In the modern banking landscape, the cloud emerged as a transformative force, reshaping the banking industry's infrastructure and operational paradigms. In this article, we'll delve into the dynamic intersection of cloud technology as part of fintech software development services and explore how this alliance drives innovation for banks worldwide.

What is cloud computing banking?

Cloud computing in banking enables banks to store and process data, host applications, and provide services like online banking and customer relationship management through the cloud, resulting in higher scalability, cost efficiency, and accessibility.

The current state of cloud computing in financial services

The integration of cloud computing has evolved from an experimental concept to a forefront driver of digital transformation in banking.

Financial institutions ranging from global banking giants to fintech startups have recognized the potential of cloud technology for data storage, customer relationship management, risk analysis, and even some mission-critical core banking services.

The current state of the cloud in banking represents a symbiotic relationship, and banks use the cloud to deliver personalized and innovative services to their clients. However, the move to the cloud has been cautious and gradual due to the highly regulated nature of the financial sector and customer data sensitivity. Banks are collaborating with cloud service providers to ensure data protection, encryption, and adherence to industry regulations.

Сloud service and deployment models

Cloud service models allow financial institutions to transition from a capital-intensive approach to a more adaptable business model, effectively reducing operational expenses. Within this section, we’ll talk about the most popular cloud computing service models, evaluating their applicability to operations and deployment strategies.

- Business process-as-a-service (BPaaS): In this model, the cloud is harnessed for standardized business processes like billing, payroll, and human resources. BPaaS combines the expertise of other service models, offering a holistic approach to process optimization.

- Software-as-a-service (SaaS): Under this model, a cloud service provider hosts business software and relevant data accessible to users through web browsers. This practice encompasses software categories such as accounting, customer relationship management, enterprise resource planning, invoicing, and human resource, content, and service desk management.

- Platform-as-a-service (PaaS): A cloud service provider furnishes a comprehensive platform for application, interface, and database development, storage, and testing. This model empowers businesses to streamline the lifecycle of custom applications, diminishing IT expenditures and reducing the necessity for hardware, software, and hosting environments.

- Infrastructure-as-a-service (IaaS): Instead of procuring servers, software, data center space, or network equipment, this cloud model allows enterprises to purchase these resources as fully outsourced services. The IaaS model eliminates the need for direct ownership and management of physical infrastructure, enabling businesses to focus on their core activities.

Clouds are deployed in three primary ways:

- Private clouds: Private cloud infrastructure is dedicated exclusively to a specific bank and exists on the company's premises. A private cloud can be managed either by the business itself or a third-party partner. This deployment model offers the highest level of security among all cloud options.

- Public clouds: This model makes the cloud infrastructure accessible to the general public or an industry group. A public cloud is owned by an organization that provides cloud services to users.

- Hybrid clouds: Hybrid clouds include two or more distinct clouds, which can be private or public. While these clouds retain their identities, they are interconnected to provide cohesive services.

What model to choose?

Many banks still wonder whether they should migrate to the cloud or adopt on-premise software. Cloud-based banking services offer high scalability, but banks must ensure their data is safe and secure when stored in the cloud.

In this regard, an optimal solution is to adopt a hybrid/on-premise cloud-based banking approach. Banks can keep critical data and operations on-premises while leveraging the cloud for non-sensitive functions. Plus, banks can keep sensitive customer data within their premises, making it easier to comply with regulations without missing out on the benefits of cloud computing.

LET’S TAKE YOUR BANK TO THE CLOUD

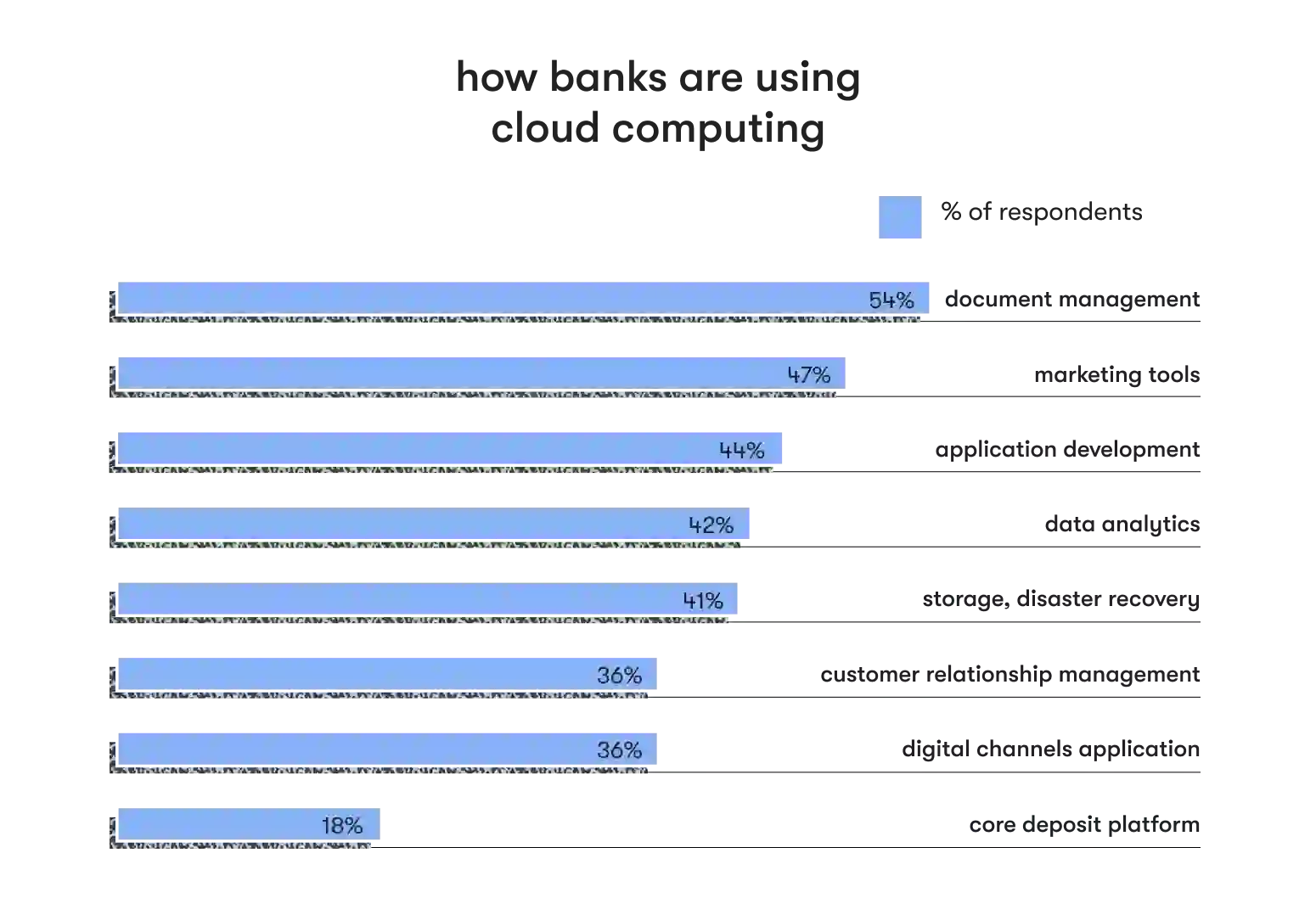

The cloud in banking: use cases

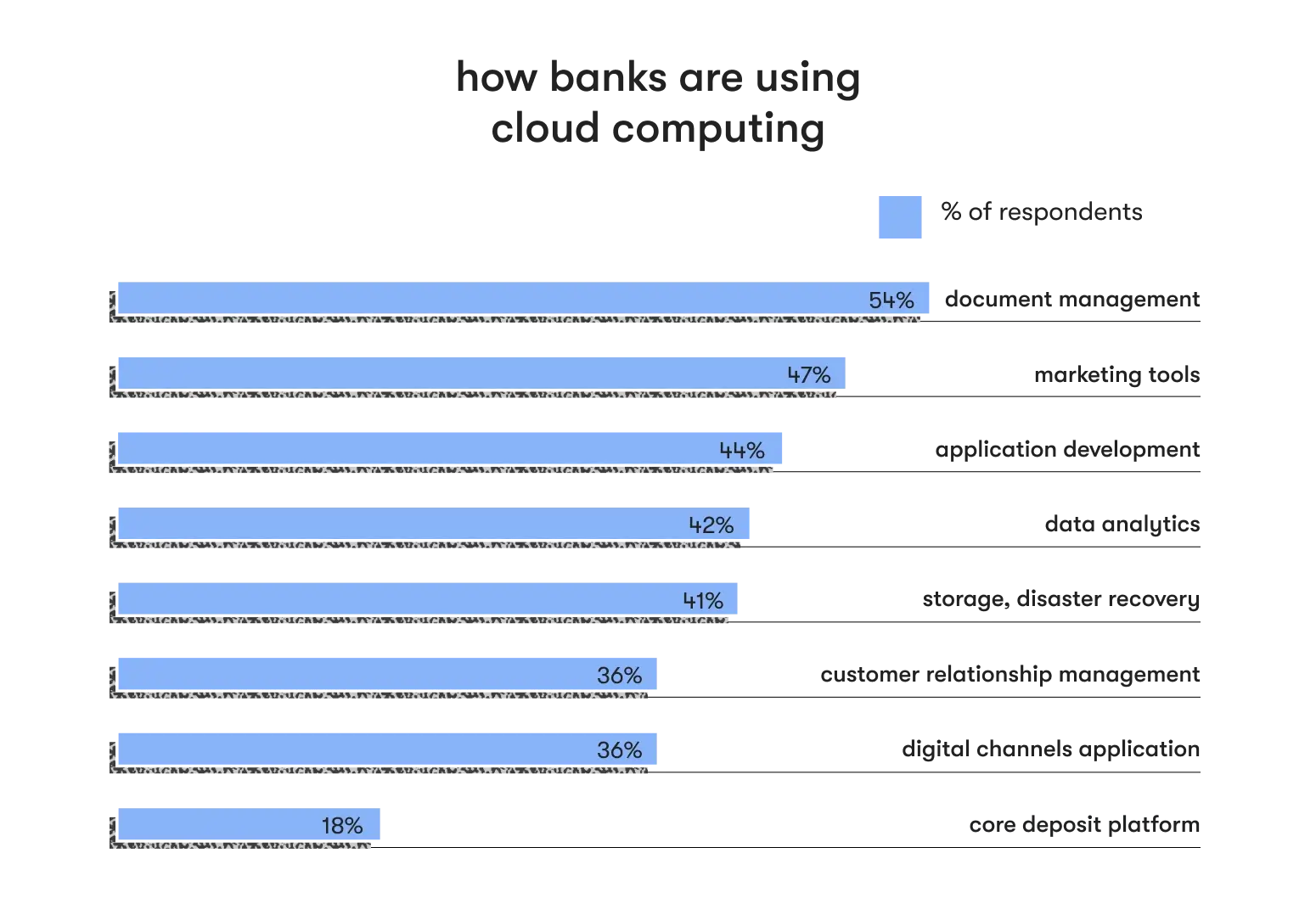

Cloud computing revolutionizes various facets of bank operations and services. Some key applications of cloud computing in the banking sector include:

- Sensitive data storage and management: Banks leverage cloud infrastructure to store and manage vast amounts of data securely. This practice includes customer records, transaction history, financial data, and regulatory documentation.

- Customer relationship management (CRM): Cloud-based CRM systems enable banks to track customer interactions, preferences, and behaviors. This approach helps in delivering personalized services and targeted marketing campaigns.

- Enterprise resource planning (ERP): Cloud-based ERP solutions streamline internal processes by integrating various departments such as finance, human resources, and procurement, enhancing efficiency and coordination.

- Digital banking services: Cloud computing in the finance industry enables the delivery of digital banking services such as online banking, mobile apps, and e-wallets, providing customers with convenient access to their accounts and transactions.

- Risk management and advanced analytics: Cloud-based analytics platforms assist banks in real-time risk assessment, fraud detection, and compliance monitoring by analyzing large datasets efficiently.

- Loan origination and processing: Cloud technology facilitates smoother loan application processes, automating workflows and enhancing department collaboration for quicker decision-making.

The benefits of the cloud in banking

The integration of cloud technology in the banking sector offers a range of significant benefits that are reshaping the industry's landscape:

- Agility and scalability: Cloud solutions enable banks to swiftly adapt to changing demands by providing scalable resources. This flexibility allows them to efficiently handle spikes in activity, launch new services, and adjust their infrastructure without the delays associated with traditional hardware upgrades.

- Cost efficiency: Cloud adoption reduces the need for extensive on-premises infrastructure investments. Banks can adopt a pay-as-you-go model, minimizing upfront costs and optimizing resource allocation, ultimately leading to cost savings.

- Innovation acceleration: Cloud environments offer fertile ground for innovation. Banks can rapidly experiment with new technologies, develop and deploy applications faster, and refine customer experiences without traditional IT constraints.

- Enhanced customer experience: Cloud-driven analytics and data processing empower banks to understand customer behaviors and preferences comprehensively. This approach leads to tailored services, personalized marketing, and improved customer interactions.

- Security and compliance: Cybersecurity in banking stands as a paramount concern in the digital age. Leading cloud providers like Microsoft Azure and Amazon Web Services (AWS) offer robust security features and compliance certifications, often surpassing what individual banks can implement on their own. This level of security enables banks to maintain rigorous data protection measures and adhere to regulatory requirements and industry standards.

- Disaster recovery and business continuity: Cloud environments provide reliable data backup and recovery mechanisms, ensuring banks can swiftly resume operations despite unforeseen disruptions.

While these benefits are promising, it's important that banks carefully plan and execute their cloud strategies, considering the various factors and challenges to ensure a successful transition to the cloud.

The biggest challenges in adopting cloud in banking

When planning cloud migration, financial institutions must carefully address concerns related to data confidentiality, security, regulatory standards, protocol compatibility, and the assurance of service quality.

The main challenges in adopting the cloud include:

- Regulatory compliance: The banking sector is heavily regulated to ensure transparency and security. Adapting cloud solutions while adhering to regulatory requirements that vary across jurisdictions poses challenges in maintaining compliance.

- Data security and privacy: The sensitive nature of financial data makes security paramount. Banks must ensure that customer information, transaction records, and other critical information are rigorously protected from data breaches and unauthorized access. Securing compliance with data privacy regulations like GDPR and ensuring data encryption in transit and at rest add complexity.

- Vendor risk management: Banks rely on cloud service providers (CSPs) to manage their infrastructure. However, this dependence introduces vendor-related risks, including their financial stability, data handling practices, and adherence to security standards.

- Integration complexities: Many banks have legacy systems that need to be integrated with cloud services. Ensuring smooth interoperability between existing on-premises systems and cloud solutions can be challenging.

HIRE OUR TEAM TO BUILD A FUTURE-READY CLOUD INFRASTRUCTURE FOR YOUR BANK

Moving to the cloud: where to start?

The decision for a bank to transition to the cloud can be driven by various factors, but foremost among them is often the need for improved applications.

Historically, significant investments in new technologies have been hindered by the substantial capital expenditure required for building infrastructure. Cloud computing changes this dynamic, as financial institutions can allocate resources for operational expenses and pay based on their actual usage of services. Consequently, testing new applications on the cloud becomes a streamlined and cost-effective process compared to traditional infrastructure setups.

When choosing an optimal technology solution, it's important to know that no single cloud computing service model will comprehensively address the diverse requirements of every financial institution. Instead, a balanced approach entails creating and maintaining an application portfolio that encompasses both cloud-based and on-premise applications.

While investments in legacy systems are anticipated to persist, cloud-based services particularly excel in newer business domains. Leveraging the cloud is expected to yield advantages such as reduced investment in implementing business strategies and accelerated product and service rollout, especially for offerings accessible via mobile devices and the Internet.

To sum up

In the dynamic landscape of modern finance, AI-driven banking, machine learning, the use of big data, and mobile banking are reshaping the industry as we know it. Cloud computing has become an indispensable tool for banks aiming to drive cost savings, enhance agility, and improve the customer experience.

As financial institutions strive to enhance their digital agility and maintain security standards, fintech is gaining momentum. We can expect to witness a continued convergence of cloud technology and banking, leading to enhanced services, greater financial inclusion, and a more secure and efficient financial ecosystem for banking institutions and their customers.

As technology continues to evolve, financial institutions that opt for cloud computing can adapt faster to the ever-changing business landscape. At EPAM Startups & SMBs, we provide cloud development services to neobanks and established financial institutions willing to establish a competitive edge through cutting-edge technologies.

FAQ

Since 2011, Dmitri has been helping business readers navigate the technology market through expert analysis and editorial work. At EPAM Startups & SMBs, Dmitri shows startups and SMBs across industries how to drive business value from their software engineering investments.

Since 2011, Dmitri has been helping business readers navigate the technology market through expert analysis and editorial work. At EPAM Startups & SMBs, Dmitri shows startups and SMBs across industries how to drive business value from their software engineering investments.

Explore our Editorial Policy to learn more about our standards for content creation.

read more