The world of finance and banking is continually changing, and one of the latest trends causing a stir is the integration of gamification into these sectors. This innovative approach involves applying game-like elements and principles to banking and finance to enhance user engagement, educate customers, improve their experience, and drive desired behaviors. By leveraging gamification, financial institutions can create interactive and engaging digital experiences that help them connect with their customers on a deeper level while streamlining complex processes.

Gamification in banking and finance has gained momentum recently, as it offers numerous benefits. For instance, implementing gamification often helps increase user engagement, loyalty, and satisfaction, improving customer retention and acquisition. Additionally, gamification can motivate users to save money, invest in their future, or use digital banking apps and services more frequently. This can drive revenue growth for financial institutions, reduce costs, and improve efficiency.

Various gamification techniques, such as point systems, badges, levels, leaderboards, challenges, and quests, are used in the digital finance landscape. These techniques aim to make banking and finance more fun, interactive, and rewarding for users. For example, users can earn points or badges by completing tasks such as setting up automatic savings plans, paying bills on time, or using mobile banking apps. Leaderboards and challenges can encourage users to compete with one another and achieve specific financial goals.

What is gamification in the banking business?

Gamification in banking refers to incorporating game mechanics and design principles into non-game contexts within the financial sector. The goal is to make financial activities more interesting, enjoyable, and rewarding for customers. Financial institutions achieve this by integrating points, badges, levels, and rewards into their services, creating a more immersive and interactive user experience.

Through gamified finance, mundane transactions and tasks beyond traditional bank account interfaces are transformed into exciting challenges. Digital transformation in banking leverages human tendencies towards competition, achievement, and recognition, fostering a positive and dynamic relationship between customers and their financial services providers. Ultimately, gamification in banking aims to create engaging experiences to enhance customer satisfaction and engagement while improving brand loyalty and revenue for financial institutions.

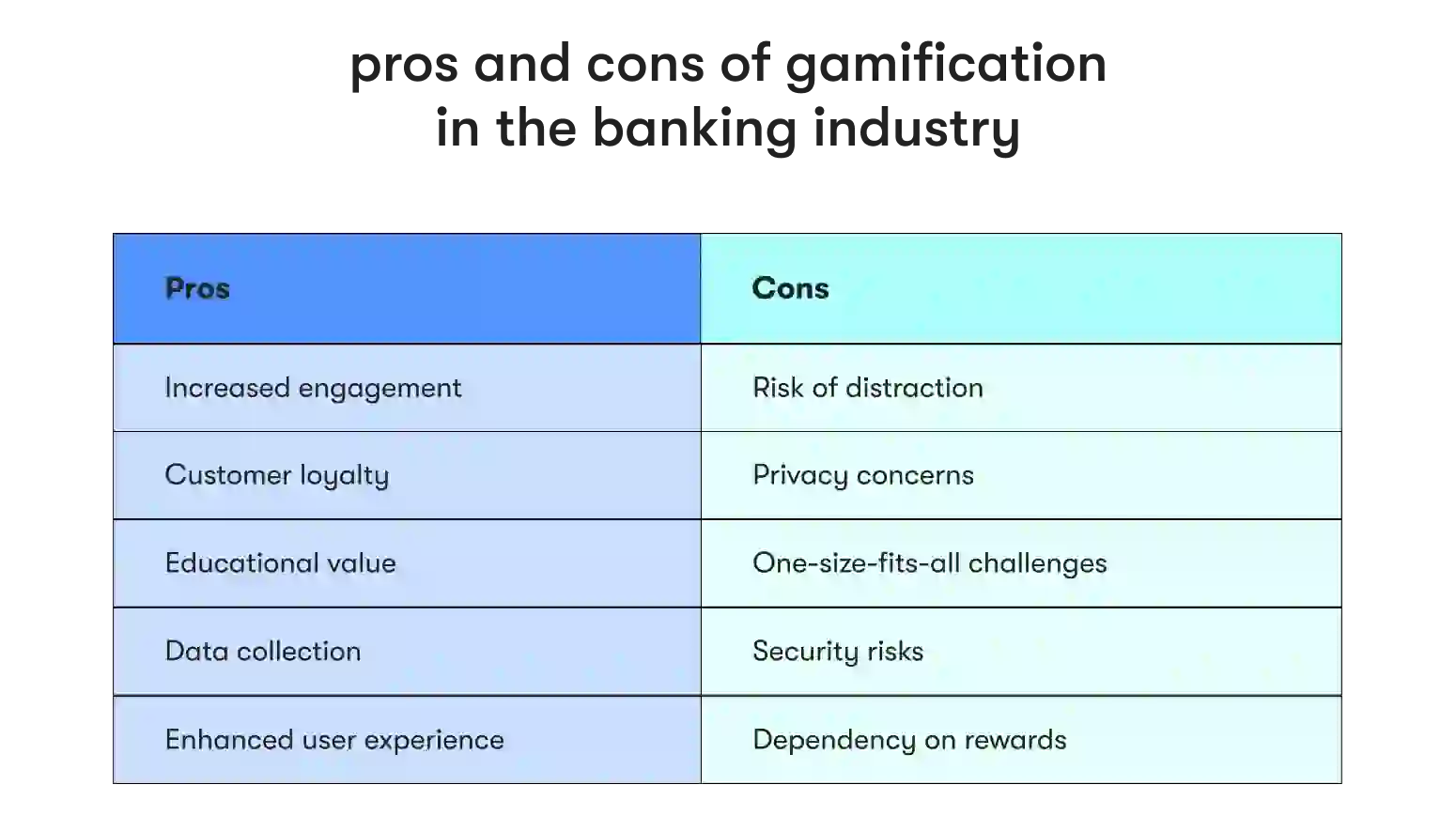

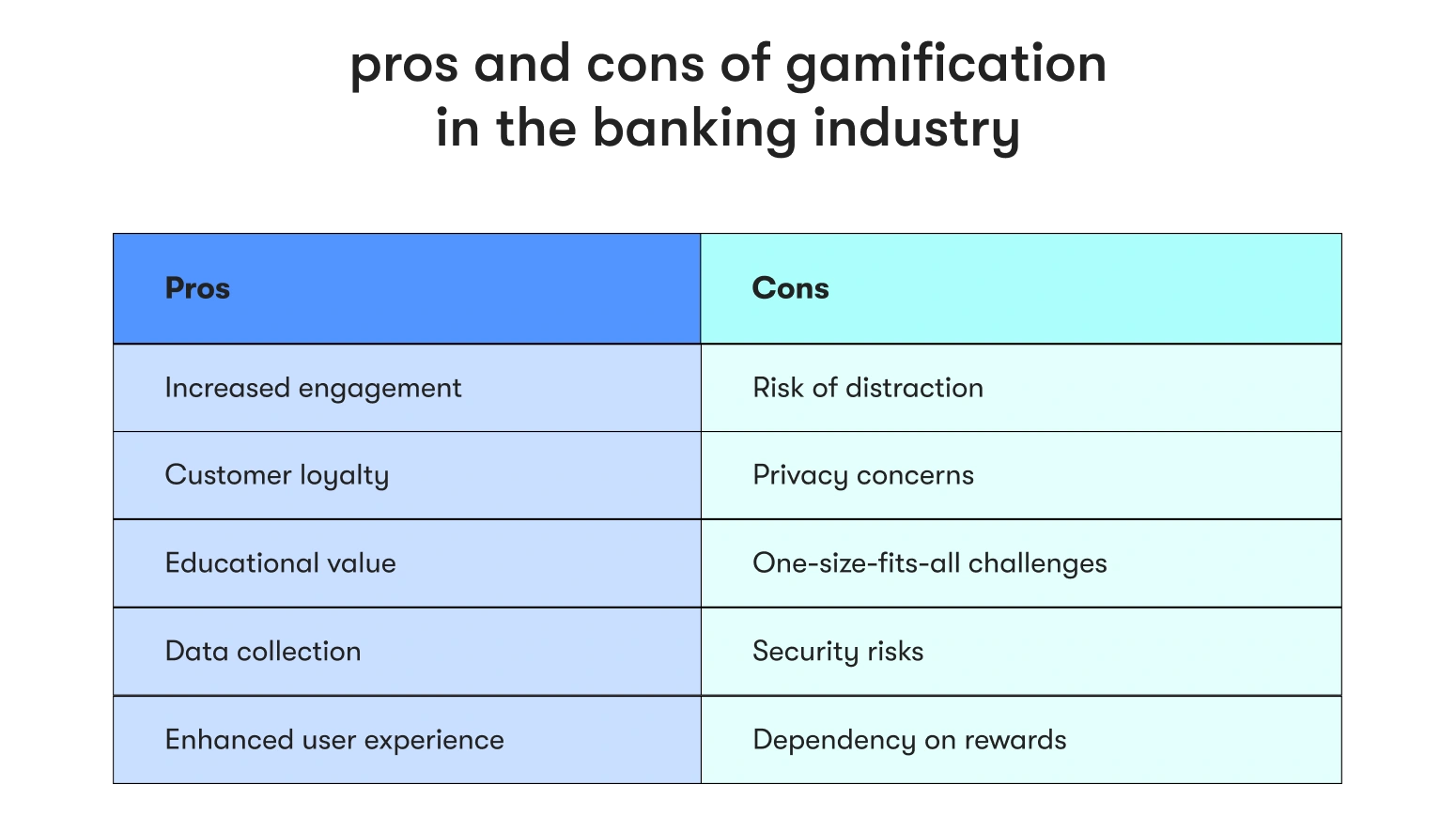

Pros and cons of gamification in banking

Pros:

- Increased engagement: Gamification makes mundane financial tasks more enjoyable, encouraging users to actively participate in managing their finances.

- Customer loyalty: By offering rewards and recognition, gamified finance creates a sense of loyalty among customers, making them more likely to stick with a particular bank or financial service.

- Educational value: Gamification provides effective mobile banking apps and platforms for educating users about financial concepts, investment strategies, and other essential aspects of personal finance.

- Data collection: Financial institutions can gather valuable analytics data on customer behavior, preferences, and engagement patterns through a gamified banking app, aiding in personalized services.

- Enhanced user experience: Gamification transforms the user experience, making it more enjoyable and user-friendly, which can lead to increased customer satisfaction.

Cons:

- Risk of distraction: Excessive gamification may distract users from the core financial activities, potentially compromising the seriousness of certain transactions.

- Privacy concerns: Collecting extensive user data for gamification raises privacy concerns, necessitating a careful balance between personalization and safeguarding customer information.

- One-size-fits-all challenges: Designing gamification features that resonate with a diverse customer base can be challenging, potentially alienating specific demographics.

- Security risks: Incorporating game-like elements may introduce security vulnerabilities if not implemented and monitored rigorously.

- Dependency on rewards: Overreliance on rewards can lead to customers focusing solely on incentives rather than the long-term financial benefits of their actions.

GO FOR FINANCIAL GAMIFICATION

Tailor gamification strategies to your target audience's specific demographics, preferences, and financial goals with our expert digital banking engineering help.

Types of gamification used in digital banking

Various gamification techniques enhance user engagement and transform routine financial activities into immersive experiences. These strategies leverage game-like elements to make online banking more enjoyable, educational, and rewarding for users. Here are some prominent types of gamification strategies used in digital banking:

Points and badges

Points and badges are classic gamification elements where users earn points for completing specific tasks or achieving milestones. Badges are visual representations of accomplishments, fostering a sense of achievement and progress. This technique motivates users and provides a tangible record of their financial journey.

Levels and leaderboards

Introducing levels and leaderboards adds a competitive dimension to digital banking. Users can progress through different levels by completing tasks or reaching financial goals. Leaderboards display users' achievements, creating a friendly competition that motivates continued engagement. This technique taps into the natural human desire for recognition and accomplishment.

Virtual characters

Incorporating virtual characters or mascots into the digital banking experience adds a playful and relatable aspect. These characters can guide users through processes, offer financial tips, and create a more personalized and enjoyable interaction. Virtual characters humanize the digital experience, making it more engaging and memorable for users.

Banking tutorials

Interactive tutorials gamify the learning process by turning educational content into engaging experiences. Users can explore and understand complex financial concepts, investment strategies, or new features the bank introduces more interactively and enjoyably. This technique enhances financial literacy and encourages users to explore the full range of custom core banking services.

Challenges and missions

Setting up challenges and missions provides users with specific goals to achieve within a given timeframe. Completing these challenges can unlock rewards, encouraging users to participate actively in digital banking. This technique adds an element of excitement and accomplishment to routine financial tasks.

Rewards and incentives

Offering tangible rewards and incentives, such as cashback, discounts, or exclusive offers, motivates users to perform desired financial activities. These rewards provide immediate gratification and create a positive association with using digital banking services. The technique ensures that users feel valued for their engagement and loyalty.

Progress tracking

Providing users with visual representations of their financial journey, such as progress bars, milestones, or achievements, enhances the sense of accomplishment. Users can track their progress and see the impact of their financial decisions over time. Progress tracking is a powerful motivator, encouraging users to stay committed to their financial goals.

Social media integration

Integrating social media allows users to share their achievements, challenges, or financial goals with their social networks. This enhances the social aspect of digital banking and serves as a form of organic marketing for financial institutions. Social media integration turns individual financial journeys into shared experiences within a community.

These diverse gamification techniques go beyond traditional banking interfaces, creating a more interactive, engaging, and user-centric digital banking experience. By incorporating these elements, financial institutions aim to meet and exceed customer expectations in an increasingly competitive and digital-savvy era.

The core in-app gamification principles involve the following

The core in-app gamification principles are a set of guidelines that aim to enhance user engagement and retention through the use of game-like elements in a non-game context.

Engaging and encouraging

Engagement is the key to successful gamification. Designing features that captivate users and encourage them to explore various aspects of financial services fosters a positive relationship and engages users.

Eliminating boredom

Gamification aims to turn mundane financial tasks into exciting challenges. By injecting elements of fun and surprise into online transactions, financial institutions can prevent users from feeling bored or disinterested.

Rewarding positive behaviors

Rewarding positive financial behaviors reinforces desirable spending habits. Whether saving money, making timely payments, or investing wisely, incentives motivate users to continue making sound financial decisions.

Top gamification techniques in banking

Gamification techniques in banking leverage elements from the world of games to enhance user engagement, drive positive behaviors, and create a more enjoyable and rewarding customer experience. Here are some key gamification techniques employed in the banking sector:

Real-time feedback

Providing immediate notifications or feedback when users complete tasks, achieve milestones, or engage in desired financial behaviors.

- Purpose: Reinforces positive behaviors, keeps users informed about their progress, and adds an element of immediacy to the gamified experience.

Seasonal or holiday-themed campaigns

Designing gamified campaigns for seasons or holidays, incorporating festive elements and exclusive rewards.

- Purpose: Capitalizes on seasonal enthusiasm, boosts user participation during specific periods, and adds a thematic touch to the gamification experience.

Unlockable features

Gamifying features that users can unlock as they achieve certain milestones or complete specific tasks.

- Purpose: Encourages continuous engagement as users strive to unlock additional functionalities or exclusive benefits.

INNOVATE YOUR BANKING APPLICATION

Get in touch to implement banking gamification techniques with our professional team’s assistance.

Gamification in banking: case studies

Gamification in banking has emerged as a strategy to enhance customer engagement, improve financial literacy, and encourage desired behaviors such as saving and spending responsibly. Here are some case studies of banks and financial institutions implementing gamification:

Octochallenge by CIMB OctoSavers

- Overview: CIMB OctoSavers, a digital savings account by CIMB Bank, introduced Octochallenge, a gamified savings feature to encourage customers to save more.

- Key features: Octochallenge leverages gamification elements such as challenges, goals, and rewards to motivate customers to save regularly and reach their financial targets.

- Implementation: Customers set savings goals and receive challenges to achieve those goals. They earn rewards and incentives as they progress, fostering a sense of achievement and progress.

- Impact: Octochallenge has increased engagement among CIMB's customers, encouraging them to save more consistently and achieve their financial goals.

ZA Mank by ZA Bank (Hong Kong)

- Overview: ZA Bank, a virtual bank in Hong Kong, introduced ZA Mank, a gamified financial management platform designed to educate users about personal finance and promote responsible spending habits.

- Key features: ZA Mank offers various gamified features, including quizzes, challenges, and simulations, to educate users about financial concepts and encourage them to make informed financial decisions.

- Implementation: Users participate in challenges and quizzes to earn rewards and unlock financial insights tailored to their spending habits and goals.

- Impact: ZA Mank has helped users better understand personal finance, improve their financial literacy, and adopt more responsible spending behaviors.

Monobank

- Overview: Monobank, a digital bank in Ukraine, implemented gamification features within its mobile banking app to enhance user engagement and promote financial well-being.

- Key features: Monobank's gamified features include personalized financial challenges, rewards for achieving savings goals, and interactive financial education modules.

- Implementation: Users set savings targets, participate in challenges, and earn rewards for achieving milestones. The app also provides personalized insights and recommendations to help users manage their finances more effectively.

- Impact: Monobank's gamification efforts have increased user engagement, higher savings rates, and improved financial literacy among its customer base.

How we can help you with gamification

Are you a financial institution looking to harness the power of gamification in digital banking? Our team specializes in designing customized gamification solutions tailored to your specific needs, with a team of developers, project managers, designers, QA testers, and more. From enhancing user engagement to driving positive financial behaviors, we can help you create a fintech application that sets you apart in the competitive landscape. Contact us today to discuss how gamification can transform your digital banking services.

Conclusion

Gamification has been a buzzword in banking for some time now. It is a technique that uses game mechanics to make banking activities more engaging, enjoyable, and rewarding. It is not just a fleeting trend but a transformative force shaping the future of banking and financial interactions.

By integrating game-like elements, banks can create a more immersive and interactive experience that fosters a deeper connection with customers and helps build loyalty and engagement. Gamification can make routine transactions, such as paying bills, saving money, or investing, more fun. It can also help customers develop healthy financial habits like budgeting, saving, and investing.

However, balancing and keeping banking fun while maintaining the seriousness of financial activities is vital. Banks must ensure that gamification is a tool to enhance rather than detract from the importance and gravity of financial transactions.

As technology advances, the possibilities for innovative and engaging gamification in finance are limitless. From personalized rewards and incentives to virtual reality banking experiences, the future of gamification in banking is bright. Financial institutions are now leveraging the latest technologies to provide a personalized and engaging banking experience that suits the needs of individual customers.

FAQ

Anush has a history of planning and executing digital communications strategies with a focus on technology partnerships, tech buying advice for small companies, and remote team collaboration insights. At EPAM Startups & SMBs, Anush works closely with subject matter experts to share first-hand expertise on making software engineering collaboration a success for all parties involved.

Anush has a history of planning and executing digital communications strategies with a focus on technology partnerships, tech buying advice for small companies, and remote team collaboration insights. At EPAM Startups & SMBs, Anush works closely with subject matter experts to share first-hand expertise on making software engineering collaboration a success for all parties involved.

Explore our Editorial Policy to learn more about our standards for content creation.

read more