transferred and traded on blockchain platforms.

Scalability

As we already mentioned earlier, this technology keeps on upgrading as developers are finding ways to make it more scalable for banking businesses. In the ongoing development, new technologies and protocols are constantly being developed to address the scalability challenges.

Well, have you heard of the term layer 2 solutions? It means sidechains and other scaling solutions can increase the transaction capacity of blockchain networks.

As a long-term goal, scalability is still a work in progress, and the potential for significant improvements exists.

Financial inclusion

Blockchain helps to reach the unbanked population by offering financial assistance to individuals who lack access to traditional banking systems. This was made possible by promoting micropayments. Blockchain-enabled secure, low-cost micropayments open up new avenues for monetization and access to resources.

Enhanced customer experience

Customer data is securely stored and utilized on the blockchain to create personalized financial products and services. Furthermore, the automated KYC/AML processes on a blockchain can simplify customer onboarding and improve the user experience. This transparency and control over data provided by blockchain can foster trust and loyalty among customers.

GET THE BENEFITS OF BLOCKCHAIN FOR YOUR BUSINESS

Adopt this future-defining tech with a development partner you can trust.

How is blockchain changing the banking industry?

Blockchain has been making its way into the healthcare, business, sports, entertainment and other industries in many ways. In the banking industry, the role of blockchain is more comprehensive.

Blockchain promises to transform the way we bank, borrow, and interact with money. Gone are the days for financial institutions to rely on single, centralized entities for every financial transaction. With blockchain, power is distributed across a network of computers, eliminating the need for intermediaries and their associated fees and inefficiencies.

The transactions on the distributed ledgers are processed and settled in seconds, eliminating the time-consuming delays. Today, cross-border payments, which once had issues of slow processing times and exorbitant fees, are done with potentially reduced costs and time.

People are expecting banks to adopt blockchain for the security it offers. Its cryptographic methods help in securing money transfers against fraud and errors. The distributed nature of the network eliminates single points of failure, further bolstering its security and resilience.

Beyond these core benefits, blockchain opens doors to innovative financial products and services. Smart contracts, initial coin offerings, and self-executing agreements based on predefined conditions automate workflows and eliminate the need for manual verification, reducing costs and accelerating transactions.

Companies using blockchain in finance

The number of financial companies and banks using blockchain is steadily increasing, with some major players showing signals of mainstream adoption. One such initiative is the Canton Network launched in mid-2023 by the conglomerate of Goldman Sachs, Microsoft, Deloitte and 30+ other A-list network participants. Here are some more blockchain use cases in banking and financial services domains:

OpenZeppelin

This security expert safeguards the smart contracts that power countless blockchain applications. By securing the foundations of DeFi, OpenZeppelin is ensuring trust and stability in this burgeoning ecosystem of financial institutions. You can understand the workings of OpenZeppelin as they are building digital vaults that protect financial transactions on the blockchain.

Propy Inc.

Streamlining real estate transactions, Propy uses blockchain to create tamper-proof records of property ownership and transfer. Their platform reduces paperwork, accelerates closings, and enhances transparency, making home buying less stressful and more secure. Think of them as the blockchain notary, providing an immutable record of property deeds.

Uulala

This micro-investment platform lets users own fractions of high-value assets like artwork or real estate using blockchain tokens. This democratizes access to previously exclusive investment opportunities, opening doors for everyday people to participate in the wealth creation game. Uulala acts as the bridge between individuals and valuable assets, fragmenting them into accessible pieces.

SoluLab

This Swiss startup uses blockchain to revolutionize trade finance. Their platform streamlines complex trade processes to reduce the risk of fraud and facilitate faster transactions. SoluLab is essentially the blockchain grease for the engine of global trade, smoothing out the bumps and speeding up the flow of goods.

Ripple

A household name in cross-border payments, Ripple leverages blockchain to provide faster, cheaper, and more transparent international transactions. Think of them as the SWIFT network on steroids, powering seamless money transfers across borders. Built on top of the XRP Ledger, Ripple offers rock-solid security and transparent transaction visibility, making it a trusted partner for high-value financial transactions.

Mastercard

This payments giant is actively exploring blockchain's potential to improve security, efficiency, and access to financial services. Mastercard is a major player integrating blockchain into existing financial infrastructure, paving the way for wider adoption.

Paxos Trust Company

Ensuring stability and trust in the digital asset world, Paxos provides regulated custody and settlement services for cryptocurrencies. They act as the blockchain bank, holding digital assets securely and facilitating their movement in a compliant manner. Its Paxos Stablecoin, PAXG, is a shining example, backed one-to-one by physical gold stored in insured vaults. This hybrid offering bridges the gap between the volatility of cryptocurrencies and the stability of precious metals all because of its adoption of blockchain in financial services.

American Express

Adopting the innovative potential of blockchain technology, American Express is exploring its use in areas like loyalty programs and supply chain management. They are a prime example of traditional financial institutions adapting to the new tech, keeping their finger on the pulse of fintech advancements. By adopting this tech, the company has guaranteed low-cost international payments to its customers.

JOIN THE RANKS OF BLOCKCHAIN PIONEERS

Partner with EPAM Startups & SMBs to develop your blockchain product.

The future of blockchain in the banking industry

Looking at the future of banking, blockchain technology surely has a major role in it with new developments on its way.

Since the 21st century is all about technology, blockchain is a chance to build a fairer, more accessible and efficient financial system that helps individuals and businesses alike. The financial institutions that adopt this tech will lead the charge into a future where finance is no longer bound by borders, bureaucracy, or outdated systems.

How can we help you implement blockchain in banking?

If you are tired of slow transactions, paper mountains, and outdated systems then look nowhere else as blockchain technology is here to upgrade your sector.

But how do you implement and integrate blockchain within your existing business operations? Well, you don’t have to worry about the technicalities because EPAM Startups & SMBs is here to help.

We are your digital transformation partner to help you estimate the potential of blockchain for your banking company and bring this vision to life with expert blockchain software development services. Our technical teams will securely integrate blockchain into your existing infrastructure and design groundbreaking financial products like micro-investments and instant cross-border payments, to name just a few blockchain applications in finance.

START YOUR BLOCKCHAIN JOURNEY TODAY

Get in touch with our blockchain consultants to discuss your project.

Conclusion

Finally, we would like to add that this decentralized technology promises to rewrite the rules of banking, with uncompromising security, lightning-fast transactions, and groundbreaking financial products.

Many organizations that have adopted it are free of traditional banking hassles. Some companies offer blockchain services to help finance and banking industries to adopt this tech. Now you know how this distributed ledger technology offers secure real-time payments and fractional ownership of assets. This tech opens doors to a more inclusive, efficient, and innovative future of finance.

While challenges remain, the potential is undeniable. Companies like OpenZeppelin, Propy, and Ripple are already showing the benefits of blockchain and its real-life applicability. They have changed everything from cross-border transactions to trade finance.

FAQ

Anush has a history of planning and executing digital communications strategies with a focus on technology partnerships, tech buying advice for small companies, and remote team collaboration insights. At EPAM Startups & SMBs, Anush works closely with subject matter experts to share first-hand expertise on making software engineering collaboration a success for all parties involved.

Anush has a history of planning and executing digital communications strategies with a focus on technology partnerships, tech buying advice for small companies, and remote team collaboration insights. At EPAM Startups & SMBs, Anush works closely with subject matter experts to share first-hand expertise on making software engineering collaboration a success for all parties involved.

Explore our Editorial Policy to learn more about our standards for content creation.

read more