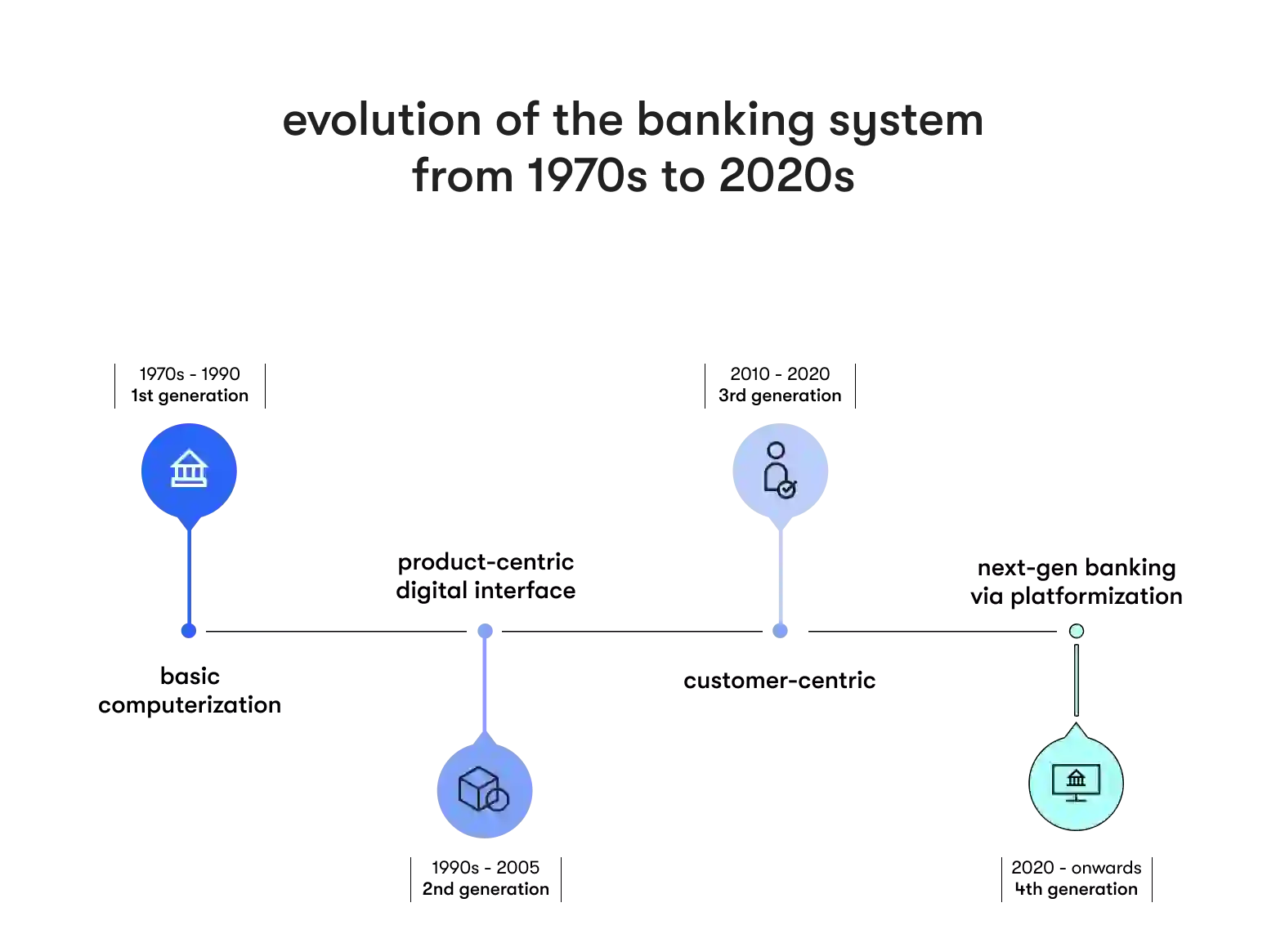

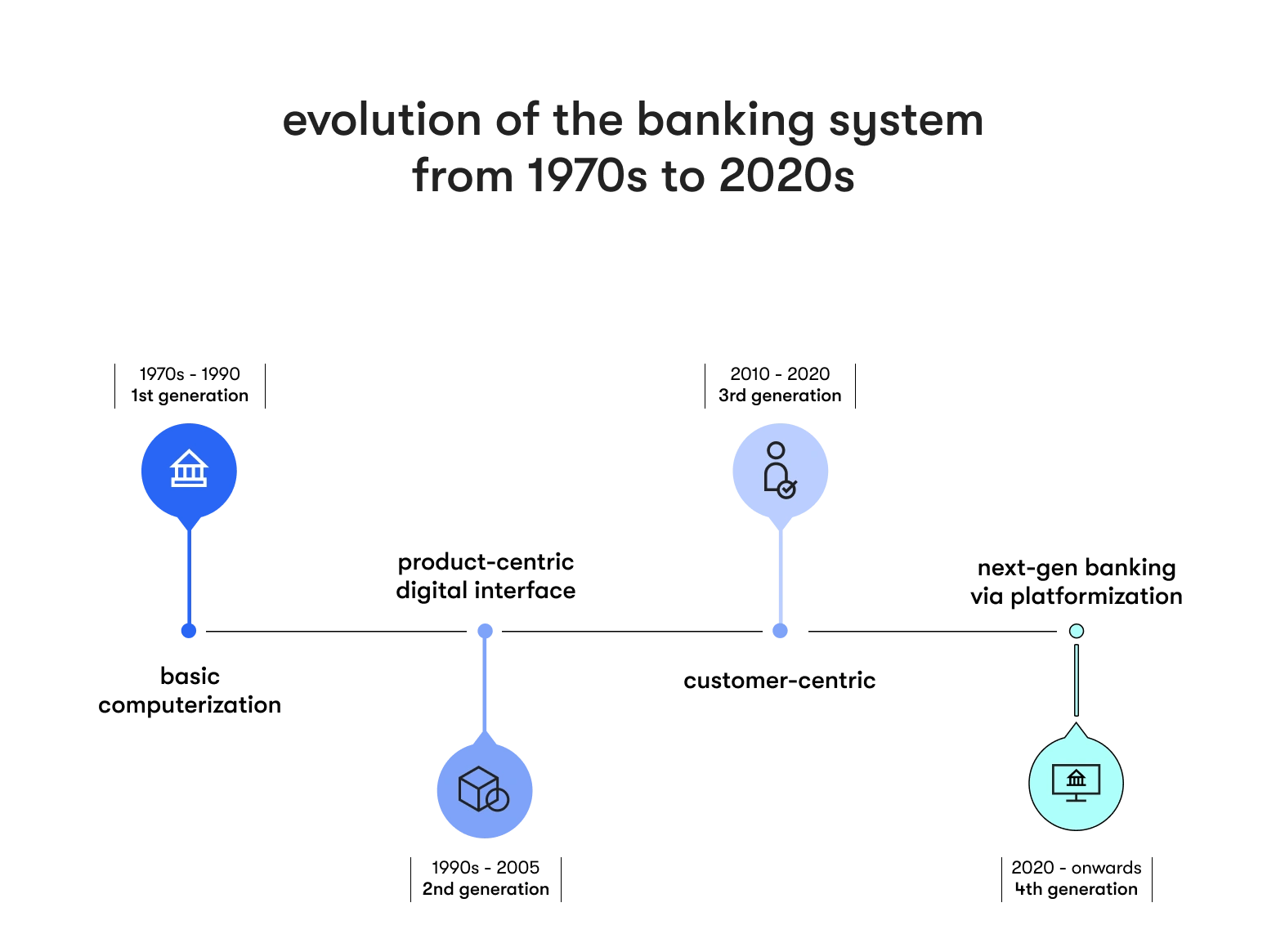

Over the past few decades, the banking industry has experienced a significant revolution driven by technological advancements and a changing customer landscape. Traditional brick-and-mortar banks are no longer the only option for consumers, as digital interfaces have become increasingly popular. This transformation has allowed banks to offer more convenient and accessible services to customers, such as online banking, mobile banking applications, and digital wallets.

The current state of banking is marked by a shift towards finance digitalization, with more and more banks embracing technology to offer seamless and efficient services. This trend has been accelerated by the COVID-19 pandemic, which has forced customers to rely on digital channels for their banking needs.

The banking industry has experienced several revolutions over the years, starting with the introduction of ATMs in the 1960s, followed by the advent of online banking in the 1990s. The latest revolution in the digital banking future is marked by the emergence of fintech startups, disrupting the traditional banking sector by offering innovative and customer-centric services.

The banking industry is expected to continue to evolve and adapt to changing customer needs and expectations. Some trends expected to shape the finance industry's future include the increasing use of artificial intelligence and machine learning, the rise of blockchain technology, and the growth of open banking. These trends are expected to drive innovation and create new opportunities for banks to offer customers more personalized and convenient services.

How banks have changed in the last 30 years

Over the past few decades, the banking sector has undergone a remarkable transformation, moving away from the traditional ways of operation and embracing modernization to cater to customers' changing needs. This shift in business models has been facilitated by the rapid advancements in technology, which has brought about the rise of custom core banking software development and the automation of various financial workflows.

The digitization of banking processes has enabled banks to provide faster, more efficient and cost-effective customer services. With digital banking, customers can now access their accounts and perform a wide range of transactions from the comfort of their homes or offices using their mobile devices or computers. This has significantly reduced the need for customers to visit bank branches physically.

Additionally, automating financial processes, such as loan approvals, account opening, cash-out, and payments, has drastically reduced the time and effort required to carry out these transactions. This has helped banks to improve their efficiency and reduce their operational costs.

The banking revolution: adapting to change

In recent years, there has been a substantial change in the banking industry, known as the banking revolution. With emerging technologies such as blockchain, artificial intelligence (AI), and machine learning, financial institutions have been forced to adapt and evolve to keep up with the changing landscape. The phrase "banking revolution" is not just a theoretical concept but a dynamic reality.

Banks are employing various strategies to stay relevant in this era of rapid change. One such method is investing heavily in technology to improve their digital capabilities. For example, many banks use AI-powered chatbots to provide 24/7 customer support to their clients. Others are using blockchain technology to enhance security and reduce the risk of fraud.

Another strategy is to offer more personalized services to customers. Banks are now using customer data to provide tailored products and services that meet the unique needs of each individual. For example, some banks use machine learning algorithms to analyze customer spending patterns and offer customized financial advice.

The banking revolution has significant implications for the future of the industry. As more and more customers move towards digital banking, traditional brick-and-mortar banks may become obsolete. Banks of the future that need to adapt to the changing landscape risk losing their customer base to more innovative and tech-savvy competitors.

What Generation Z expects from banking

The banking industry is now faced with a significant shift in consumer expectations, thanks to the entry of a new generation into the workforce and financial markets.

Generation Z, born between 1997 and 2012, is more digitally native than any previous generation. Growing up with technology, they have different expectations from banking institutions. Banks now need to analyze the preferences and requirements of this tech-savvy demographic to meet their needs. This involves thoroughly understanding how they interact with technology, their attitude toward financial products, and their expectations from customer service.

By tailoring their offerings to meet the needs of Generation Z, banks can build loyalty with this growing customer base and position themselves for long-term success in the digital age. Banks must adapt to the market's changing needs to remain competitive and attract this new customer base. Understanding the needs and preferences of Generation Z is crucial for banks as they strive to meet the demands of the highly connected world we live in today.

ENSURE YOUR BANK’S RESILIENCE GOING FORWARD

EPAM Startups & SMBs is your trusted digital transformation partner with 15+ years in the financial services industry.

Common challenges in the banking industry

Like any other industry, the banking sector has its fair share of challenges. However, given its operations' sensitive and critical nature, the industry faces many complex and unique challenges that require urgent attention and innovative solutions.

Regulatory hurdles are one of the banking industry's most significant challenges today. Banks must navigate a complex web of regulations and compliance requirements that change frequently. These regulations are designed to protect consumers and maintain financial stability, but they can be challenging to understand and costly to implement.

Another major challenge for banks is cybersecurity threats. The banking sector is a prime target for cybercriminals due to the vast amounts of sensitive data and financial information banks hold. Banks must invest heavily in cybersecurity measures to protect their operations and customers from cyber-attacks.

Moreover, the rise of cryptocurrencies has posed another challenge for central banks. While cryptocurrencies can potentially disrupt traditional banking systems, they pose risks such as money laundering, terrorist financing, and other illicit activities. Banks must find ways to incorporate cryptocurrencies into their operations while managing these risks.

Regulatory challenges

Banks operate in a highly regulated environment, and navigating the complex web of regulations is a perpetual challenge. The regulatory requirements imposed on banks are often numerous and demanding, ranging from capital adequacy ratios, liquidity ratios, and stress testing to anti-money laundering (AML) regulations, Basel III, and the Dodd-Frank Act. These regulations not only affect the way banks conduct their business but also impact their operations, risk management, and profitability.

Compliance with regulations is critical for banks to maintain their reputation and avoid regulatory penalties and fines. Therefore, banks employ various strategies to ensure compliance while maintaining efficiency. These strategies include investing in technology and automation to streamline their operations, enhancing their risk management practices, and adopting a proactive approach to regulatory reporting. They may also engage with regulatory bodies to better understand the requirements and seek guidance on compliance matters.

Overall, regulatory compliance is a significant challenge for banks and requires ongoing efforts to keep up with the changing regulatory landscape and avoid potential risks.

Cybersecurity concerns

The rapid digitization of our world has led to a significant increase in cyber threats, particularly in the banking sector, where sensitive customer data and financial transactions are at the forefront. As such, it has become crucial for banks to implement robust cybersecurity measures to protect their customers and operations from malicious attacks.

Cryptocurrency and digital money

The rise of cryptocurrencies has caused a significant shift in the traditional banking landscape. As digital currencies continue to gain popularity, there has been a growing interest in their potential impact on the banking industry. In this context, examining the role and impact of cryptocurrencies in the financial ecosystem becomes essential.

From a broader perspective, cryptocurrencies offer several advantages over traditional banking systems. They enable instantaneous peer-to-peer transactions without intermediaries, significantly reducing transaction costs and increasing transparency. However, integrating digital currencies into mainstream financial systems poses unique challenges that must be addressed to ensure the continued stability and security of the banking sector.

Regulatory compliance is one of the most significant challenges in integrating cryptocurrencies into the banking industry. The decentralized nature of digital currencies makes them difficult to regulate, and there are concerns about their use in money laundering and other illegal activities. Banks must comply with strict regulatory requirements, and integrating digital currencies into their systems must be done within the framework of existing regulations.

Despite these challenges, several opportunities are associated with integrating cryptocurrencies into mainstream financial systems. For example, using blockchain technology in the banking system could enhance the security and efficiency of financial transactions, making them faster, cheaper, and more transparent. Moreover, banks could expand their customer base and increase revenue by embracing cryptocurrencies.

Climate risk management

Climate risk management is identifying, assessing, and mitigating the risks associated with climate change. It involves understanding how climate change will impact different sectors and industries and developing strategies to reduce the potential adverse effects. This can include adapting infrastructure to be more resilient to extreme weather events, transitioning to cleaner energy sources, and implementing policies to reduce greenhouse gas emissions. Effective climate risk management is crucial for ensuring our planet's long-term sustainability and the stability of businesses and economies.

Many financial institutions now incorporate climate risk management into their strategies, recognizing their critical role in promoting sustainability and economic resilience. This involves evaluating and mitigating the potential impact of climate-related events, such as natural disasters or changes in regulatory policies, on their operations and investments. By proactively addressing climate risks, banks can safeguard their financial stability and contribute to the broader effort to combat climate change and protect the planet for future generations.

Competition in the digital banking space

The emergence of digital-only banks has created a highly competitive environment in the financial services sector. To stay relevant and competitive, traditional banks are forced to adapt and transform their operations through fintech solutions to meet the demands of the digital age.

Key trends in banking shaping its future

Banks embrace key market trends, redefining customer experience and operational efficiency to stay ahead in the rapidly evolving financial landscape. Artificial Intelligence (AI), personalized services, cloud migration, and non-fungible tokens (NFTs) are explored in detail, showcasing their impact on the future of banking.

AI in banking

Artificial intelligence has brought a new era of digital transformation and innovation to the banking sector. Integrating AI technologies in banking has enabled financial institutions to provide more efficient and personalized customer services. For instance, AI-powered chatbots can assist customers in performing various banking operations seamlessly, such as checking account balances, making payments, and even answering frequently asked questions.

AI-powered predictive analytics has enabled banks to analyze and predict customer behavior, improving risk management and fraud detection capabilities. With the help of machine learning algorithms, banks can now analyze large volumes of data and generate valuable insights that can help them make better decisions regarding customers' needs and preferences.

Personalized services

In today's competitive banking landscape, customer-centric approaches have become increasingly important. Banks constantly strive to provide personalized services to their customers, as they understand that tailoring their services to meet each customer's specific needs can significantly improve customer satisfaction. This is why the importance of personalized banking experiences cannot be overstated.

To achieve this level of personalization, banks are leveraging the power of big data and customer insights. By collecting and analyzing customer financial behavior, preferences, and needs, banks can gain valuable insights to design and deliver customized services that meet each customer's unique needs.

This approach enhances customer satisfaction and helps banks build stronger, more meaningful customer relationships. By providing personalized experiences, banks can demonstrate that they understand their customers and are committed to meeting their needs. This, in turn, fosters trust and loyalty, which are critical components of long-term customer relationships.

Cloud migration and its implications

Today, an escalating number of banks are leveraging cloud computing not simply to effect cost restructuring, but to innovate, offer new services, and improve their customer experience. Cloud migration emerges as a vital imperative, enabling banks to be more agile, adaptable, responsive, and customer-focused.

Cloud migration is not just about hosting data or applications in the cloud, but it’s also about the potentiality to bring about a dramatic shift in how banks operate and service their customers. It equips banks with the tools they need to manage their operations more efficiently, deliver greater value to their customers, and face their competitors with confidence. With cloud technology, banks can rapidly scale their operations, seamlessly implement innovative digital services, and foster an environment that privileges data privacy and security.

DISCOVER HOW CLOUD MIGRATION CAN UPSCALE YOUR BANKING SERVICES

Our team of tech experts is ready to join you in 3 weeks or sooner and deliver services rooted in years of experience in fintech and banking software.

Non-fungible tokens (NFTs) in banking

Non-fungible tokens, commonly known as NFTs, have gained immense popularity in art. However, their potential applications are broader than this sector alone.

Recently, NFTs have also started gaining traction in banking and financial services. These unique digital assets have emerged as game-changers in asset tokenization, enabling the fractional ownership of high-value assets such as real estate, art collections, and other luxury assets. NFTs are also being leveraged to facilitate secure and seamless digital identity verification, reducing the risk of identity theft and fraud. The financial industry is exploring the vast potential of NFTs and is expected to witness a surge in their adoption in the coming years.

The future of banking technologies

This section delves into the fascinating world of banking technologies and the future that awaits them. Banks are currently opting for comprehensive outsourced development services and business information services to follow the trends and establish new innovative standards.

We’ll dive into the latest technological advancements, including quantum computing, blockchain, Internet of Things (IoT) devices, and 5G technology below, to explore their potential impact on the banking industry.

Quantum computing in banking

Quantum computing is a rapidly advancing technology that promises to significantly improve processing power beyond what classical computers offer. It can revolutionize data analysis and encryption by processing large amounts of data much faster than conventional computers.

In the financial industry, the implications of quantum computing are significant, ranging from risk management to fraud detection. Its ability to handle complex real-time calculations could allow for more accurate risk assessments and faster fraud detection, ultimately leading to better decision-making and improved customer security. Additionally, quantum computing can improve the efficiency of trading algorithms, which can help banks optimize their investment strategies. Overall, the potential of quantum computing in the banking industry is vast and could bring about significant changes in how financial institutions operate.

Blockchain in the future of banking

Once synonymous with cryptocurrencies, blockchain technology has emerged as a transformative force across diverse industries, with its influence profoundly felt in banking.

In the financial sector, blockchain bolsters security and transparency and significantly improves transaction efficiency. Its decentralized architecture, fortified by cryptographic protocols, renders it impervious to tampering or hacking, ensuring the utmost security for financial data.

Moreover, the transparency inherent in blockchain allows all transaction participants simultaneous access to identical information, mitigating the risks of fraud and errors. Beyond security benefits, blockchain's streamlined transaction processing capabilities hold the potential to trim both time and costs associated with conventional financial transactions, rendering it an increasingly attractive option for businesses and individuals alike. As blockchain technology advances, its ongoing impact on the global banking landscape promises to usher in a new era of secure, transparent, and efficient financial transactions.

IoT devices in banking operations

The Internet of Things (IoT) has emerged as a transformative technology not just limited to smart homes but is also reshaping banking operations. The proliferation of IoT devices in the banking sector contributes to many advantages, including improved customer experiences, real-time monitoring, and data-driven decision-making.

One of the key benefits of IoT in banking is the ability to provide better customer experiences. IoT-enabled devices such as wearables and mobile phones allow banks to offer personalized services to their customers. For instance, customers can receive real-time notifications on their mobile phones about their account balance, transaction history, and other key information. Furthermore, banks can use IoT devices to provide location-based services, such as discounts at nearby shops or restaurants.

IoT devices also enable real-time monitoring of banking operations, which helps identify potential issues before they become major problems. For example, banks can use IoT sensors to monitor ATMs and identify when they need maintenance or repair. Additionally, IoT devices can be used to monitor the security of banking facilities, such as detecting unauthorized access or suspicious activities.

5G technology and financial services

Implementing 5G technology marks a significant milestone for the banking industry, offering many new possibilities and opportunities. With this cutting-edge technology, banking services are set to become faster, more efficient, and highly reliable.

The enhanced connectivity of 5G networks will revolutionize how financial software services are delivered and consumed, making them more accessible and convenient. With 5G, customers can expect lightning-fast transactions, seamless access to banking services, and improved data security.

This technology will enable providers to offer new and innovative IT services for banks that were once impossible, such as virtual banking, next-level mobile payments, and real-time analytics. The advent of 5G technology represents a significant step forward for the banking industry, promising to transform how we manage our finances and improve the overall customer experience.

ENSURE THE SUCCESSFUL FUTURE OF YOUR BANK

Opt for comprehensive digital banking development services and accelerate the success of your project.

Conclusion

As we continue to navigate the ever-evolving banking landscape, it is becoming increasingly clear that the future of banking is filled with both unprecedented opportunities and challenges. Banks must embrace technological advancements, address regulatory concerns, and meet the new generation's expectations to thrive in this dynamic environment.

The advent of digital technologies has revolutionized the way we conduct financial transactions. From mobile banking to digital onboarding, customers now have access to a wide range of banking services that are fast, efficient, and convenient. However, with this convenience comes the risk of cybercrime and fraud. Banks must invest significantly in cybersecurity measures to protect their customers' data and prevent fraud.

Moreover, regulatory compliance has recently become a top priority for global banks. With increased scrutiny from regulatory bodies, banks must ensure that they comply with all laws and regulations that govern their operations. This includes maintaining accurate financial records, adhering to anti-money laundering and counter-terrorist financing laws, and ensuring adequate risk management systems are in place.

In addition, meeting the expectations of the new generations — the millennials and Gen Z — is another significant challenge that banks must address. These customers are digital natives who expect a seamless and personalized banking experience. They demand instant gratification, personalized services, and a high level of transparency from their banks. Banks must therefore invest in innovative technologies such as artificial intelligence and machine learning to provide personalized services that cater to the needs of these customers.

In conclusion, the evolution of banking is not a linear path but a dynamic journey influenced by a range of factors. Banks must remain vigilant, adaptable, and open to new possibilities to stay ahead of the curve. By embracing technological advancements, addressing regulatory concerns, and meeting the new generation's expectations, banks can ensure they remain relevant, responsive, and successful in future years.

FAQ

Anush has a history of planning and executing digital communications strategies with a focus on technology partnerships, tech buying advice for small companies, and remote team collaboration insights. At EPAM Startups & SMBs, Anush works closely with subject matter experts to share first-hand expertise on making software engineering collaboration a success for all parties involved.

Anush has a history of planning and executing digital communications strategies with a focus on technology partnerships, tech buying advice for small companies, and remote team collaboration insights. At EPAM Startups & SMBs, Anush works closely with subject matter experts to share first-hand expertise on making software engineering collaboration a success for all parties involved.

Explore our Editorial Policy to learn more about our standards for content creation.

read more